If you are reading this, you might be deeply hurt by the stock market from 2019 to 2022. I feel you. The last 4 years could have been the most profound shift in the financial market ever. In this article, I will explain what happened to the stock market from 2019 to 2022. In the conclusion, I will attempt to forecast what may happen beyond 2023.

Disclaimer: This is by no means a buy/sell/hold recommendation. Personally, I will write what make sense to me at this moment of time. Read with caution. This is a highly simplistic article and I will explain using demand and supply which are the basic market forces that move prices.

The “Beginning”

COVID-19 was first identified in Wuhan, China in Dec 2019. The World Health Organization (WHO) declared public health concern in 30 Jan 2020 and later a pandemic on 11 March 2020. Province lockdowns soon became a global lockdown in the coming month.

In the last 50 years, the world has become a “smaller” world due to globalisation. It is now much easier to obtain goods, services and even labour across continents. As a result, some countries who have more resources (food, raw materials, land) can sell those countries that have less. In an utopian world, resources are used more efficiently.

In a way, the fate of every country in the world are now intertwined with each other.

The closure of China, being the 2nd biggest economy has impacted the world by reducing the global supply. The illustration below show the top exports that China sells and the potential impacts on the destination countries.

The “Flawed” Gameplan?

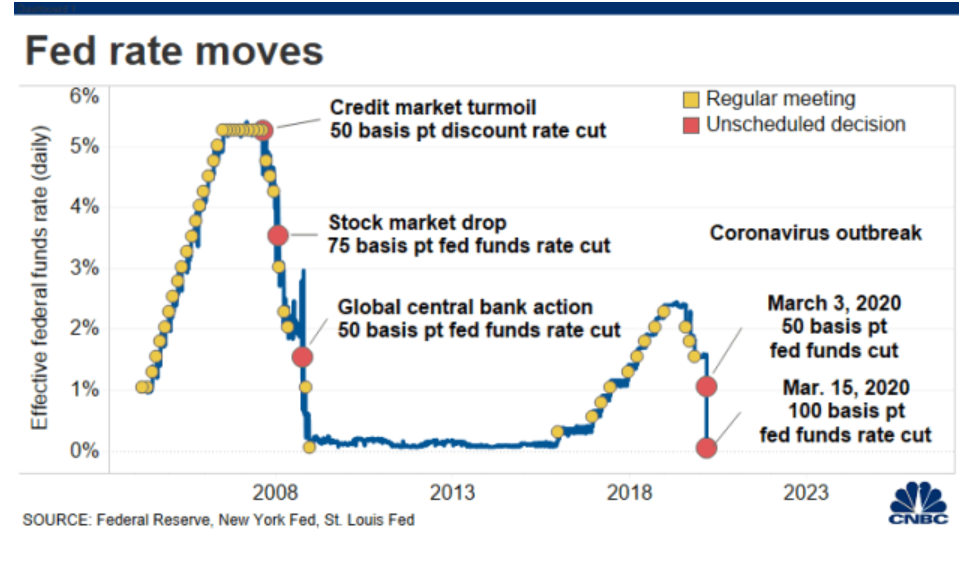

As the world started to shut their doors, the FED in an attempt to save the economy blew the dust off their previous gameplan during the financial crisis of 2007 to 2009. Though it felt like a decade ago, on 15 March 2020 the Federal Reserve announced it is dropping its benchmark interest rate to zero and launching a new round of quantitative easing (QE).

For QE to happen, the central banks buy bonds (typically government) and other assets. Thus, it injects money supply into the economy. This adverted the previous credit crunch in 2007 to 2009.

I believe that COVID-19 was however not a credit crisis. However, as there are now more liquidity in the market. More money are now chasing the same (probably lesser) amount of goods. This increased the demand for goods and services.

The WFH Trend

COVID-19 brought many changes in our lives and one of them was working from home (WFH). While retail and restaurants were badly affected, the technology sector thrived as we are more reliant on technology to conduct our meetings.

Share prices of companies such as Zoom, Microsoft, Salesforce, Netflix roared upwards. As their business boomed, the demand for labour in this sector increased. As a result, wages increase. This increases the disposable income to buy even more goods and services.

