The last 2 weeks was a bumpy one for China’s stocks. Technology companies ranging from Alibaba, Tencent, Didi and all the way to the educational sector pretty much spooked investors all over the world. There was massive selling and it seemed to have paused after JD reported good earnings.

Some of these company’s valuation are getting attractive once again as prices corrected in the last 2 weeks. This wasn’t music to the ears for those that are already invested. On the ground, I heard of many investors who took this opportunity to average down (buying at lower prices to lower the average prices). However, some investors seemed to have cracked under pressure and started asking why dollar cost averaging is not working.

Today, this article seeks to explain why dollar cost averaging is not working on China’s stocks… yet.

What is Dollar Cost Averaging (DCA)?

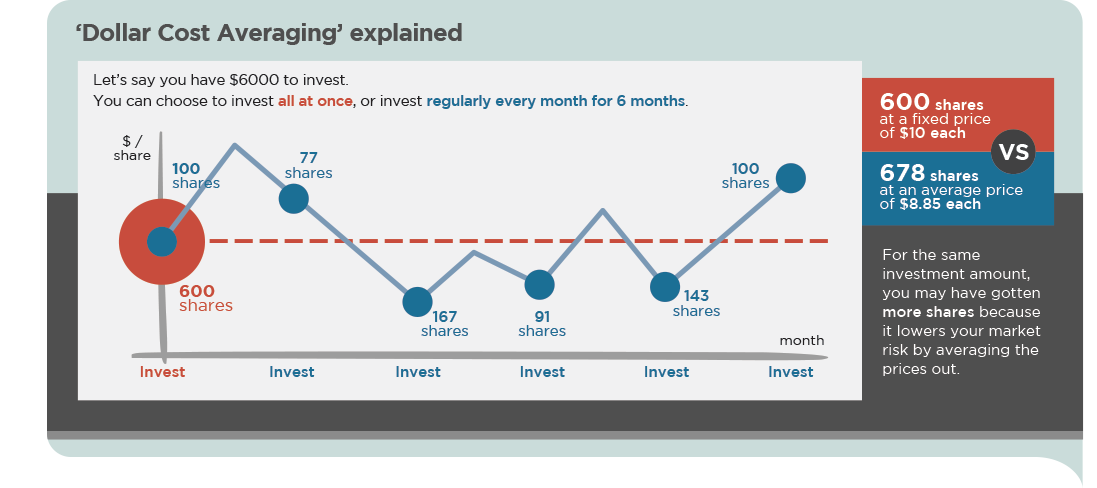

You probably have heard of this term Dollar Cost Averaging (DCA) from a friendly Financial Services Consultant as he was talking about investment. This strategy was made popular to retail investors as a way to invest by reducing the impact on volatility (the ups and downs) in the stock market.

“Time in the market, not timing the market”. This quote always serves as a reminder that investing (not speculation) is about being in the market and not timing the market. (Read More: Why Buy Low And Sell High Is Useless Advice).

The power of dollar cost averaging is making volatility your friend by buying at regular intervals. It is your objective to own as many shares as possible. In the above example, you are invest $1000 for 6 months.

Month #1: Share Price $10. You will be able to buy 100 shares ($1000/10 = 100)

Month #2: Share Price $13. You will be able to buy 77 shares now ($1000/13 ≈ 77). You have 177 (100+77) shares now. The total capital is $2000. The total value of your shares $2301 (177*$13). At this moment, you are profiting $301.

Month #3: Share Price $6. You will be able to buy 167 shares now ($1000/6 ≈ 167). You have 344 (100+77+167) shares now. The total capital is $3000. The total value of your shares $2064 (344*$6). At this moment, you are losing $939. Most people starts to open their warchest now.

Month #4: Share Price $10.98. You will be able to buy 91 shares now ($1000/10.98 ≈ 91). You have 435 (100+77+167+91) shares now. The total capital is $4000. The total value of your shares $4776.30 (435*$10.98). At this moment, you are profiting $776.30 again. You are happy again.

Month #5: Share Price $7. You will be able to buy 143 shares ($1000/7≈143). You have 578 (100+77+167+91+143) shares now. The total capital is $5000. The total value of your shares $4046 (578*7). At this moment, you are losing $954 again. Some people start to freak out and wonder why dollar cost averaging is not working. In the case of China, the chart has been one direction downwards and “the moment” in the time for losses are prolonged.

This is the reason why people feel that dollar cost averaging is not working… yet.

Month #6: Share Price $10. You buy 100 shares. In total, you would have 678 shares. Total capital $6000. The total value of your shares $6780. You are profiting again.

You are making volatility your friend

Dollar cost averaging works when there are ups and downs. Currently, as the Chinese market is down, you will feel that it is not working. When the market recovers, DCA will suddenly “work again”. At this point, you will often hear people start talking about their investment gains.

“Time in the market, not timing the market”.

I had to copy the quote again. Remember that investing (not speculation) is about buying shares of the companies/funds/assets you want through time. Dollar Cost Averaging is just one way that you can consider to invest.

Final Thoughts

You are not alone in this journey. I believe that there are many who have invested in the Chinese market because of good valuation. Of course, there will be non believers of Chinese market because of their tight regulations. At the end of the day, it is about investing with the strategy that you are most comfortable with.

You can buy stock tips. But you can never buy conviction.

Ask yourself if the asset allocation strategy fits your profile. Engage a professional to finetune the strategy. Lastly, do start. With every crisis, comes an opportunity.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.