What is a Naruto Run and how is it related to Financial Freedom? What we are running to?

Recently, there is a big joke in the USA as there is now a whopping 1.7million people who have signed up to “storm Area 51” Facebook event. The event, which is called ‘Storm Area 51, They Can’t Stop All of Us’, was seemingly created as a joke. However, it has got so serious such that the US Air Force has issued a stark warning to anyone thinking of trying to gain unauthorised access to the base. (Read more: Naruto Run Area 51)

This sentence was what made it famous.

‘If we naruto run, we can move faster than their bullets. Lets see them aliens.’

For those of you thinking of what is a naruto run? You have come to the right place. A Naruto run is a style of running in which person or character runs leaning forward with their arms stretched out behind them. For those that need some visual image, look at the gif below.

Not the most important of information. In this article, we want to find out how we can Naruto run our way to financial freedom. Have you ever pondered about this question before?

“Why are some people rich and how did they become rich at a young age?”

How is it possible for people that young to be rich? This question comes out a lot for people who are in their 40s or 50s. They have worked hard for a HUGE part of their life but are not rich yet. Just how is it possible for people who in their 30s become richer faster than them! This also puzzles me UNTIL I met people who are became Millionaires in their 30s. These are ordinary Singaporeans who also serve the same NS, buy the same HDB, and also get married (Read More: Sandwich Generation: Is it still possible to be rich?). I had a rare opportunity to interview these people and what they shared with me changed my life forever. To my surprise, I realised that there are many similarities on how they naruto run themselves into Financial Freedom. Today, we will look at 3 similarities strategies that majority of them used to reach their Financial Freedom.

- Learn a high paying skill set

Let’s face it. To make money from assets, we first need to have money. In our initial working years, majority of us won’t have a lot of money to invest. Imagine you have a chance of a lifetime to make 1000% from the stock market, would you want to have $10,000 or $100?

$100,000 -> After 1000% -> $1,000,000

$1,000 -> After 1000% -> $10,000

See the difference?

For young people, the capital that we have will be limited. As a result, there might be tons of opportunities that we might be missing out if we don’t have money. Instead of lamenting on the fact that we don’t have money, successful people they learn a high paying skill SO THAT they can get more money to invest WHEN THE TIME COMES. To find a high paying skill set, we need to first understand what the market needs NOW. You can always get this information from LinkedIn (Read more: Tops Skills 2019). Some of the skills sets are evergreen, like Sales Leadership, Marketing and customer service.

There are many skills to learn. Choose one and get very good at it.

- Maximise the available tools you have in your disposal

Multiplier accounts (Read More: Money Maximization: REV©), Fixed Deposits, Bonds, CPF (Read More: Make The Most Of Your CPF). There are many tools that we are exposed to. But, it is still under utilized by many people! These are simple things that we can do to help us maximise the amount of money in our bank accounts especially when there is minimum fee or commission involved in these accounts. Successful people maximises what they have with what they have. Every cents counts.

I have a client who was not maximizing his bank accounts in Singapore. After, I share the REV strategy with him, his banking interest INCREASED by 600%

Before REV: $1400 interest per year

After REV: $10,000 interest per year

After sharing with many people, I realised that most Singaporeans will be able to get around $150 to $300 a month just using this strategy. These are just extra cash to be obtained if you put in that extra effort.

- Learn Investing

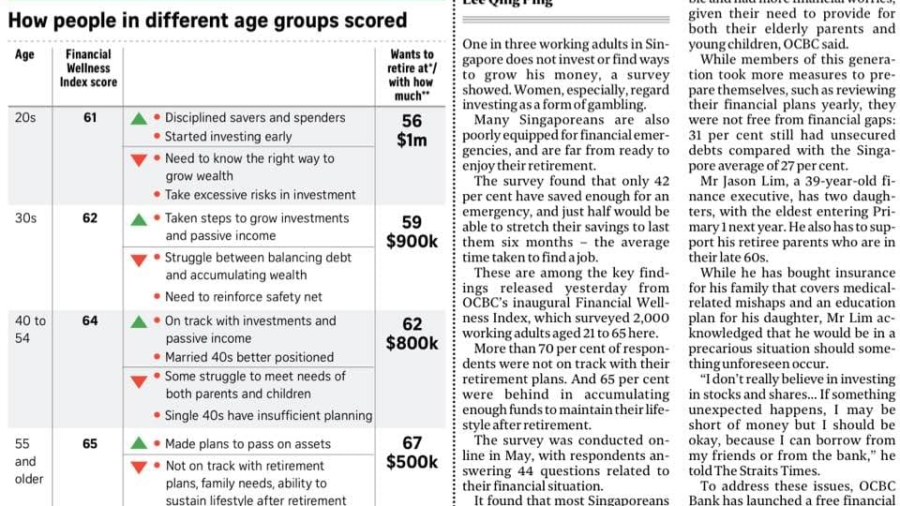

In a recent survey (Read more: Most Singaporeans behind on retirement plans, many unsure how to grow wealth), 1 out of 3 Singaporeans is not investing. My question in my previous article is that are the 2 Singaporeans investing properly?

Most people that I met do some level of “investing” but when questioned deeper, I realised that many of these people “gamble” instead. So, how do you identify if you are gambling or investing? Ask yourself these questions

- Do you know what kind of business are you investing in?

- Do you know how this business collect revenue?

- What kind of risk are you taking when putting your money here?

If you are unable to answer those question confidently, you might be gambling with your money.

I realised that successful people who became rich actually spend money to learn how to invest. It is like a springboard to jump even higher. Yes. It will cost money. Yes it will cost time. Yes. It will take effort. It is like everything else. If you want to be good at something, it will definitely cost money, time and also effort. Why else would you want to risk your hard earn money.

In summary, we hope that everyone can naruto run their way to financial freedom.

Here, at wealthdojo, our vision is to be the platform for everyone to become enlightened in their financial decision so that they can become financially free. Our tagline: Your black belt to financial freedom. We hope this website will be one to let you be rich and also succeed in the financial world.

If you would like to start your financial journey today. Subscribe to us to learn how you can move through your financial journey together.