Inflation Woes

This trinity of events in my view, created inflation. With China lockdown (lower supply), increase in money supply and wages (higher demand), this pushed the prices of goods and services upwards.

To add fuel into fire, the Russia-Ukraine crisis put even more pressure the global economy.

What was believed to be a transitionary inflation became a persistent one. While we are seeing some slow down in inflation today, it is way higher than Pre COVID-19 inflation rate of 2%.

source: tradingeconomics.com

The Pivot

To tame inflation, the FED began their series of aggressive interest rates hikes from March 17, 2022. This is done to create some price stability in the market. While I believe the COVID-19 crisis was more of a supply issue, the FED could only influence the market through demand side solutions.

When interest rates increase, this makes borrowing more difficult. As a result, business may spend lesser and this may cool the market. We are starting to the effects of this as news of hiring freeze began to surface.

This spooked the stock market sending share prices of many technology companies tumbling to their 52 weeks low.

What happened in the stock market 2019 to 2022 Taming Inflation

What’s coming in 2023?

So, what’s next? The following section will be my prediction of the market. Please read with caution.

I believe things will become better in 2023. This is because supply chain will be easing. I believe the lockdown impacted supply chain as China is the “manufacturing factory of the world”. The world will be “reunited” again after 8 Jan 2023 as China finally open their doors to the world. At the same time, Chinese tourist will once again roam the world with pent up spending. I believe this inflation will be transitionary while supply chain eases up.

While manpower in the technology sector are still on freeze, I’m seeing more demand for manpower in the retail and restaurant space. As this sector struggles to find workers, this will push wages up. In a way, we might see improvements in income inequality. I believe this wage increase is healthy.

Hence, I believe Inflation will stay for a while. This will in turn mean that interest rates will be hovering around current levels. This will then depress stock valuation of companies.

Howard Marks from Oaktrees communicate this best in his recent memo. While we were blessed with low interest for the last 40 years, we should look forward to a more “normal” interest environment in the years ahead.

