Insurance companies will be showing lowered illustrated rates after 1st July 2021. Although there is no real impact because the rates are illustrated after all, you might be wondering why is this happening? I think the most important question that you have will be this.

“Will this affect my returns in the years to come?”

What is a Participating Fund?

To understand your returns better, you first need to understand what is a participating fund. You can take a look at LIA: Guide to Participating Fund. I will be summarizing some of the points in the guide.

Participating policies (such as endowment, life, retirement) are life insurance policies which provide both guaranteed and non-guaranteed benefits. The aim of a participating policy is to provide stable medium to long-term returns through the combination of guaranteed benefits and non-guaranteed bonuses. Participating funds can invest in a range of assets, including equities, in search of potentially higher returns.

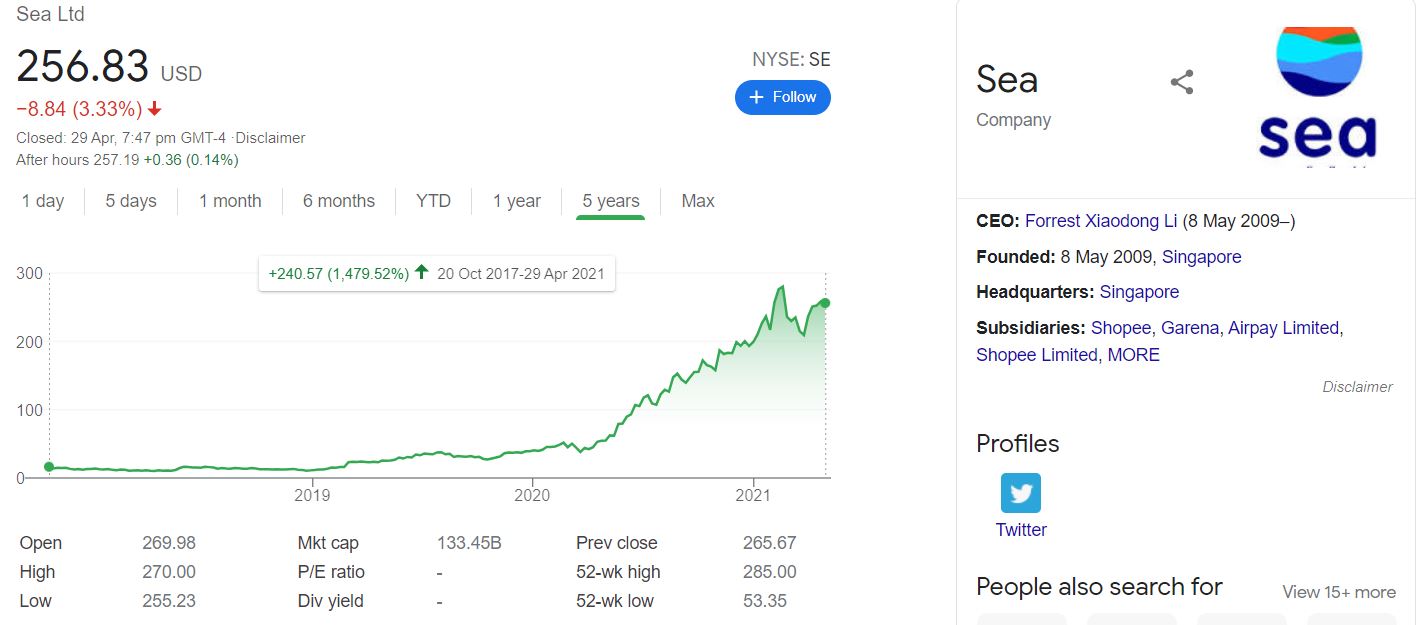

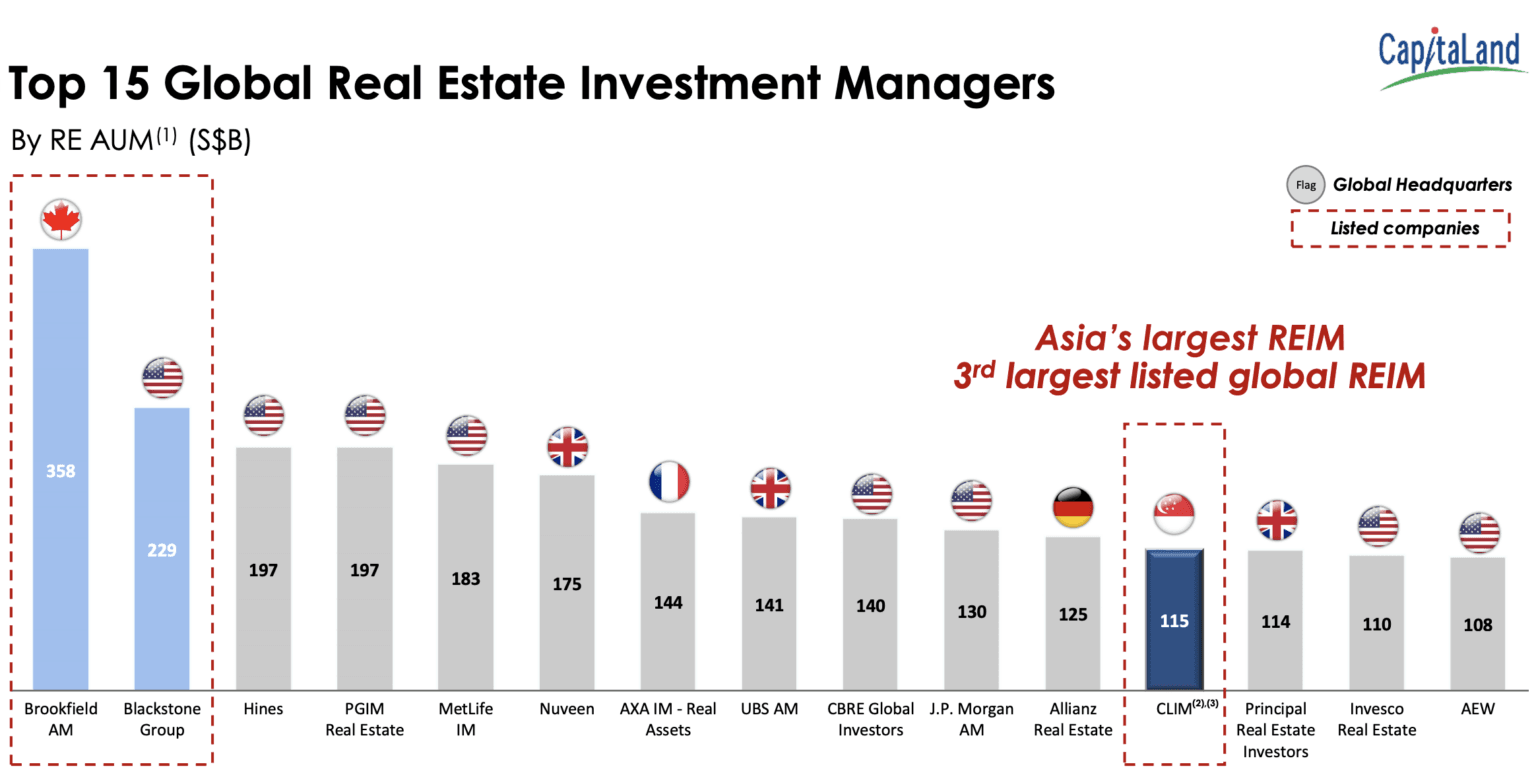

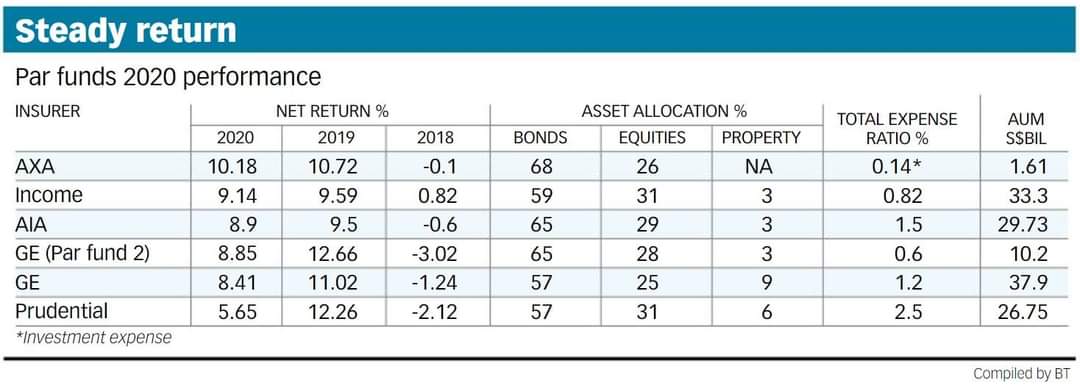

This means that the participating fund need not be conservative. Equity positions in the 5 companies (as shown above) is around 30% of the entire fund. However, we need to note that insurer need to provide a guaranteed benefits.

