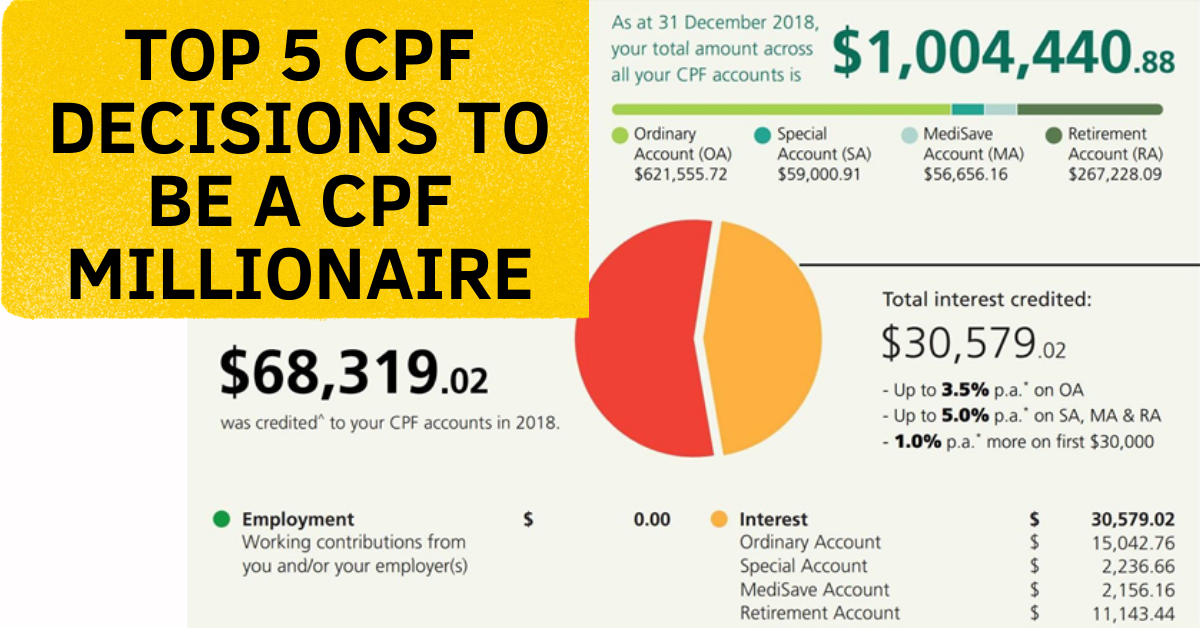

CPF remains one of the main cornerstone of wealth management in Singapore. There are tons of information regarding the CPF on the web and I’m happy to see that CPF is having a purposeful outreach to the retirees and even the younger crowd. I do notice a better acceptance of the CPF during my 9 years in financial services and I do hope this trend continues.

Previously, I have spoken about 5 Things You Need To Know About Your CPF. This stems from 5 mistakes people make using their CPF that I have written in the last year. One of my friend then asked me why not write about the best advice that I will give with regards to CPF.

I have reservations about using the word “advice” because this assumes that I understand the situations, the profile, the life stage and risk tolerance, etc about that individual. Hence, this article is not about best advice but perhaps best decisions you can make if it fits your situation.

If you wish to find out more, I’m organising a CPF webinar on 29th April 2021. Limited seats only. Click here to join us.

#1: Transfer money from OA to SA

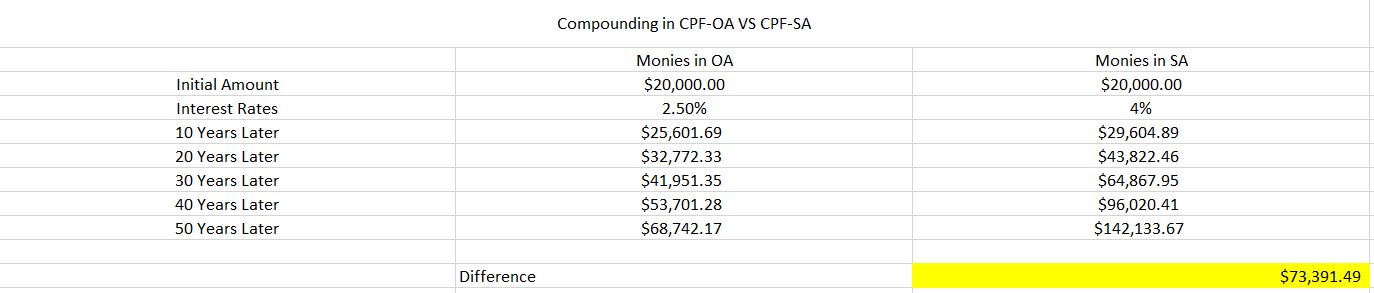

This is a pretty easy one. Currently, the floor rate of CPF-OA is 2.5% and the floor rate of CPF-SA is 4%. You would want to put more money into an account with higher interest with all things kept constant.

