Happy Birthday!! On 12 Jan 2009, Nakamoto sent 10 bitcoin to Hal Finney. This became the first “transaction” in bitcoin history. 12 years later, prices of Bitcoin exploded to reach USD$40K (on 9 Jan 2021). What a journey! Such exponential increase in prices tend to spike interest among the retail investors on their wealth management journey. If you reading this, welcome to the club.

In this article, I will write about my understanding of bitcoin, where we are at the moment and also answer an important question in your mind.

Is it too late to invest in bitcoin?

Disclaimer: I don’t claim to be an expert in Bitcoin. All views represent my own. I would love to engage in a healthy discussion of bitcoin in the comments section below.

Context Of Bitcoin: Currency Of Trust

Bitcoin was born slightly after the full swing of the banking crisis. What started as a subprime mortgage crisis eventually created a domino effect that crippled the ENTIRE world financial system. You can imagine the distrust in the financial industry at that time.

The original Satoshi Nakamoto white paper states: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Financial institutions now have new and stricter regulations to comply. At the same, another school of thought arose. Skip the financial institution altogether. It is what it meant by disruption. Imagine a world where you can make financial transactions without going to a bank. This loosely translates to a more efficient and cheaper financial services.

This is where Bitcoin was born.

Bitcoin is positioned to be the “currency of the future”. This boils down to back to the fundamental of money which is trust. The US Dollar has been positioned to be the global currency because it is widely accepted and “trusted” (consider why you won’t want to hold Zimbabwe’s currency). 61% of all foreign bank reserves are denominated in U.S. dollars, and nearly 40% of the world’s debt is in dollars. On the dollar bill, you will see this world called legal tender which means that it is acknowledged by the laws as a mechanism to settle a private or public debt or in order to meet a fiscal responsibility which includes paying taxes, abiding by contracts, and finally damages or fines.

Bitcoin is making waves as it becoming more “widely accepted” (I will discuss more about this later). It is also “trustable” as it is backed by blockchain technology. To put loosely, blockchain technology is used to share valuable data in a secure, tamperproof way. That’s because blockchains store data using sophisticated math and innovative software rules that are extremely difficult for attackers to manipulate. At this moment of writing, Bitcoin is not legal tender yet but is deal with as property or goods.

For a deeper understanding of cryptocurrency, blockchain technology and bitcoin, here is a good article by PwC.

Can it ever be used as money?

In the economic literature, something can only be used as money when it has these 3 functions. A medium of exchange, a measure of value and a store in value. Perhaps the heavily debated issue is if Bitcoin if it has a store in value.

Is there a store in value?

