On 20 August 2023, the Plus model was announced during the National Day Rally. This will bring a shift in mindset when it comes to Property Investing in Singapore. Due to popular demand, I have wrote down some of my thoughts on the property investing scene in Singapore and the direction you can consider to take.

Disclaimer: These are my own personal thoughts and it should not be used as your buy/sell/hold decision. Please check in with your property consultant (which I’m not) for your analysis.

Public housing to be affordable…

The government and HDB has time and again stress the importance of HDB being affordable. That being said, in the last decade, we have seen the “lottery effect” as places such as Duxton, Queenstown, Toa Payoh and so on (view the complete list here). If you look at the data, most $1 million HDB tend to be in the central regions of Singapore. They also tend to be the bigger units (5-Rooms).

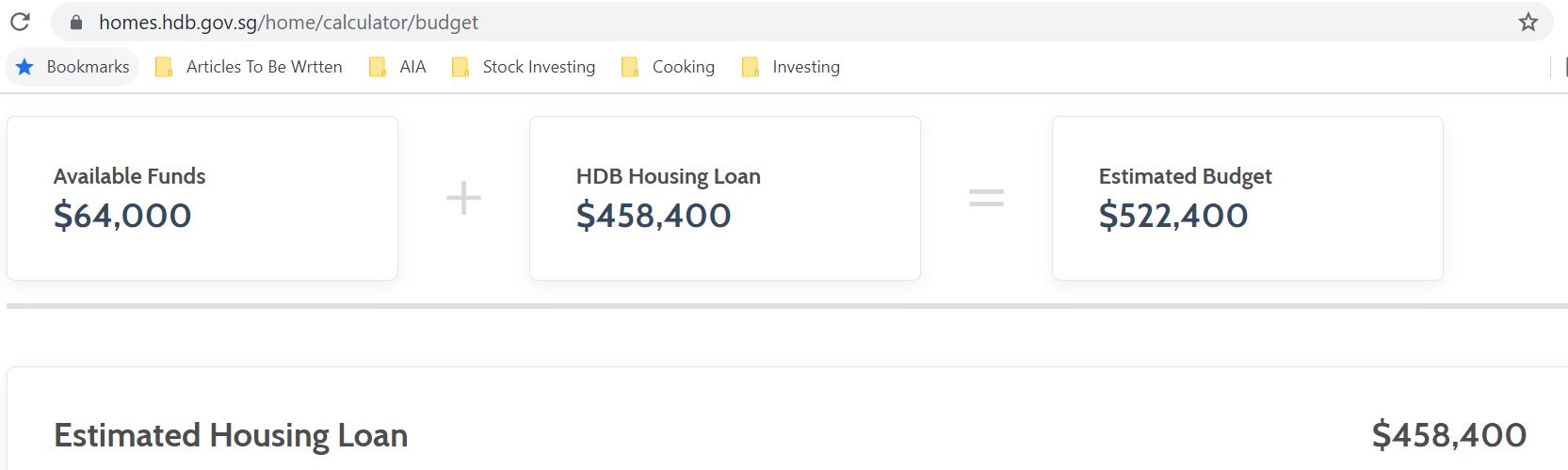

This means that majority of the HDBs are still affordable given that our median household income (roughly around $10,000 as per 2022) has risen over the years. With the prices of 4 Room BTO between the ranges of $400K to $600K in the May 2023 batch, this means the median property price ratio to median annual income ratio is around 3.3 to 5. This is an extremely healthy range considering the ratios in London (13.9), Hongkong (41.6) and Japan (115).

I expect Singapore’s public housing prices to remain affordable if the government continue its’ stance on affordable housing. Our BTO prices will increase in line with our median household income. As long as our median household income increase, we will see an increase in the public housing prices.

… and accessible

The “lottery effect” had unintended effects of making the rich richer. This is because BTO prices in the central tends to be higher when it is launched. This in turn lead to the more affluent couples BTO in that area. As they then sell their BTO, this gave them a “lottery effect” which made them richer.

This will NOT be possible in the years to come.

The government has stepped in to introduce 2 schemes namely the Plus and Prime model. In both models, there will be subsidies to help young couples in their BTO. This means that couples who have lower income will have access to these BTO and able to stay closer to the city.