For the same $20,000, you would have $68K in your CPF-OA and $142K in your CPF-SA after 50 years. This is a difference of $73K. However, I do acknowledge that some might need to use the monies in the OA for your housing loan or downpayment. If you do not have “extra” monies in your CPF-OA, you can consider to transfer it to your SA.

Please note that this process is irreversible.

#2: CPF-SA Shielding

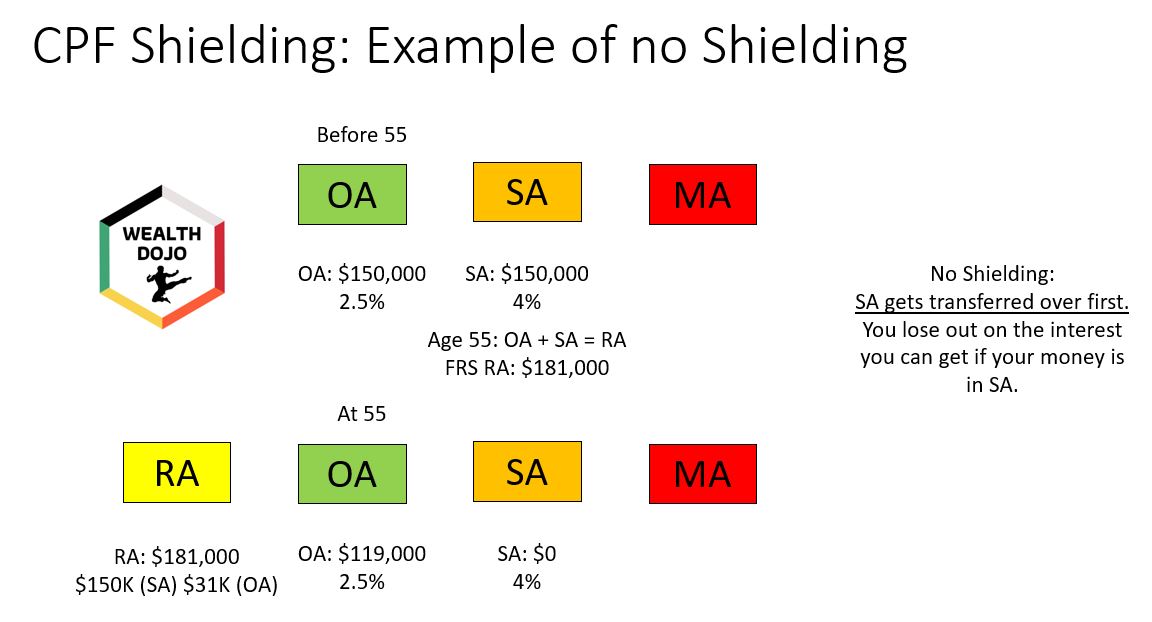

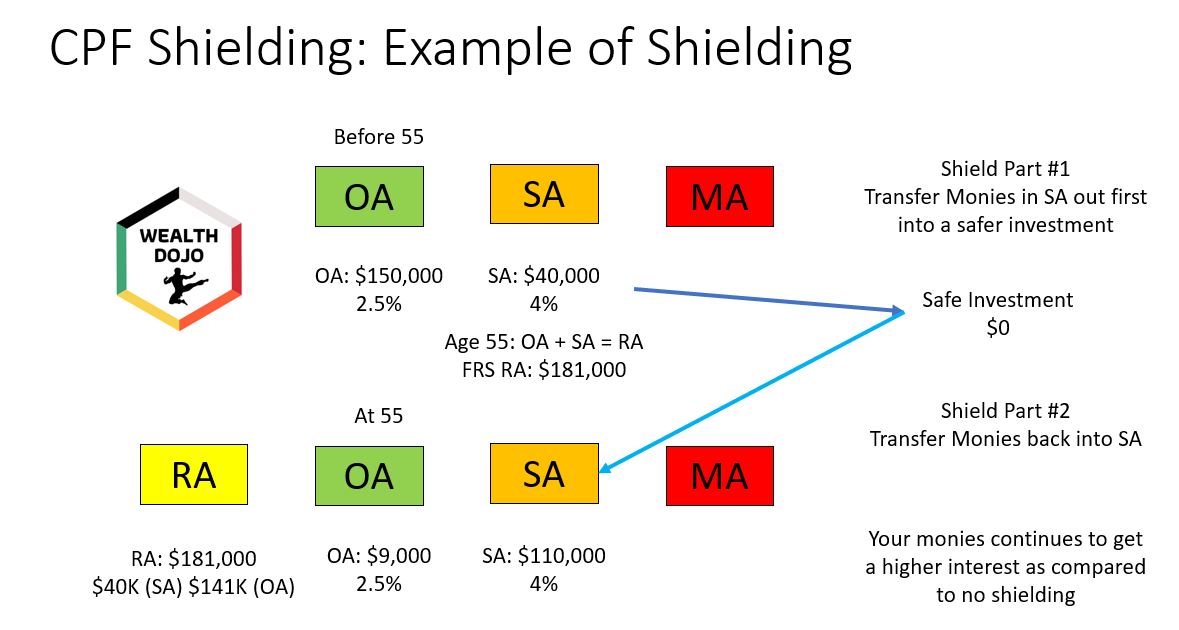

At the age of 54, you might want to consider CPF-SA shielding. In a nutshell, it means keeping your monies in your CPF-SA account to get a higher interest. This is because at age of 55, the formation of your RA (retirement account) starts from your CPF-SA and than your CPF-OA.

This is an example of no shielding. All your CPF-SA ($150K) will be transferred in the creation of you CPF-RA account leaving $0 in your CPF-SA after age of 55.

With CPF-SA shielding, you temporarily transfer out you CPF-SA into a “safe” investment. $40,000 is left in the CPF-SA due to the rules of the CPF. At age 55, during the creation of the CPF-RA account, only $40K is transferred from CPF-SA and the rest will be transferred from CPF-OA. You then transfer the monies back to your CPF-SA which is giving 4% interest.

Remember that the crust of this is to keep your monies in the higher interest account.

