In 2022, I having more conversations with my clients whether they should increase their retirement sums due to inflation. I begin to realize that it is not easy for them to project their future needs when they don’t know the perimeters needed.

Hence, I have build up a quick calculator for them to calculate in less than 1 minute how much they need and how much they have to invest NOW to achieve their retirement goals.

The Assumptions

Behind every model requires a few assumption. I will go through the ones that require more thought process.

- Replacement Ratio

This is the percentage of income to maintain lifestyle. Most studies suggest aiming for a target of between 70 and 85 percent of pre-retirement income. Typically, most of us spends a certain portion of our income to maintain our lifestyle. Some of us will spend more, some of us will spend less. To most of us, our spending habits will stay with us for a long period of time.

For Example: Peter earns $6K monthly and spends $4K every month on household needs etc. This means his replacement ratio is roughly 67%.

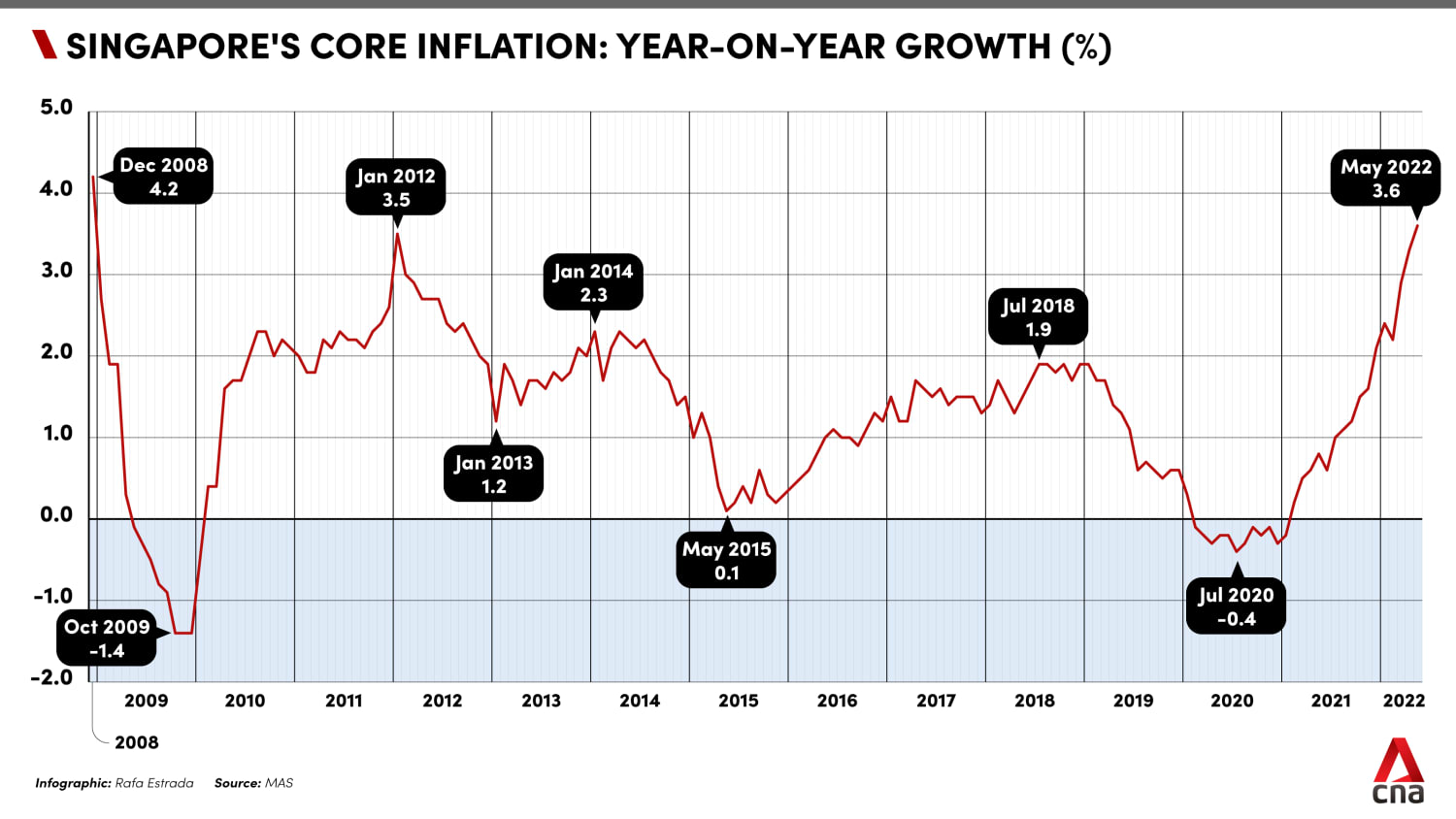

- Inflation Rate

Though this is well defined, it is not easy to determine a meaningful figure especially when inflation has been going up in the last few months. From the graph below, you can see that we have spikes in inflation previously. However, it has been maintained at a certain level for prolong periods of time.

While, MAS does not have an explicit inflation target. The MAS has concluded that, on average, a core inflation rate of just under 2%, which is close to its historical mean.

I would think to err on the side of planning, we can use a inflation rate of 3%.

source: tradingeconomics.com

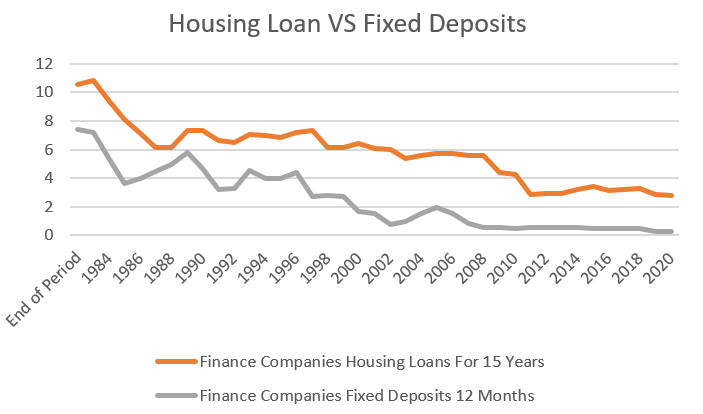

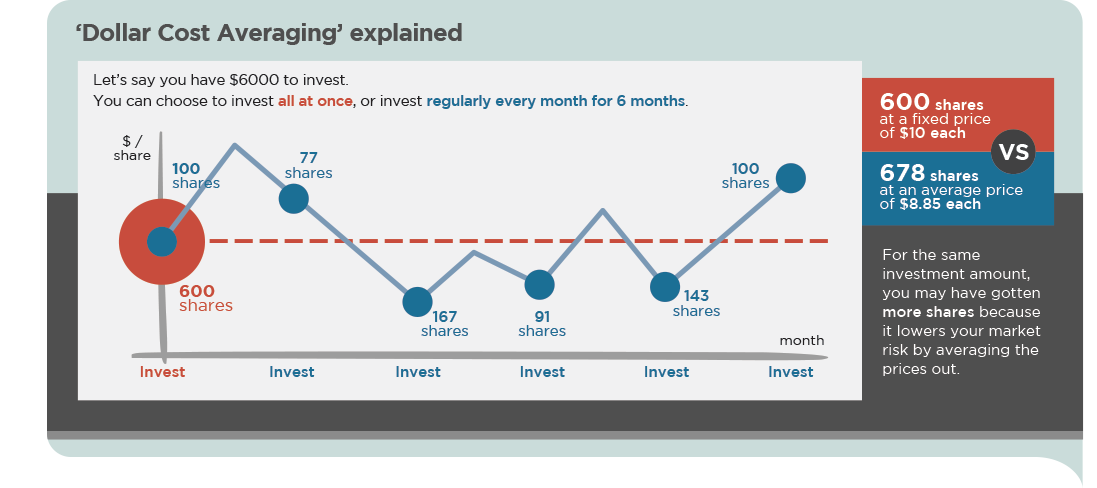

- Expected Investment Rate

This is the rate that you want your investment to grow yearly to reach your goals. For this to be effective, it would be easier to attribute it to your risk profile which will then lead you to the appropriate investment instrument you will find suitable.