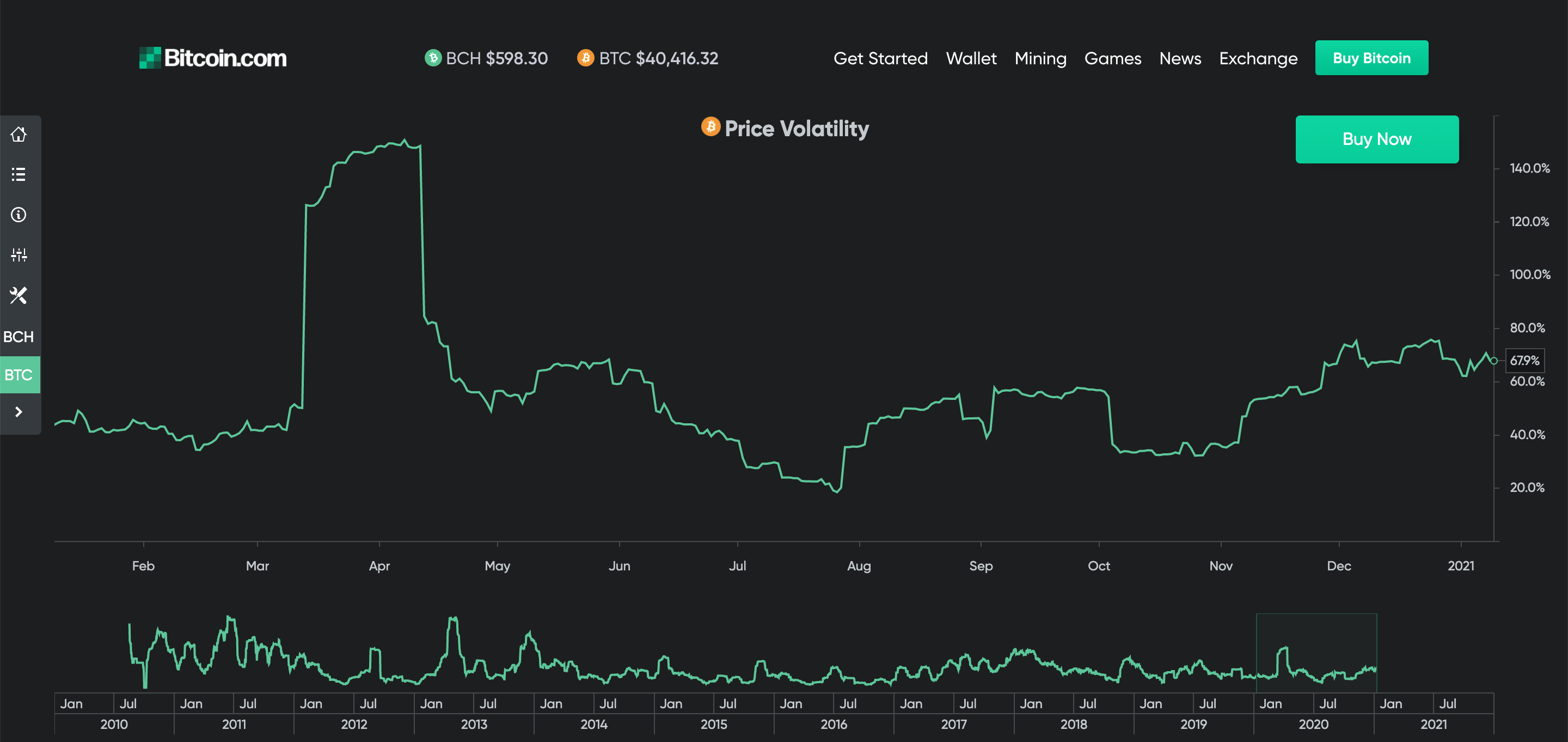

Consider this graph on the volatility of bitcoin over the past year and also past 10 years. The prices of bitcoin was never in any sense stable (which is what makes it exciting). Prices volatility have been north of 20%. A store in value is defined as something that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved. Whether you are a bull or bear for bitcoin, I think we can agree that there is no predictability for the value of the coin in the near future.

Is it being used as a medium of exchange?