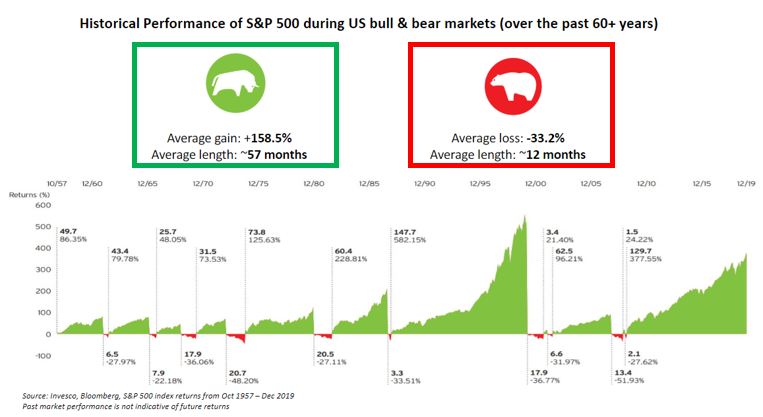

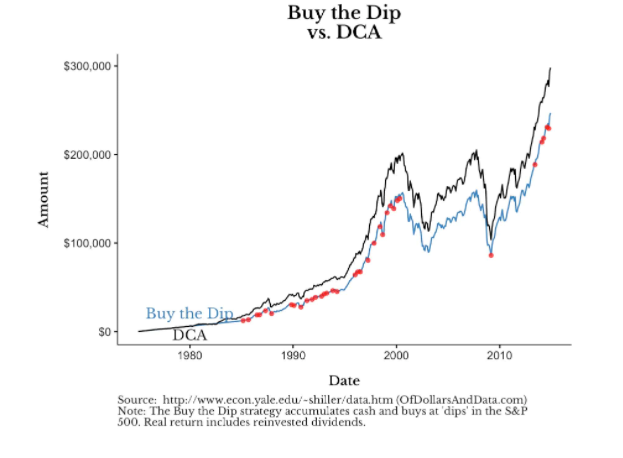

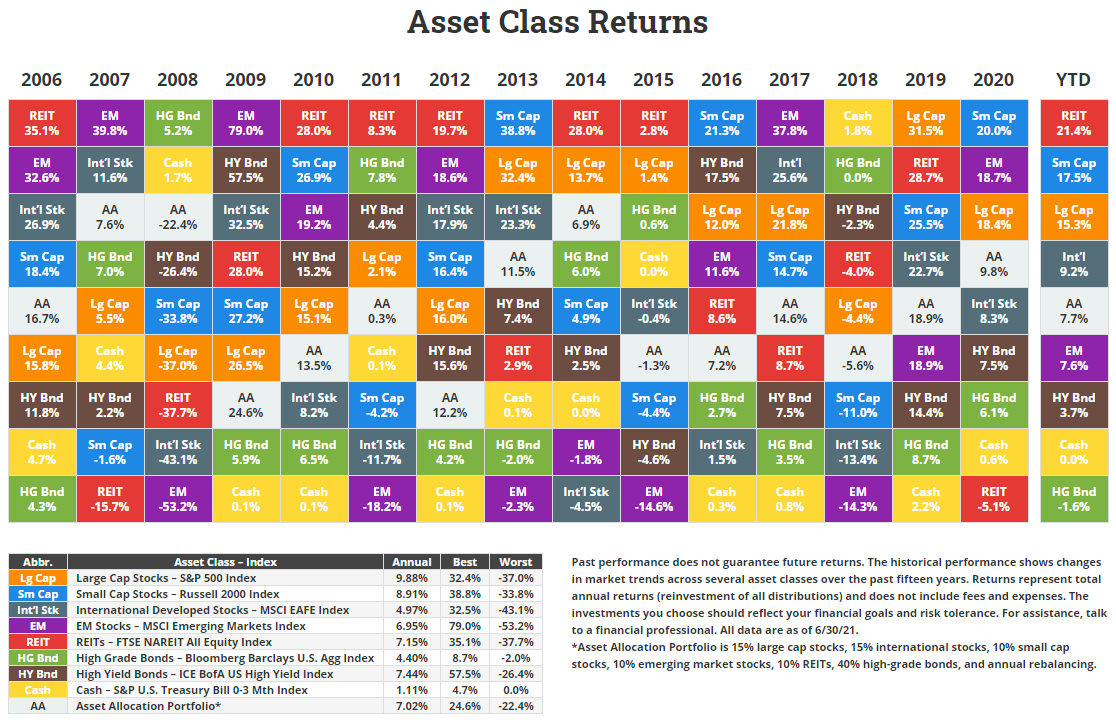

In today context, we are preparing more for a slowdown or soft landing. As the credit window is more constricted now, it is important to build up capital fast for any opportunity.

