This show from Netflix needs no introduction. Amidst the games, the show highlighted the Korea Economy. One with highly-skewed income disparity, worsening household debt and survival of the fittest amid fierce competition.

South Korea is the 12th biggest economy in the world with a GDP of $1.6T. Singapore is trailing behind at 36th with a GDP of $364.2B. Though they are larger in GDP, it seems like the struggles they have with money is the same as Singapore or even worse.

While watching the show, I keep feeling that the characters behave very badly when it comes to money (or the lack of money). Just a few days after, I can’t help but think that it is an representation of what is happening in real life. (That’s probably why the show resonates to us on some level).

To avoid going down the slippery slope, I decided to consolidate the lessons we can learn from this so that we will NEVER have a situation like this EVER.

Hope you enjoy the read.

Spoiler Alerts: Please do not read this as it contains spoilers on the show. We invite you to come back after you finish the series.

We Have Emotions

I feel that this is something that isn’t acknowledged much in the financial world. It is often thought that most financial decision can be made logically easily. The basic assumption in most economic literature is that humans are rational in nature. However, behaviour economics proven time over time that this couldn’t be more wrong.

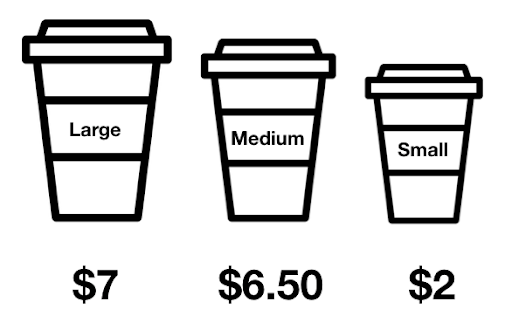

Consider this, you walk into Starbucks (or any other coffee places) to get your daily small dose of coffee. After looking at the prices, most people end up getting the big cup not because they wanted it but because it is a “much better price” than the medium. If you have also chosen the big cup, congratulations, you have experienced the Decoy Effect.

The Decoy Effects explains how an inclusion of an inferior 3rd choice (medium cup) will affect your consideration of between the initial 2 choices (large and small). When there is a decoy alternative, most people makes decision based less on what suits their needs and what we considered as a more beneficial alternative. This results in people spending more as a result at Starbucks.

This is just one of the many cognitive bias that we experience.

This is why it is not easy to invest in the long run, buying term and invest the rest is bad advice or why buy low and sell high is useless advice. I’m not denying that those are rational. It is logical. But we are humans. We experience fear, greed, anger, denial, lost, guilt, shame, hope, envy etc.

These makes it very tough to be rational in a body where we feel so much. Today, most people only focus on the rational side which makes it tough to have a good conversation on finances. I hope that more and more people can come to acknowledgement with their emotions in future.

You Can Win With The Right Strategy

In this very epic game of tug of war, strength is very important. In the team of 10 people, the protagonist team have 3 ladies, 1 weak elderly and 6 men. They faces off a stronger team consisting of all men.

While it feels like the protagonists team have a clear disadvantage in this game, the weak elderly share his wisdom and experience on how to strategize and win against teams that are bigger and stronger than them.

The protagonists team barely escape death by execute the strategy and winning against a team far stronger than them.

In the financial world, you can consider the 10 people the resources that we have. Some of my peers have rich parents, some are left properties under their names, some have good networks and have parents financially independent. But, they may not be financially as well off.

I also have friends who have siblings who depend on them, a study loan, parents who believes that children is the ultimate retirement plan. In spite of this, some of them do succeed in their financial goals by having a right strategy and executing it well.

Having a strong 10 people/resource is important. It is as important as having the right strategy and executing it well.

Learn From Others Mistakes

In another nerve wreaking game called the glass stepping game, participants are made to cross a glass bridge. Participants are presented 2 choices. Stepping on the right choice would mean safety, stepping on the wrong one would meant death. In any event the participant chooses the wrong one and dies, the one after him/her can choose the right one and proceed with the game.

In this game, it is awful being the first one.