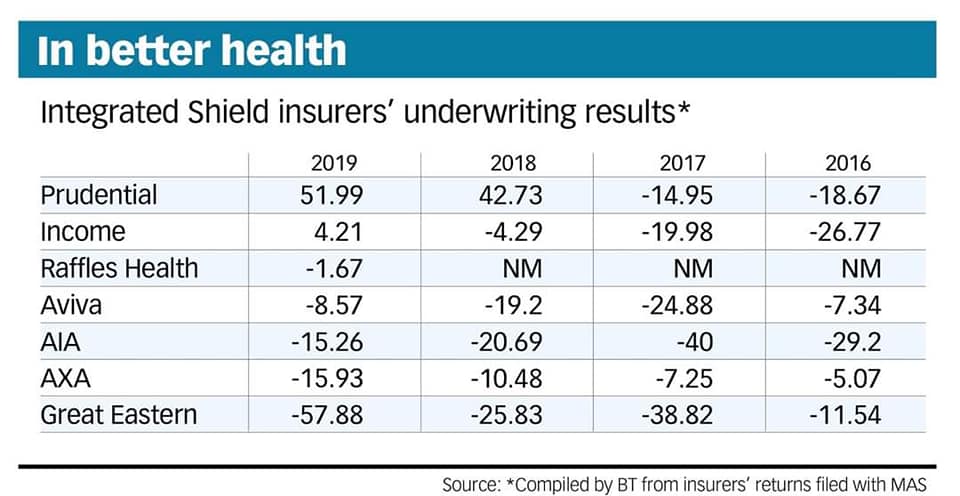

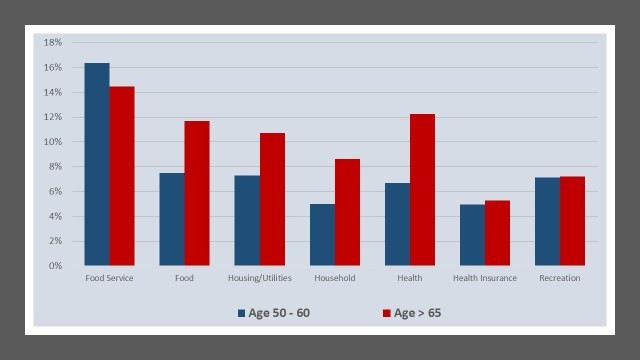