At the same time, there will be restrictions and tighter conditions to sell. For those couple who have lower income, I expect that they will continue to stay in those flats as there might not be other better options available to them. For those who have higher income and intend to “flip”, the longer Minimum Occupation Period (MOP) of 10 years and other restrictions will slow transactions in those flats.

Hence, eliminating the “lottery effect” and also create an more fair system to have home ownership (clearly trying to discourage any investment). This is brilliantly thought out.

I believe the ONLY way you can benefit from the BTO system as investment is if you fulfill the following criteria.

- Marry very young (probably age 25 or less)

- Buy the standard BTO flats (these flats tend to be “below” market rate)

- Sell after 5 years and move on

Since BTO is “blocked”, how about resale HDBs?

If you look at the resale HDB prices on Q2, 2023. These are what you can find.

Resale HDB 4BR price range: $490,000 to $850,000. Average: $670,000

Resale HDB 5BR price range: $588,000 to $880,000. Average: $734,000

The price range is wide because of the location of the property. However, they are still affordable with median property price ratio to median annual income ratio for resale 4BR to be 5.5 and resale 5BR to be 6.11.

Using this data, you will make money if you BTO and sell your flat.

That being said, prices of resale HDB will not be able to increase drastically because of the Mortgage Servicing Ratio (MSR) rule. Unless Singaporeans are comfortable with the putting more downpayment (which defeats the point of investment anyway). I believe that HDB will continue to remain affordable and you will get a small windfall effect twice if you qualify for it (since we can BTO twice in our lives).

But Private Properties are expensive

Since the door to public housing “investment” is blocked, we should then turn to private properties. Private properties are relatively more expensive because we are so used to the affordability of HDB flats.

The average private property price in Singapore is $1,200,000 in 2022. There are tons of articles in the market that says that Singapore private property market is in a bubble. Looking at it based on data, we can see that the median property price ratio to median annual income ratio for private property is roughly at 10 (if we use the example of $10K as monthly household income). Considering other worthwhile comparison (like London, Hongkong and Japan), we are still relatively cheaper.

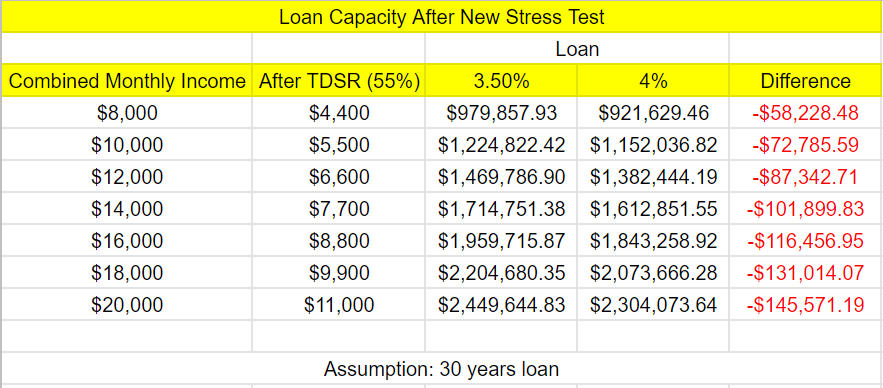

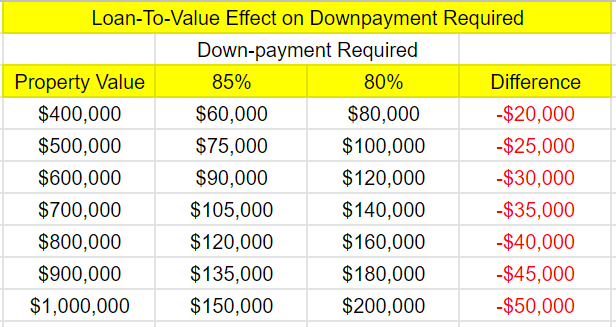

It is to my belief that there is still room to grow (and stretch) for private properties. In the table below, you can see that there are more people earning $10K/month (currently 44% of households in Singapore). These people tend to aim for private properties as they are the ones that can afford them. With private properties being around 27% of the properties in Singapore, I believe there is currently more demand than supply. This will somewhat push existing prices up until an equilibrium.