The Search For Guaranteed Benefits

To back the guaranteed returns of participating policies, insurers typically invest around 70% with bonds (Side note: investing in bonds does not mean that having guaranteed returns). In the persistent low interest environment (plus the RBC2), it becomes an problem for insurers. I believe (this is my guess) that insurance companies might offer newer plans with lower guaranteed benefits in future.

Will It Affect My Overall Returns

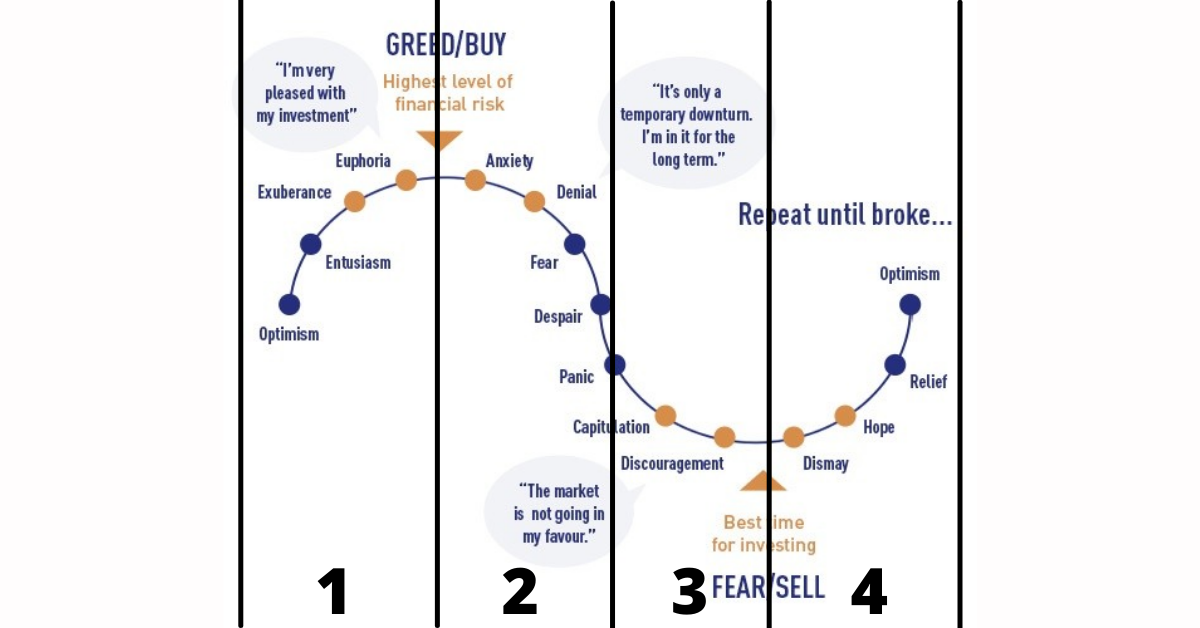

That being said, I believe the overall returns for participating funds will improve. This is because insurers has already shown trends to shift more of the assets into equity (read my last article on the data).

However, this would mean that we need to be understand returns on a participating policy may also be volatile in future.

Final Thoughts

I do not think that having a lower guaranteed benefit is necessarily bad. This is because when the participating policy has a lower guaranteed benefit, it means it only needs a lower proportion of assets goes into bonds. This will free up some capital to invest in other assets such as equity. This investment mix might provide greater potential/returns for long term investment.

As mentioned above, we need to be understand returns on a participating policy may also be volatile in future. You should be instead focus on your financial needs and whether these plans (participating or not) can serve you in your financial planning.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

Technical Mambo Jambo: RBC2

This section is only for those that are interested in the technical stuff.