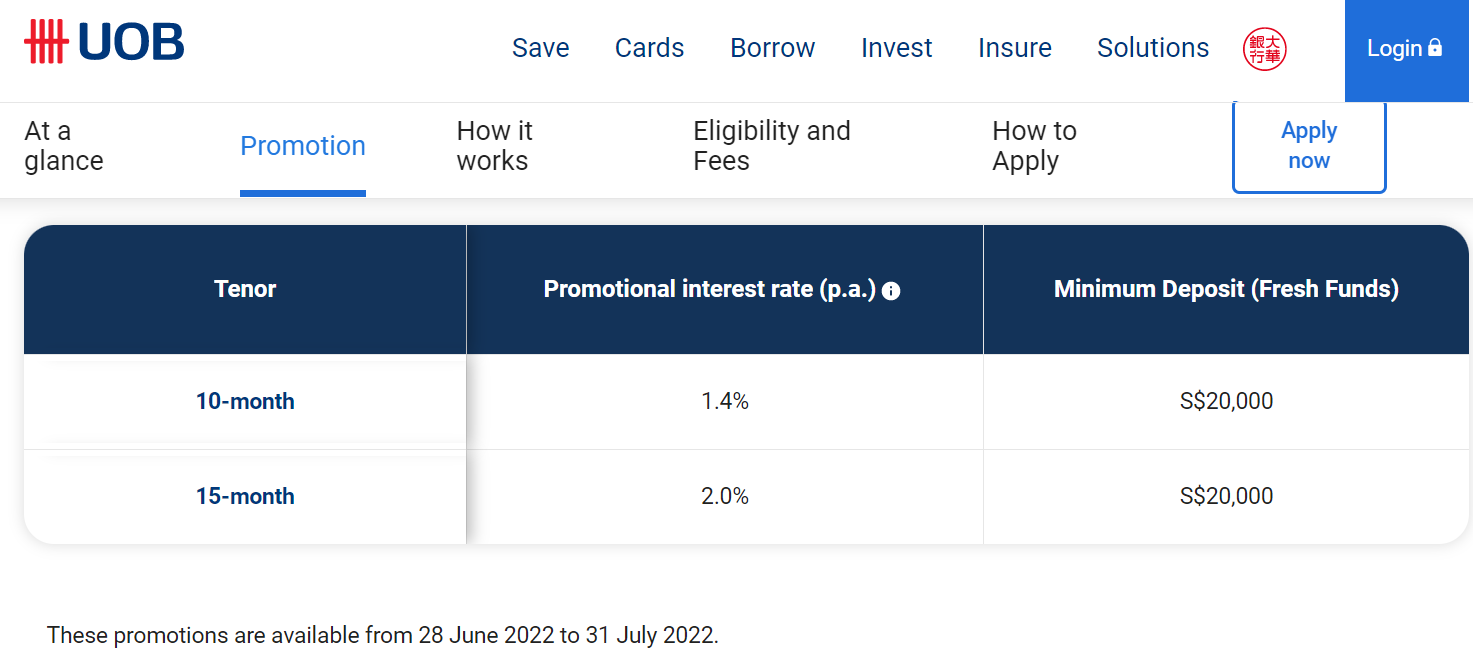

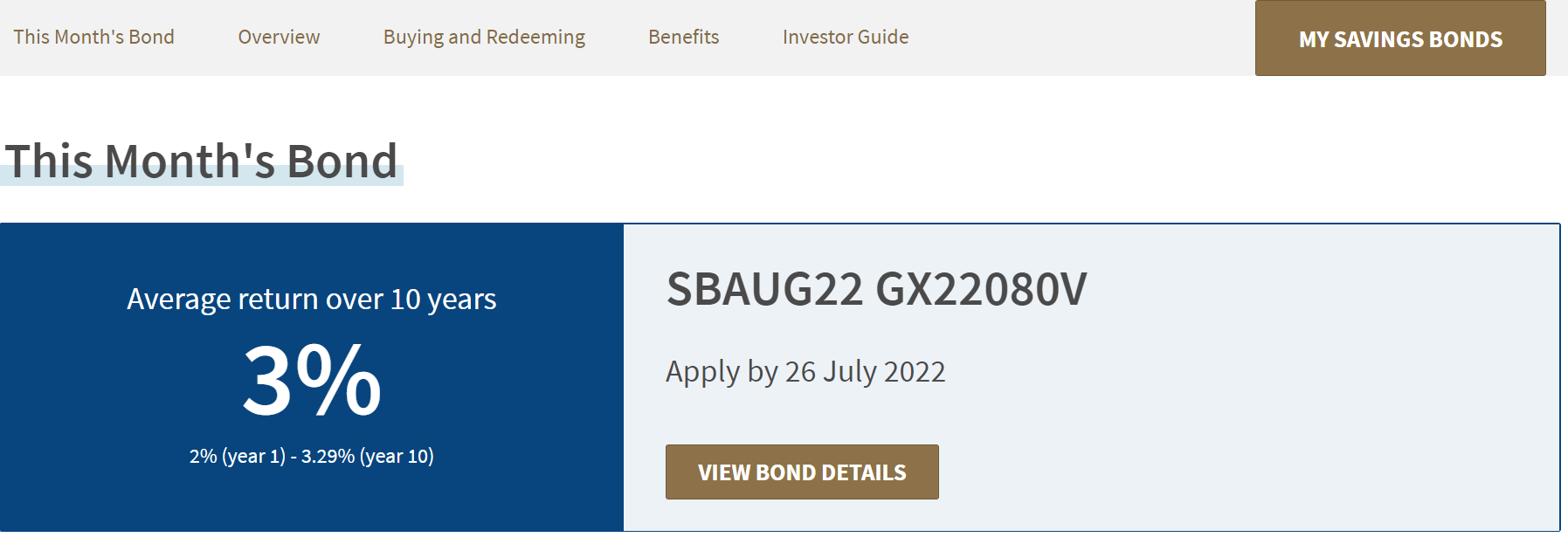

If you are someone who is risk adverse, you might consider fixed deposits which typically gives around 1% per annum. For Singapore bonds investment, the yield typically is around 2% to 3% depending on the tenure of the bond.

For those that are more adventurous, the SPDR Gold Trust (SGX: O87) annualized 10 Years Performance is 1.29%. Straits Times Index (SGX: ES3) annualized 10 Years Performance is 4.4%. SPDR S&P 500 (SGX: S27) annualized 10 Years Performance is 12.96%. Average yields are a reference point and can be used as a pinch of salt.

Taking a pause here, all forms of investments carry risks, including the risk of losing all of the invested amount. Such activities may not be suitable for everyone. With an additional disclaimer, the above doesn’t represent a buy/sell/hold recommendation.

The Retirement Calculator

Final Thoughts

I think planning beyond 2022 will be an interesting discussion as we are in midst of existing developments (Russian-Ukraine, China-Taiwan, Monkeypox, COVID19). However, we should let it stop us to plan consistently for the future.

If realised you have a retirement shortfall, congratulations! It is time to do something about it. There are various instruments available and I will be glad to have an open conversation with you on how to do that with you.

If you feel like something needs to be done, the next place you need to go to is here (to read more) or simply contact me using the information below.

I wish you all the best! Take care.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.