The Central Provident Fund (CPF) changes made in 2024 will likely to have key impacts on your retirement planning. On 16 February 2024, there was a huge outcry arising some of the changes.

There are 7 key highlights to the CPF changes but of which 2 of them have a key impact on your retirement planning.

Here are the 7 key highlights. Skip to the bottom to understand how this will impact your retirement planning.

- Enhanced Retirement Sum (ERS) Increase:

- The Enhanced Retirement Sum (ERS), the maximum amount members can put in their CPF Retirement Account for interest accrual and payouts, will be pegged to four times the Basic Retirement Sum (BRS) from January 1, 2025, up from three times.

- The new ERS in 2025 will be $426,000, providing more flexibility for members aged 55 and above to commit their CPF savings for higher monthly payouts.

- Matched Retirement Sum Scheme (MRSS) Expansion:

- The MRSS, which matches voluntary CPF top-ups for Singaporeans aged 55 to 70 if they don’t meet their BRS, will be extended to those above 70.

- The cap on the matched amount will increase to $2,000 annually, up from $600, benefiting more Singaporeans.

- Tax Relief for Retirement Account Top-ups:

- Singaporeans aged 55 and above will receive tax relief on cash top-ups to their Retirement Account (RA), with the limit increased to $8,000.

- Silver Support Scheme Changes:

- The per capita household income threshold for the Silver Support Scheme will rise from $1,800 to $2,300, expanding the scheme’s coverage.

- Increased support under the tiered scheme will require a higher income threshold, raised from $1,300 to $1,500.

- Quarterly payments under the scheme will see a 20% increase across all tiers to keep pace with inflation, benefiting around 290,000 Singaporeans aged 65 and above.

- Streamlining of CPF System:

- The Special Account (SA) of members aged 55 and above will be closed starting from early 2025, streamlining the CPF system.

- All CPF members will have three CPF accounts, with the RA or SA as the sole account holding savings for retirement payouts, depending on the member’s age.

- SA savings will be transferred to the RA up to the Full Retirement Sum, and the remaining SA savings will be transferred to the Ordinary Account (OA).

- CPF Contribution Rate Increase for Senior Workers:

- Senior workers aged above 55, up to 65, will see CPF contribution rates for their contributions and those from their employers increase by a total of 1.5 percentage points from Jan 1, 2025.

- Extension of CPF Transition Offset:

- The CPF Transition Offset for employers will be provided for another year, covering half of the increase in employer contributions for 2025 to ease the impact on business costs.

This is the summary of the highlights of the message. Please continue reading the key impacts of the CPF changes in 2024.

Key Impact #1: Closure of CPF-SA

The more savvy CPF members have already deployed a key strategy called CPF Shielding. You can read more on the redundant strategy above.

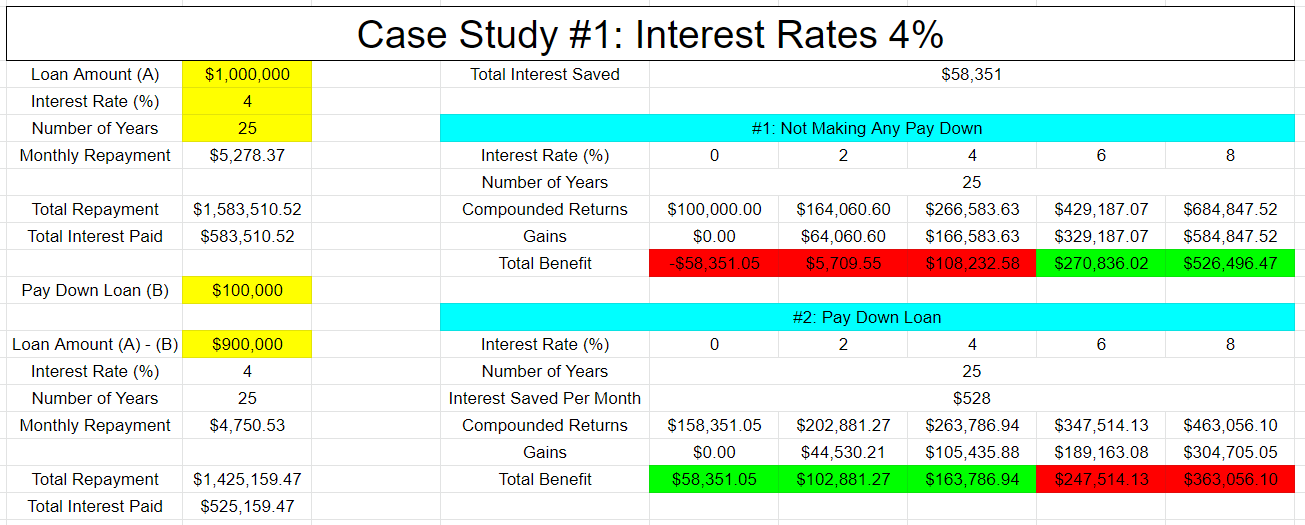

In a nutshell, you will not be able to store money in your CPF-SA to get 4% interest. You will only be able to get a 2.5% interest in your CPF-OA. This has made many people unhappy as there is one less instrument to get a predictable 4% interest.

In my opinion, I believe that it was a matter of time before the CPF shield will be scraped. One of the key intention of the CPF to provide a steady stream of lifelong retirement income. It is certainly NOT and NEVER meant to be a bank account that gives a higher interest with the right shielding.

While I can imagine why people might not be happy, this not the end of the world for you. You always have a choice on where you can put your money. (Read More: 10 SRS investments that you can consider if you are 40 and above).

Key Impact #2: Enhanced Retirement Sum to be increased.

Enhanced Retirement Sum will now be pegged to 4 times the Basic Retirement Sum. As mentioned in key impact #1, the CPF key intention is to provide a steady stream of lifelong retirement income.

With this increase, CPF members can choose to contribute up to the limit of the Enhanced Retirement Sum.

CPF-Life remains one of the best (premium vs retirement payout) instrument due to the lack of liquidity. Using a sum of annual payout of $39,960 ($3300/month) vs the premium of $426,000, this works out to be a payout of 9.38%!!! Using very simple mathematics logic, this means you will “breakeven” after taking for roughly 10.6 years by drawing your own money.

However, the caveat is the lack of liquidity and also the reduced ability to use the monies in CPF-Life as part of estate planning.

Despite the limitations, I believe this might be a welcome move by the affluent as they can set aside roughly around another $100K for an excellent premium vs payout instrument.

Final Thoughts By Wealthdojo

Changes is always the only constant. Many people are in a denial that the government’s programs should cater only to them. It has always been clear that the government programs are meant to impact the majority of Singaporeans and their objectives are well documented.

This is not the first time that there is a policy change. The recent Plus Prime Model has also changed the way you should invest in properties in Singapore. I believe this is the way to continue with sustainable growth for the nation.

What are your thoughts to this? Let me know!

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.