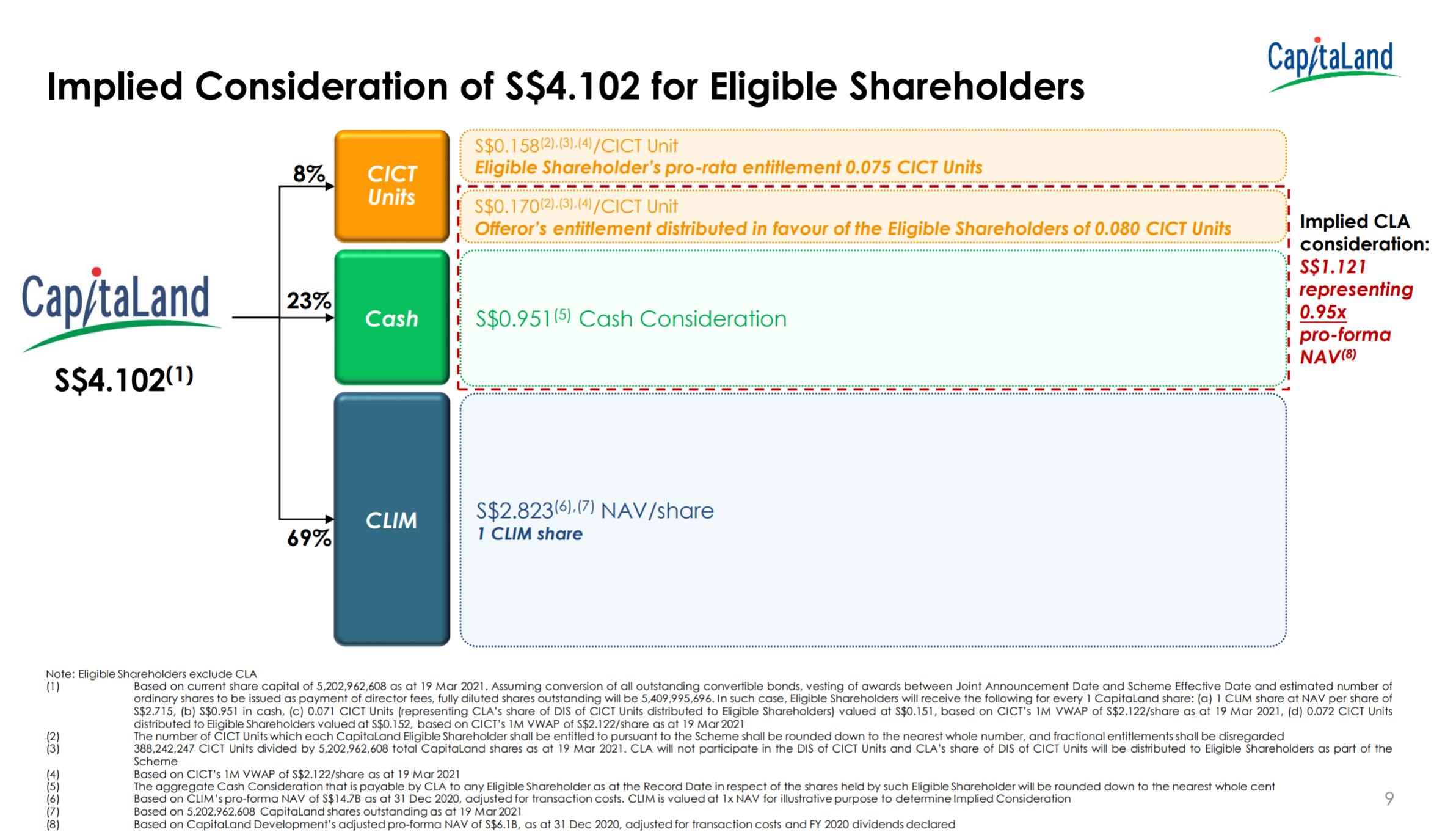

Insurer are required to adopt RBC2 from March 2020. Monetary Authority of Singapore (MAS) expects the guaranteed cash flows from assets invested by the Par Fund to match the guaranteed insurance liabilities, i.e. the guaranteed benefits of the par policies. Insurers are required to hold higher capital requirements if that is not the case.

As we are in a persistent low interest environment, it would mean that the insurer have to hold even more bond positions to match the guaranteed benefits. Thus, reducing their ability to invest in the equity market. Thus, potentially reducing overall returns.

As a result, we might see new participating policies with lower guaranteed benefits. As explained above, it may be a good thing and a blessing in disguise.

Here is a 1 hour video to explain the mambo jumbo.