Final Thoughts By Wealthdojo

I believe the government will continue to give priority to making sure that HDB remains affordable and for more inclusion into the central regions of Singapore. I believe that HDB prices will continue to appreciate based simply on income effect of household. I believe that HDB will take the income of household to be one of the proxy for pricing BTO. HDB will continue to be used (and priced) for homestay and it will be not easy to use it for investment purposes.

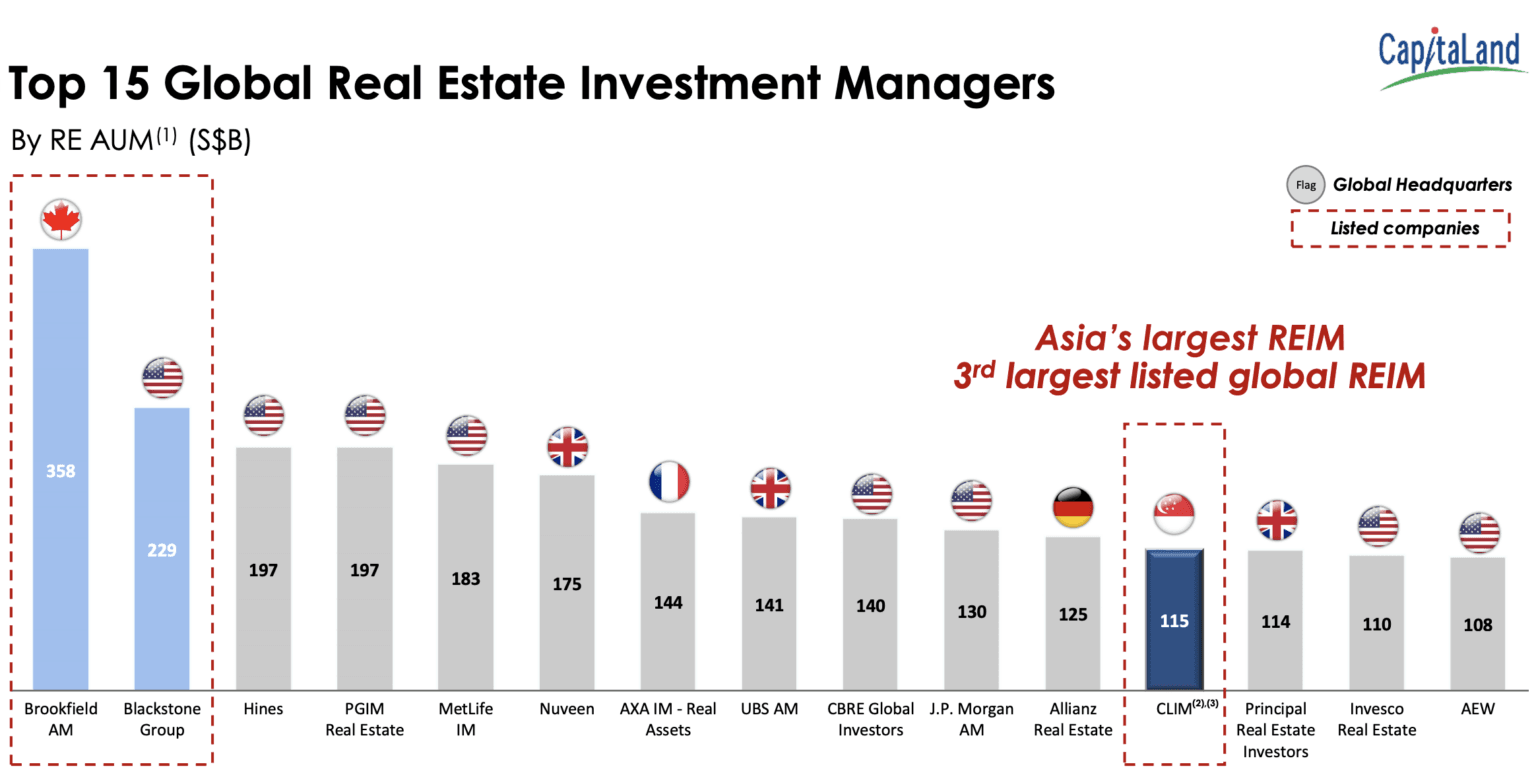

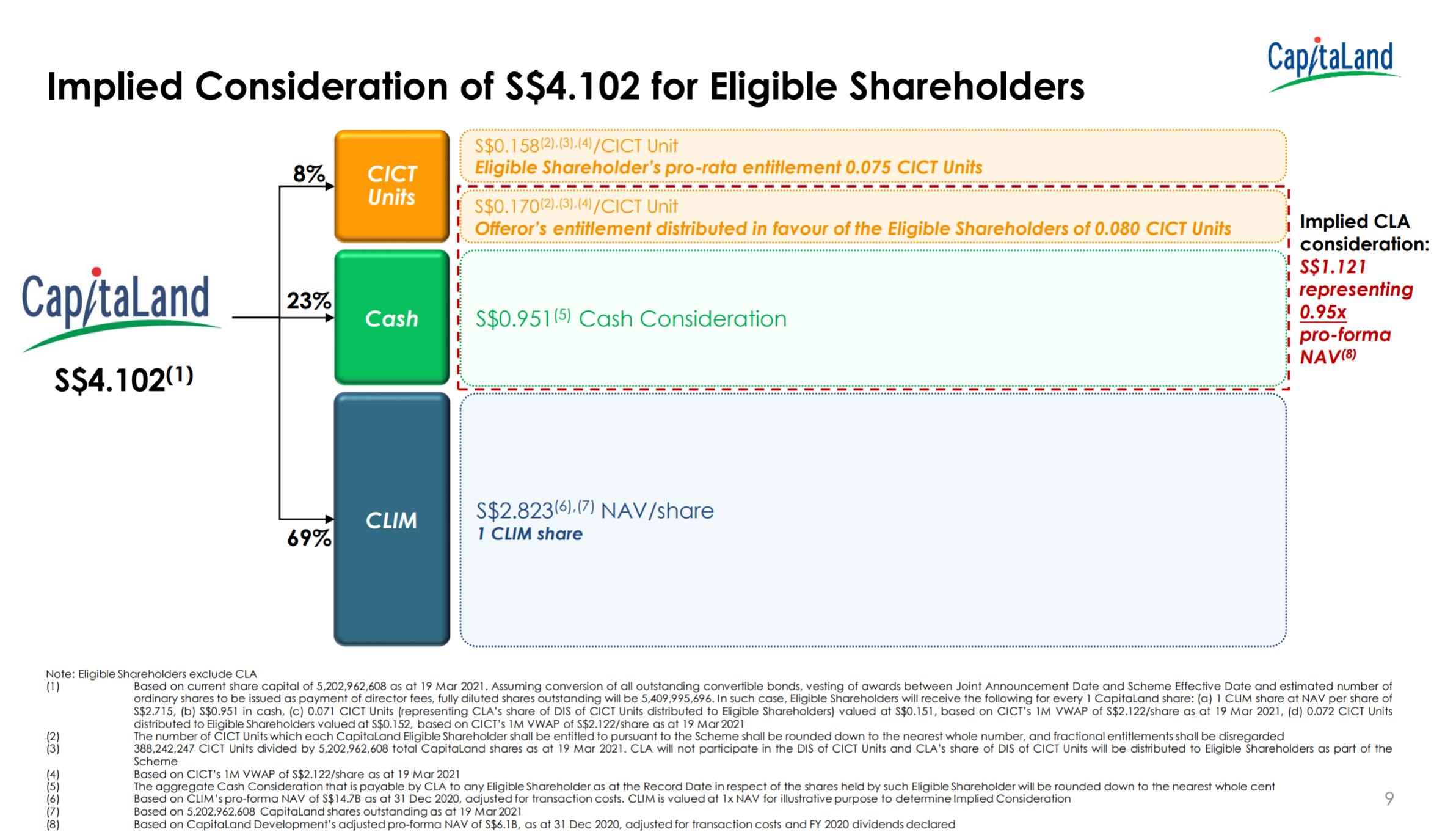

This leaves private properties to be the only viable option for property investing. This is a game that can be played when your income crosses a certain level. I believe there is somewhat cautious demand for private properties based on a few factors such as more people are earning higher and the limited supply of private properties. I believe Singapore private properties are still priced fairly comparing to worthwhile comparisons among other nations.

What are your thoughts to this? Let me know!

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.