In the financial world, money was first originated some where as early as 5000 B.C., in which tons of literature has already been written. One of the classics of financial books is The Richest Man in Babylon. Many important clues have been record and it is up to us to follow that roadmap presented to us.

Another way is to learn from the people around us. If our parents have achieve a certain level of financial freedom, we can learn from it. If our parents have not achieve any, we can also learn from that too.

In whichever case, there is always something to learn.

People Can Behave Badly When It Comes To Money

In the final game of the series, Squid game, the 2 protagonists face off in a brutal, savage and barbaric fight. As their lives and the prize money was on the line, they really had a lot to fight for.

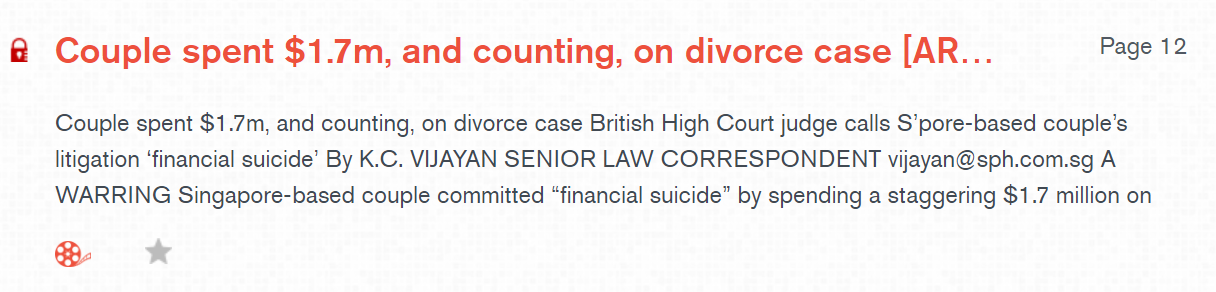

I was reminded of estate planning stories and divorce stories that were shared during my recent IBF Certification for Private Banking. Most of the stories were very unfortunate. In almost all cases, humans behaves very badly when it comes to money issues.

A old example happened in 2013 when a Singapore based couple committed “financial suicide”. Both have spend SGD$1.7 million on legal costs – just to decide where the divorce should be heard as well as litigation costs linked to the child. You can find the article from multimedia stations from NLB Libraries. It is written in The Straits Times dated Friday, 2 Aug 2013 by Senior Law Correspondent K.C. Vijayan.

In a more recent example, siblings are suing their elder brother over 2 properties worth SGD$3.1 million. As the estate planning was not poorly set up, it has resulted in a messy inheritance battle of which relationship will be ruined. Though it is not known what the legal costs are, I believe their relationship will never be the same again.

The Financial Journey

In the most iconic game called Green Light, Red Light, participants win by making their way towards the end of the line in a given time limit. They can only move when it is Green Light (when the doll is not facing them) and they have to stop any movement during Red Light (when the doll is facing them).

At the start, the participants don’t really understand what to do. 2 brave souls started the journey but ended up dead. This causes panic to everyone and people scrambled towards the “exit”. Unfortunately, they were all shot dead.

The cooler headed participants began their journey again. Unfortunately, some tripped either because they were moving too fast or just unlucky to bump into themselves. They died in their attempt to reach the end.

As some participants crossed the line and won the game, there were others that couldn’t cross the line and died as well.

In this game, it closely symbolizes our journey with money. In a given period of time (working years), we want to reach the end (retirement). Some people panic when they see others lost money in the investment and ran towards the exit (panic selling). Some people overleverage (move too fast), some people suffers from critical illness (bump into themselves), some people start too late (couldn’t reach the end). In all these cases, it resulted in people having a less than ideal lifestyle.

Final Thoughts

Overall, this show was a dark, ghastful and yet awfully realistic in showcasing the behaviour of humans put in those desperate situations.

I recommend watching a comedy after the show.

What other financial lessons have you learn from this show? Let me know in the comments below.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

What resonated with me was the marble game as not all friends are friends when it boils down to survival of the fittest. If you’re fortunate enough to find one, treasure them. Beware whom to trust in your financial journey.

Excellent point and observation. Thank you for the comments.