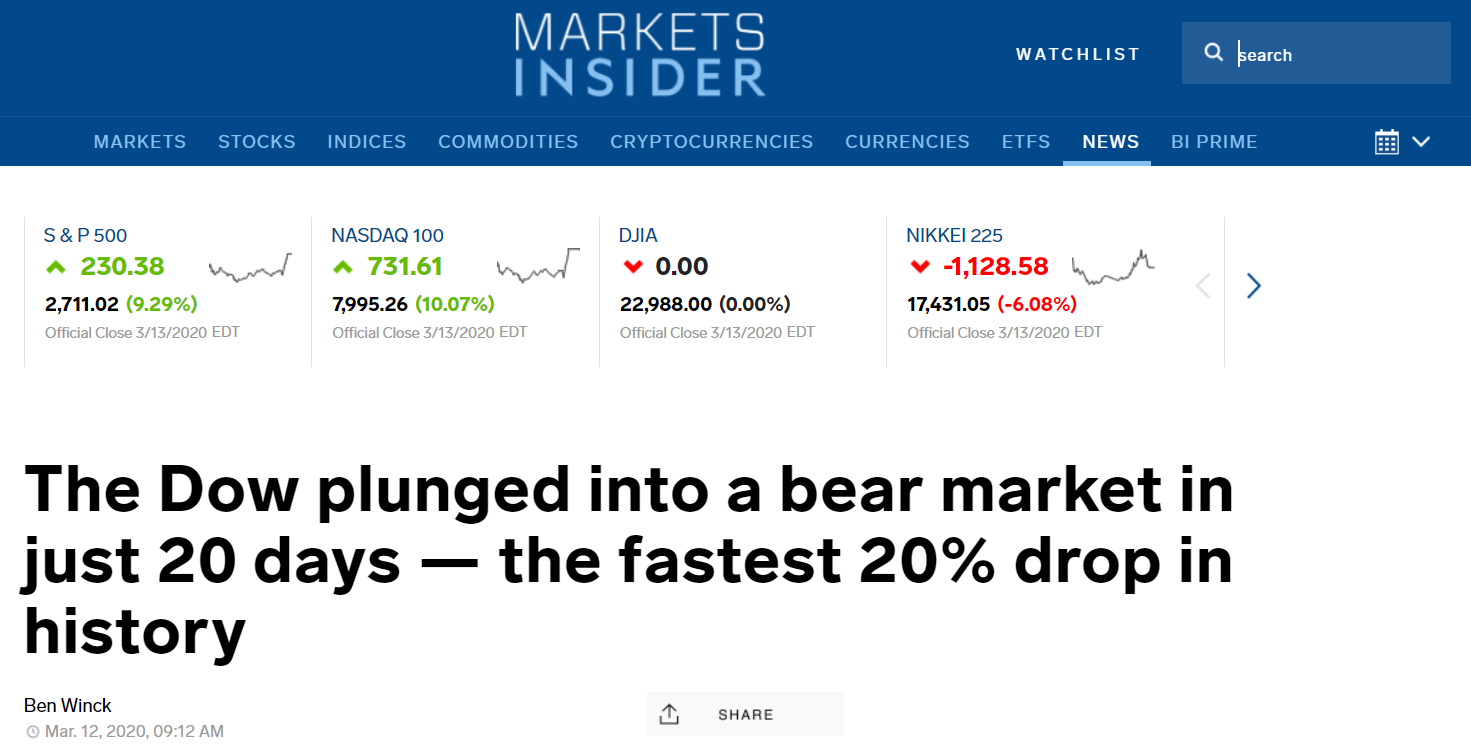

The past few weeks have been a downward slope. Some companies have started to cut senior management’s salary, some have been asked to take unpaid leave while others struggling to survive.

With the world’s economy in a standstill, some companies will not be able to see revenue coming in until 2 quarter later (optimistically). An example would be the airline industry. During the coronovirus episode, governments around the world has stopped air planes from entering into their country to stop the virus spread. As a result, airlines all over the world practically stopped. Not only has revenue have stopped, they might need to do a refund for air tickets for people that are supposed to fly for the next few months. To add insult into injury, some airlines have massive debt!

Can these companies survive?

Navigating crisis is never easy. It will be good to prepare for an emergency even before one happens. For discussion, I’m assuming the business from these companies are affected by this current crisis. For companies to survive, they can do either of the followings.

- Pray that the government will bail them out (let’s hope we don’t get there)

- Borrow money from debt (which will just push the problem into the future)

- Borrow money by issuing new shares (which will dilute shareholder’s equity)

- Have enough cash to get over these crisis 😉

Read more: (Life Hedge: How to prevent your life from being a roller-coaster (Part 1), Life Hedge: How to prevent your life from being a roller-coaster (Part 2))

How do I know if companies have enough cash to get over these crisis?

In personal finance, most of us are familiar with emergency funds. Typically, the sum makes up around 6 months of our basic expenses. It is the same for companies. I want to know if they have emergency funds? Do they have enough cash to pay off their current liability? Does it means if the company have more assets, the better it is? That’s where we can dig into the balance sheet of the company.

Let’s look at Company A. Company A has $50000m worth of quick assets and $25000m worth of current liabilities. This means that is able to meet near term liabilities using it’s quick assets.

PS: Quick assets are assets that can be converted to cash very quickly.

Company B has $100,000m worth of quick assets and $100,000m worth of current liabilities. Even though Company B has more quick assets than Company A, it has more current liabilities. It means that Company B is not as “comprehensive” in preparing to handle its current liabilities as compared to Company A. If we want to compare between 2 companies, we compare their Quick Ratio.

Quick Ratio

The quick ratio indicates a company’s ability to pay its current liabilities without needing to sell its inventory or get additional financing. The higher the ratio, the better a company’s liquidity and financial health; the lower the ratio, the more likely the company will struggle with paying debts.

In the case, Company A’s Quick Ratio is more ideal as compared to Company B.

In my own personal investment, I look at companies with a good quick ratio. This is because I want the company to be able to survive whether in crisis times or not. The health of the company is one way to find out how well the company is run. Why would you want to invest in a company that is heavily in debt?

Bottom Line

No one will care about your money as much as you do. Before you invest in any company or popular investment opportunity, be sure to do your own due diligence. If you wish to learn more about investing, I hope to nurture genuine relationships with all of my readers. Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page or my Telegram Channel! Or subscribe to our newsletter now!