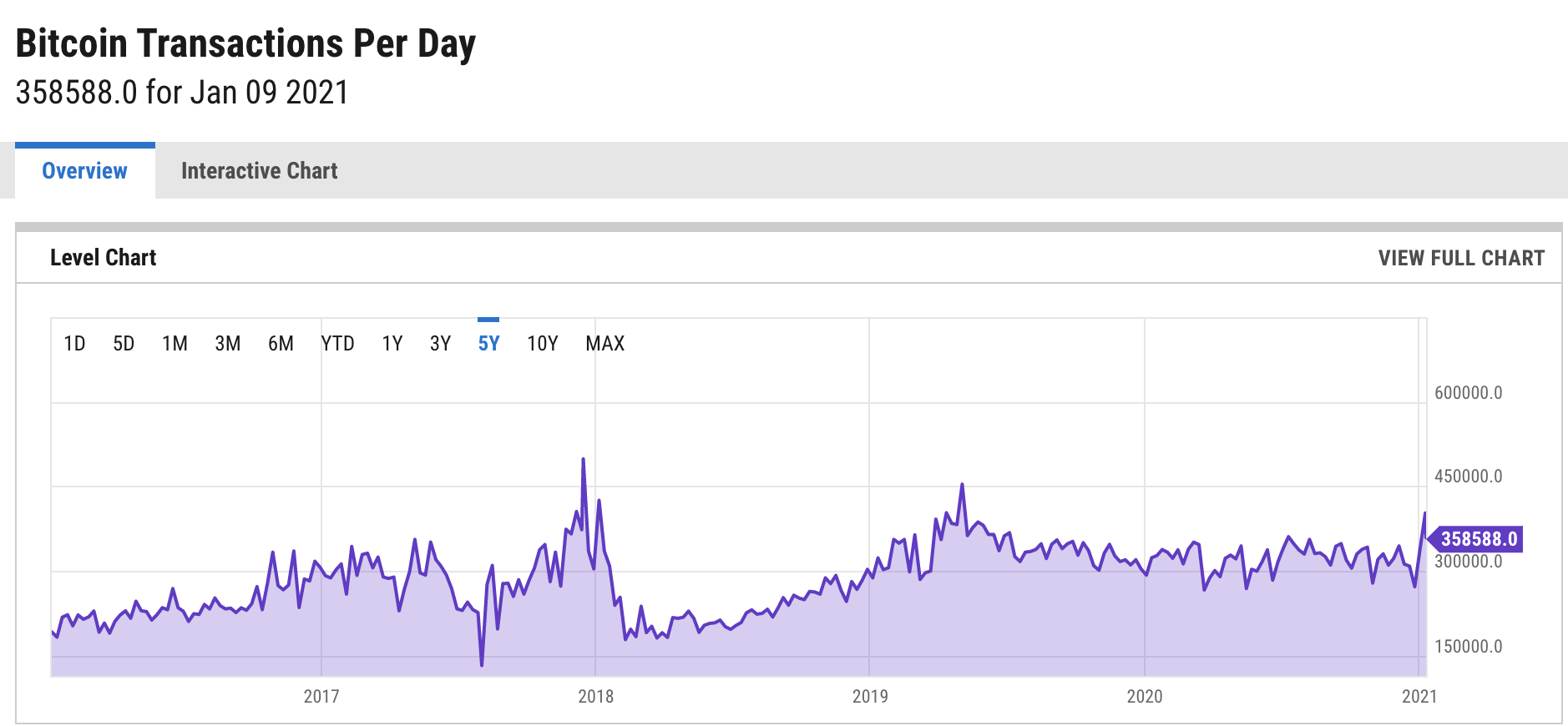

While Bitcoin transactions has been increasing over the years as it slowly become more “widely accepted”, we are unsure how much of it is being translated into real goods and services. According to newbtc, only 33% of bitcoin transactions are being used to purchases goods.

That being said, I believe that there will be more transactions in future. My question is IF my Bitcoin is appreciating at such an insane level, why would you ever use it to buy something? Taking a note back into May 22, 2010, now known as Bitcoin Pizza Day, Laszlo Hanyecz agreed to pay 10,000 Bitcoins (USD$400,000,000 or USD$400million today) for two Papa John’s pizzas for USD$25. Who in the right mind would want to use Bitcoin to buy anything? Imagine something that you bought at $25 then would now be USD$400million. There would be an extreme incentive to keep money or HODL (someone that keeps cryptocurrency rather than selling them).

Will more people start to use Bitcoin?

It is written that there is an “increasing adoption” of Bitcoin. I have my doubts as shown by this Bloomberg article. About 2% of the anonymous ownership accounts that can be tracked on the cryptocurrency’s blockchain control 95% of the digital asset. Due to the finite nature of Bitcoin, an increasing adoption have to mean that the number 2% should start to go up. I believe there are some whales that are currently holding the bulk of Bitcoin for it to be used meaningfully as money.

Personally, I believe the original intent of it being used as money is now being shaken.

Bitcoin As An Investment Speculation

While I believe the original intent of Bitcoin have not been carried out, you cannot not deny that the people have been making money on it. Whether Bitcoin should be invested depends on who you are asking or who you are.

Futuristic Individual – Yes. We will be using cryptocurrency in future.

Value Investor – No. Because there is no value creation in Bitcoin (No revenue/cashflow/earnings).

Technical Analysis Trader – Buy at signal. Sell at signal.

Bullish Retail Investor – Hell Yeh. Huat ah!

Bearish Retail investor – Run for the hills! Let me tell you a story of the Tulip bubble.

Personally, I believe that there is room to speculate on this. With no foreseeable future usage (in my own humble/limited capacity), I feel that it is a strange asset class but an attractive tradable instrument.

Final Thoughts By Wealthdojo

There are still many things shroud in mystery. Who is Satoshi Nakamoto? Who are the 2% who is holding Bitcoin’s wealth? Are they the Russians, Chinese or terrorist? We will never know (at least for now).

With Bitcoin entering into the financial system, they have became part of the system they have set out to replace. The disruptor seemed to have become absorbed into the legacy system. The banks will live another day.

All views represent my own. I would love to engage in a healthy discussion of bitcoin in the comments section below.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

Great post! I was reading it this morning while eating breakfast. Keep up the great content!

What a great post. Thank you for sharing this! I’m going to send it to all my friends.

[…] better than bitcoin which is giving a 257% returns over the past one year. Just how did it happen? Is it too late to invest in bitcoin, Tesla or even […]

[…] It is 29 Jan 2021. Gamestop (GME) share price is $325. It has gone up a long way since early January when price is around $17. The battle is still on. Several brokerage companies like Robinhood has started to restrict trading on GME. So much for a company that believes that everyone should have access to the financial markets. With this, I believe there might be more interest going towards Bitcoin. […]

[…] In this article, I will attempt to explain what good and what not good will happen from this move and potential series of events that might unfold. If you are new to Tesla and Bitcoin, I would encourage you to read about my previous Bitcoin article: Is it too late to invest in Bitcoin? […]

[…] In this article, I will attempt to explain what good and what not good will happen from this move and potential series of events that might unfold. If you are new to Tesla and Bitcoin, I would encourage you to read about my previous Bitcoin article: Is it too late to invest in Bitcoin? […]

You ought to be a part of a contest for one

of the greatest blogs on the web. I most certainly will recommend this site!