Singapore is not new to property cooling measures. Do you know that the first property cooling measure was done in September 2009? I believe this was conveniently done after the global financial crisis of 2007 to 2008 to protect the property market in Singapore.

While I believe that cooling measures are introduce to allow Singapore’s property market to achieve slow consistent growth, there will definitely be effects on homeowners, buyers and the renters crowd. I want to share 3 main implications of the new cooling measures done on 30 September 2022.

Higher Interest Rate To Calculate Loans

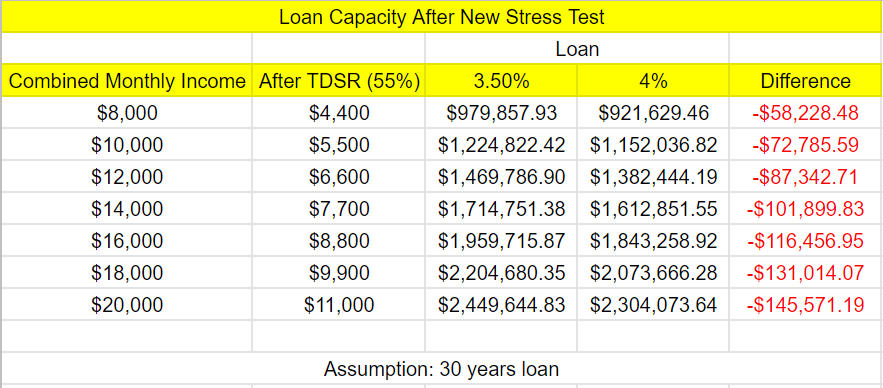

For property loans granted by private financial institutions, MAS will raise by 0.5%-point the medium-term interest rate floor used to compute the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR).

For residential property purchase loans and mortgage equity withdrawal loans, they will using the 4% per annum (p.a.) floor (up from 3.5% p.a.).

Putting this into numbers, the maximum loan that banks will be able to provide will reduce by the following amount. Personally, I think there will be no major impact from this as the quantum for the properties are in the millions. This will affect buyers who will not be able to stretch (even more) when it comes to bidding for the property.

If asked if the interest rate floor will increase again, I personally don’t think so and likely to hover around the current rates. The MAS-MND-HDB have commented that “They (interest rates) are expected to rise further in 2023 along with US interest rates, before settling at a higher level compared to the lows during the period 2013 to 2021.”

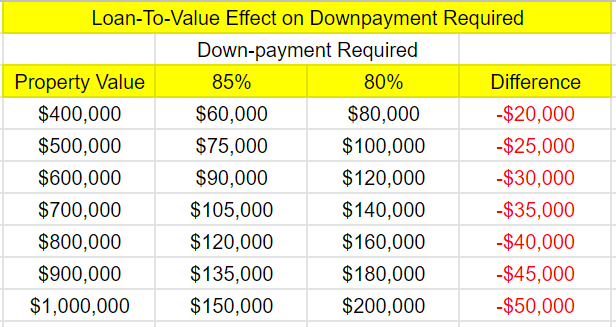

Loan-To-Value from 85% to 80%

This is applicable for HDB housing loans only (Private LTV limit remains at 75%). This means the HDB buyers will have to increase cash downpayment by an extra 5%.

I believe this is aimed at HDB that are bigger in nature namely 5RM, Jumbo, Executive Apartments etc. In particular, this aims to reduce the raise of the million dollar HDB (231 Million Dollar HDB from Jan to Aug 2022). I believe the government intends for HDB to remain affordable and want to reduce the use of HDB to do speculation.

Personally, I think there may not be major impacts even for the higher quantum levels. You will also be glad to know that first timers or the lower income group will not be affected much by this because of the housing grants (up to $80,000) available for them.

15 Months Wait Out Period For Switching From Private to HDB

This is perhaps the most talked about measure as it will affect people is planning to sell their private property into a resale HDB. Currently, people who have private properties have to sell it within six months of the HDB flat purchase.

Now, there is a wait-out period of 15 months after the disposal of their private properties before they are eligible to buy a non-subsidised resale flat. This means that it will not be easy to move towards HDB. You will be glad to know that this is a temporary measure.

You will also be glad to know that this will not affect those age 55 and above who is choosing to downgrade at that time**.

I believe there will be 4 main effects of this.

#1: There will be an increase in demand for smaller condo units. If people who do not want to wait for 15 months, they may consider to downsize to the smaller condo units. I believe transactions (perhaps price) for 2BR to increase in the months ahead.

#2: There will be an increase in demand for 4BR HDB resale units. For people age 55 and above, the 15 months wait out period will not apply to them** if they shift to a 4BR HDB or smaller.

#3: In general, lower transaction as the buying pool has shrunk. I believe that over the next quarters, the overall transaction might be lower as HDB upgraders will think twice. This reduces the effective buying pool.

#4: In general, rental rates will increase.

Final Thoughts

I believe that the government is planning for a sustainable and gradual growth of property prices. The emergence of million dollar HDB, the increase in property prices and the increase in interest rate calls for prudence for financial planning.

The effectiveness of the cooling measure will be tested as Copen Grand (7 Oct) and Tenent (Mid Nov) hits the market soon.

Property play a big role in our financial planning. It will be prudent to understand your own financial situation before making a decision into the market. It is also important to remember that other asset class (eg: insurance, estate planning, equity investment) should be taken into consideration when planning for your financial future.

I wish you all the best. Take care!

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

[…] Side note, if you are unaware of the latest property cooling measures, click here to read about it. […]