There are so many things that we can’t believe anymore. Even the age old “Put your money in the bank is safe” no longer stand through with the collapse of Silicon Valley Bank over the weekend.

Making the correct decisions when managing your wealth is essential. To do so, you may seek advice from trusted individuals like family and friends. Unfortunately, they may be making crucial mistakes with their personal finance decisions too, leading you astray.

Here are six personal finance myths that you would want to stay away from.

#1: Financial Planning is for the wealthy

“I don’t have money to plan for the future.”

The mindset that financial planning is only for wealthy individuals is a myth many people believe. Whether you are rich or poor, it is important to take control of your finances and budget planning. If you have income and expenses, creating a plan to handle them should leave you with more to spend. In the past, barriers such as high brokerage fees made it challenging to pursue a financial plan. However, transparency and technology have made it much easier to get started in the current age.

As a general rule, purchasing every product and service you desire will quickly get you into financial trouble. Following a budget is vital when you earn or have a specific amount of money. While some individuals think that having a budget doesn’t allow you to have fun, the opposite is true. You just need to make compromises. For example, if you want to buy a new car, you may have to cut out on extra wardrobe items and restaurant outings over a defined period of time.

#2: Using Credit Cards Is Best During an Emergency

“I have 6x monthly income limit on my credit card. I should be fine”

While covering an unexpected expense using a credit card may be handy, this action can be highly detrimental. Credit card interest rates are often high. Even if you have a small debt, the interest included with each payment can slowly eat away at your funds. Creating an emergency fund for troubling times is a much better option, allowing you to pay for costs you weren’t expecting.

#3: Investing Requires a Lot of Money

“Buying Apple Shares ($148 on 13Mar23) is expensive!!”. (Owned the latest iPhone 14 SGD $1311anyway)

Investing and making money in the stock market are often associated with wealthy individuals. This is a common myth seen from the portrayal of Jordan Belfort in The Wolf of Wall Street playing on fuboTV. This movie shows Belfort’s extravagance and lifestyle fueled by his success in the stock market. While having a lot of money certainly opens up multiple avenues for investment, a lot of instruments allow the average investor to enroll – in some cases, starting with as low as $10.

You can choose your preferred instrument – be it fixed deposits, bonds, mutual funds or stocks – based on the money that you have and the risk that you are willing to take.

#4: Getting Into Debt Is Bad

“Should I take a loan for my Balenciaga T-Shirt?”

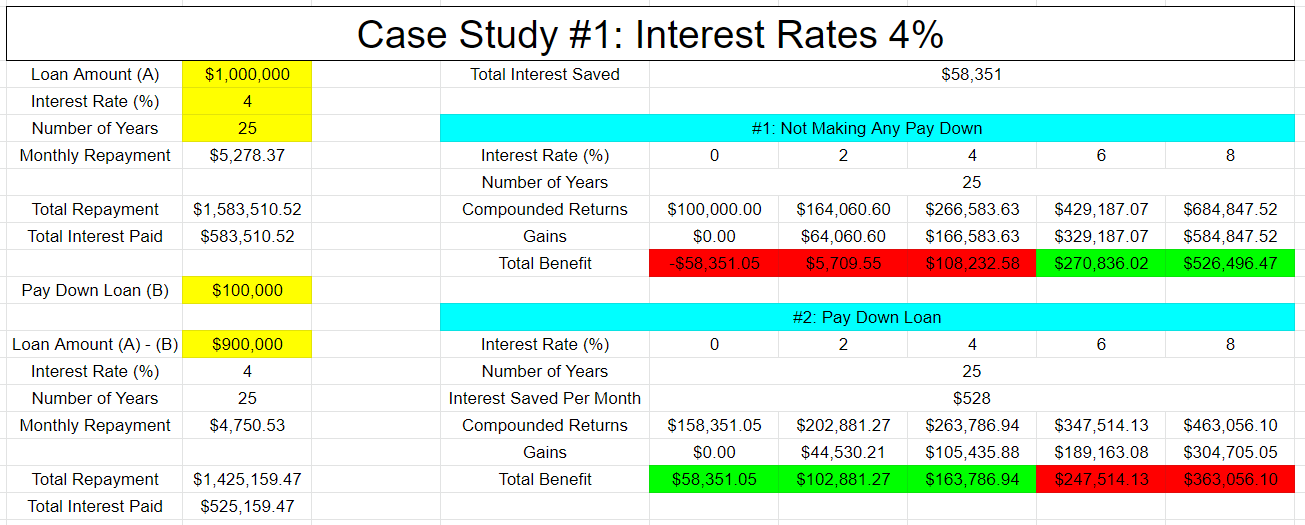

While it’s important to approach debt with caution, it can be a good decision. Borrowing money can be a handy tool to reach financial goals, such as funding a startup business or purchasing a home. While you’ll be paying interest on the amount you borrow, using debt for a positive financial pursuit can be highly cost-effective. However, using debt to finance a lavish lifestyle could lead you down the wrong path, forcing you to pay high interest. Choosing the appropriate debt tools is critical when borrowing, and the timing is also essential.

Different sectors of the economy have cycles where the values of assets go up and down. In the housing sector, if you purchase a home when values are high, thinking you can save money by deducting mortgage interest on your taxes, it may not be best. Renting allows you to wait for lower home prices. Owning a home can be a dream for many individuals. However, purchasing at the top of a cycle can become a nightmare if you have to pay high installments for an extended period. Choosing the appropriate time to get into mortgage debt can be vital if you want to benefit.

#5: Paying Off High-Interest Debt First Is Best

“Which credit card debts should I pay off first?”

If you’re following mathematics, paying off debt with high-interest rates first will lower the amount of fees you pay quicker once you close out these types of debts. While this action is a good approach, it may take a significant amount of time, making you feel frustrated.

I have found that it is helpful and motivating to pay off accounts containing a small debt (anything less than $1000) first. Once you knock a few out, you’ll have fewer accounts to deal with and can focus on paying debts with the highest interest rates.

#6: Retirement Planning Can Be Done Later

“I will plan for retirement when I’m 65”.

Another common myth relating to personal finance is that retirement planning is usually completed later in life. While starting a retirement account may be the last thing on your mind if you’ve recently graduated from college and started a new job, it can be the best time to begin this pursuit. Saving for retirement early allows you to accumulate wealth over a larger number of years. Doing so can have a significant impact on the money you have to spend when you retire.

Final Thoughts

Don’t let these myths get into your way of financial success. Discern between the noise and what make sense to you.

March Forward!

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.