“My plan is to downsize my house to use the (capital appreciation) money for retirement.”

I was walking past a coffee shop and I happened to hear the above statement. The man who looked like he was in his 50s seemed to radiate confidence about his statement. I wonder if it was possible. While we are going to explore that today, do check out my most popular blog post in 2020 so far: 5 mistakes people make using their CPF.

Context Setting

To buy a home in Singapore, I would say a good majority of us will take a loan. As we are able to take up to 90% (HDB loan) or up to 75% (Bank loan) of the property prices, this means we have to put a down-payment. To illustrate, a $400,000 HDB property would require us to fork out at least $40,000 as down-payment.

To pay for this down-payment, I know most people would use their CPF-OA to pay for it. At the same time, most people will also use their CPF-OA to service their home loans.

This means that our CPF-OA might be wiped out throughout our loan bearing years.

What most people fail to recognized is that we are charged interest for using our CPF-OA, this is known as accrued interest.

CPF Accrued Interest

Accrued interest is the interest amount that you would have earned if your CPF savings had not been withdrawn for housing. The interest is computed on the CPF principal amount withdrawn for housing on a monthly basis (at the current CPF Ordinary Account interest rate) and compounded yearly.

(Source: How does the Board calculate the accrued interest on the amount of CPF used for my property?)

As CPF is meant for our retirement in our planning of Wealth Management, to safeguard the “loss of interest” during the years the monies are used for property, we need to refund the CPF-OA the following.

- The down-payment that was used

- The monthly installment that was used

- The accrued interest (interest that we would have received from our down-payment and installment if we didn’t withdraw from CPF)

Will the plan work? Let’s put it to the test

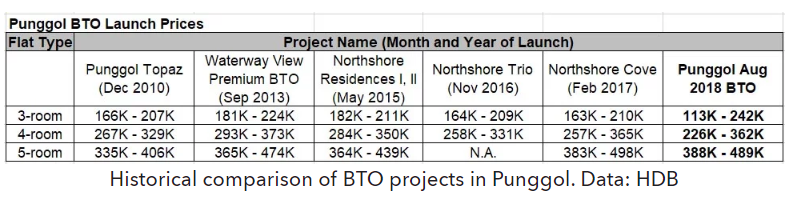

Let’s fixed a few reasonable assumptions to form an illustration. We will looking at downsizing from a 4 bedded HDB to a 3 bedded HDB after the loan tenure of 25 years.

HDB 4RM Value: $400,000

Down-payment: $40,000 (10%). Buyer Stamp Duty (BSD): $6600. Legal Fee: $3000.

Loan amount: $360,000. Monthly Installment: $1634. HDB Loan: 2.6%

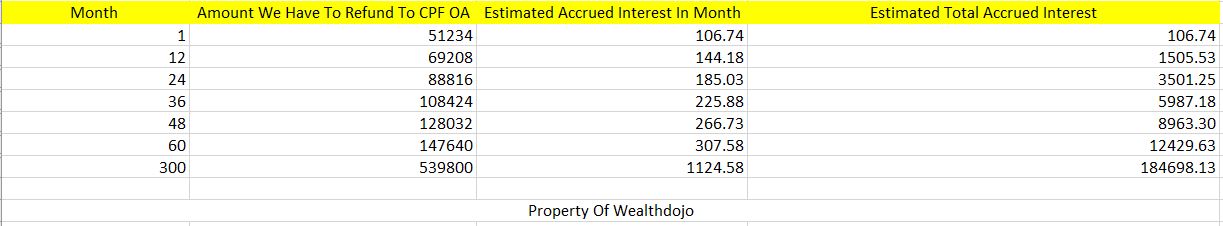

In month 1, we add the down-payment, BSD, legal fee and the first monthly installment of $1634 to get $51,234. From day 1, the accrued interest would already be $106.74. In 25 years time (300 months), the total accrued interest would have already accumulated to $184,698!

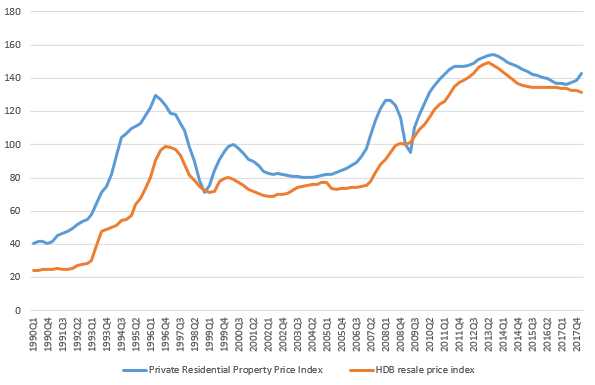

Assuming the property market grows at 3% annually, your $400,000 property will now be worth $837,511. Isn’t that great? Your profited $437,511!! Before you think that your profit will be $437,511 and can be used for retirement, here is when the accrued interest trap comes in.

When you sell your house, you have to return back to your CPF the down-payment, the monthly installment and also the accrued interest. This would mean that you have to return $724,498 ($539,800 + $184,698) into the CPF. Your cash proceeds will only be $103,013.

Wait there’s more!

Because you are downsizing, you can use your existing CPF-OA to acquire a HDB 3RM. Using time value of money, a HDB 3RM wroth $300,000 now will be worth $628,133 in 25 years time if it grows at the same 3%. You have to make sure that you have enough money to acquire that HDB 3RM.

Wait there’s even more!

You have to pay the HDB resale levy of $30,000 (as of 2020), agent fee of $8,375 (1%) and also legal cost of $3000.

Wait there’s even some more!

After the age of 55, you have to set aside your Full Retirement Sum (FRS) which is a combination of your Ordinary Account and your Special Account. This might post some problems to use your CPF-OA to acquire a HDB 3RM if you are unable to reach your Full Retirement Sum.

And lastly..

Assuming that you can acquire the HDB 3RM without problems, would $113,013 be enough for retirement?

Conclusion

Retirement planning is often more than a single solution. There are many caveats that stumble the best of us. To ensure your retirement is secure, work together with someone that you trust and exhibit good expertise in this matter.

In my experience helping people plan for retirement, I realised those that retire in comfort usually have a combination of retirement tools ranging from properties, stocks, annuity and also insurance.

Thank you the uncle at the coffee shop who inspired me to write this article. Please help to share this article so that this article may find its’ way to him.

No one will care about your money as much as you do.

In Wealth Management, it is important to Pay yourself first. Beware of scams. Before you invest in any company or popular investment opportunity, be sure to do your own due diligence. If you wish to learn more about investment, I hope to nurture genuine relationships with all of my readers.

Check out my most popular blog post in 2020 so far: 5 mistakes people make using their CPF.

Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page or my Telegram Channel! Or subscribe to our newsletter now!