Final Thoughts

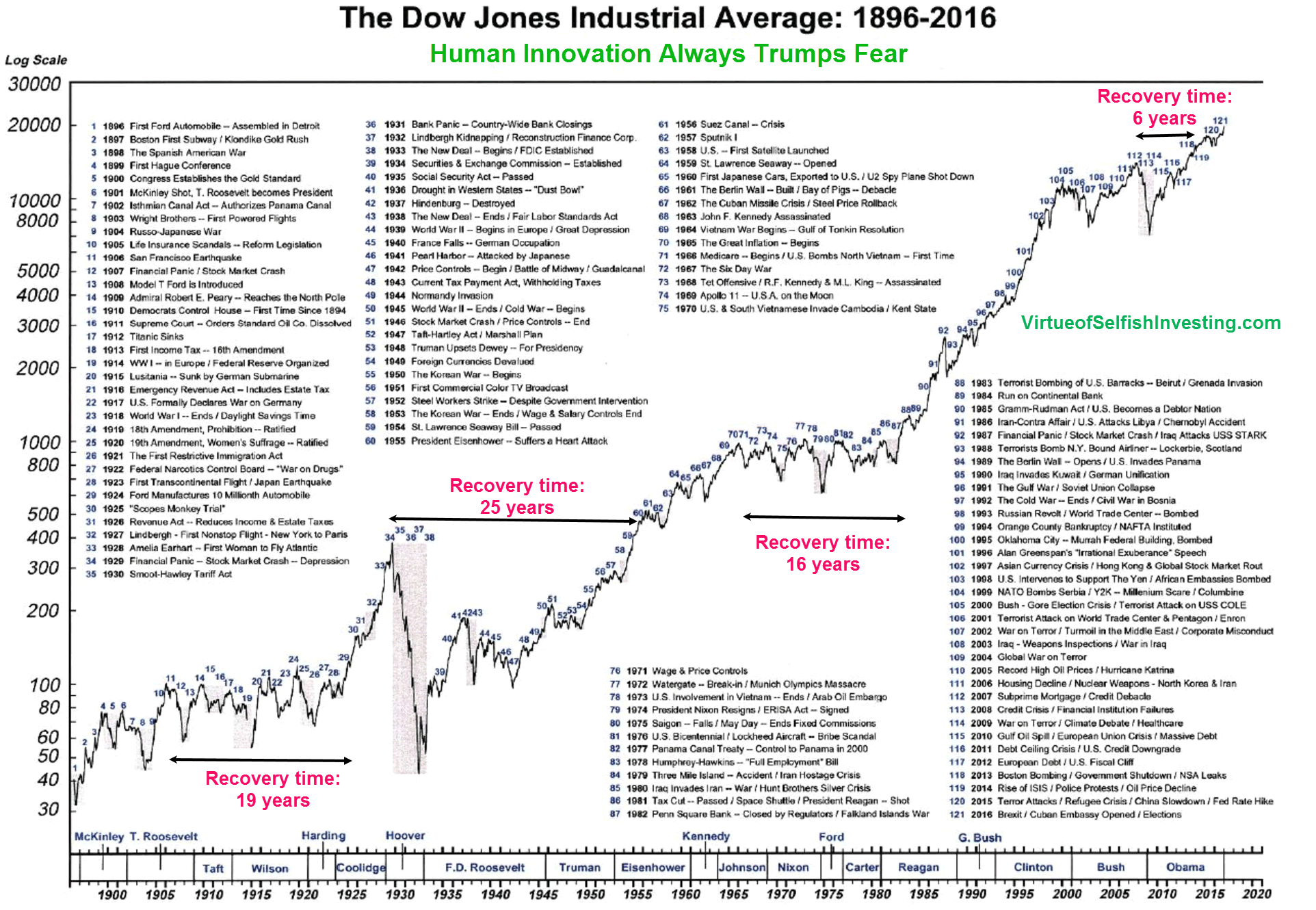

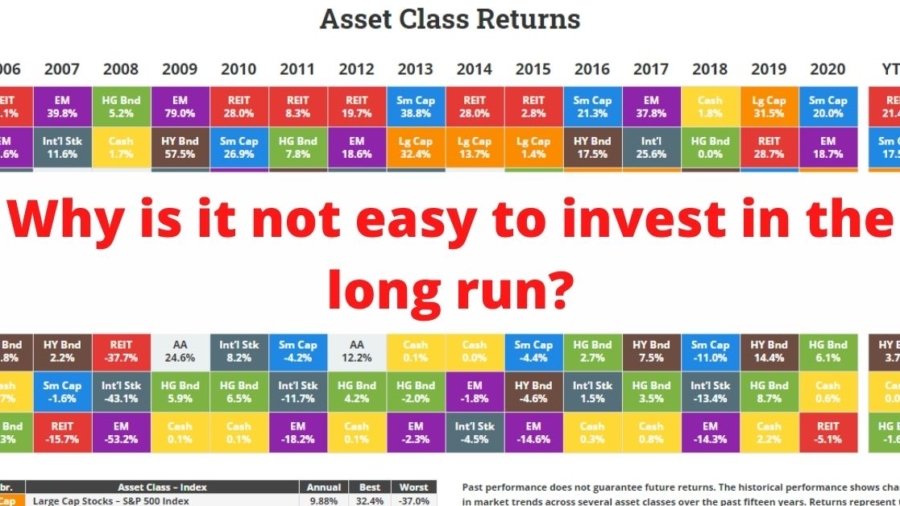

Congratulations for making it thus far. I don’t think it was easy to invest in this environment. It was certainly a 180 degrees pivot from 2020 to 2021. Nevertheless, it is more important to be educated in investment. I believe the window of opportunity is opening.

Like what Howard Mark says, a sea change is coming. Are you prepared?

I wish you all the best. Take care!

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.