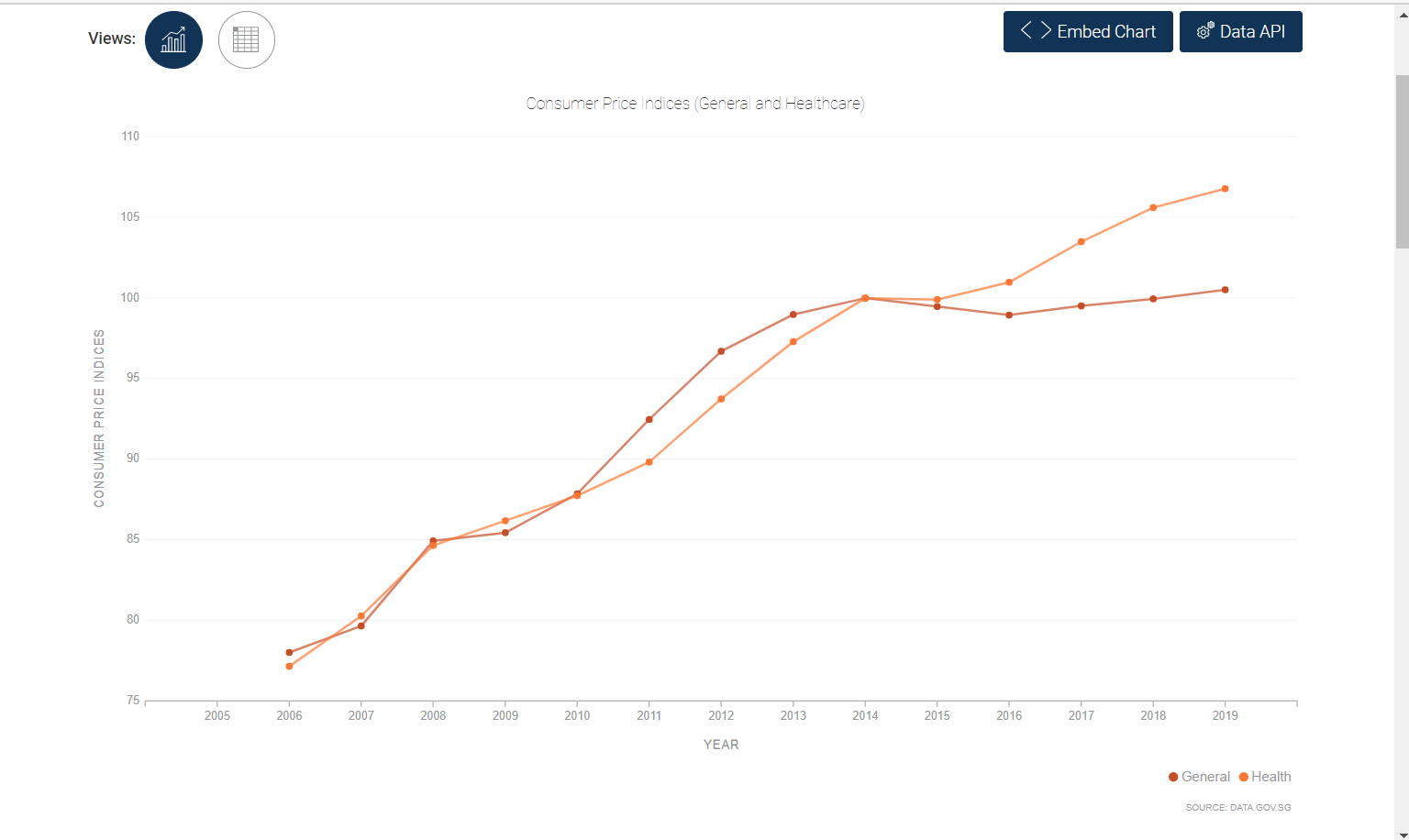

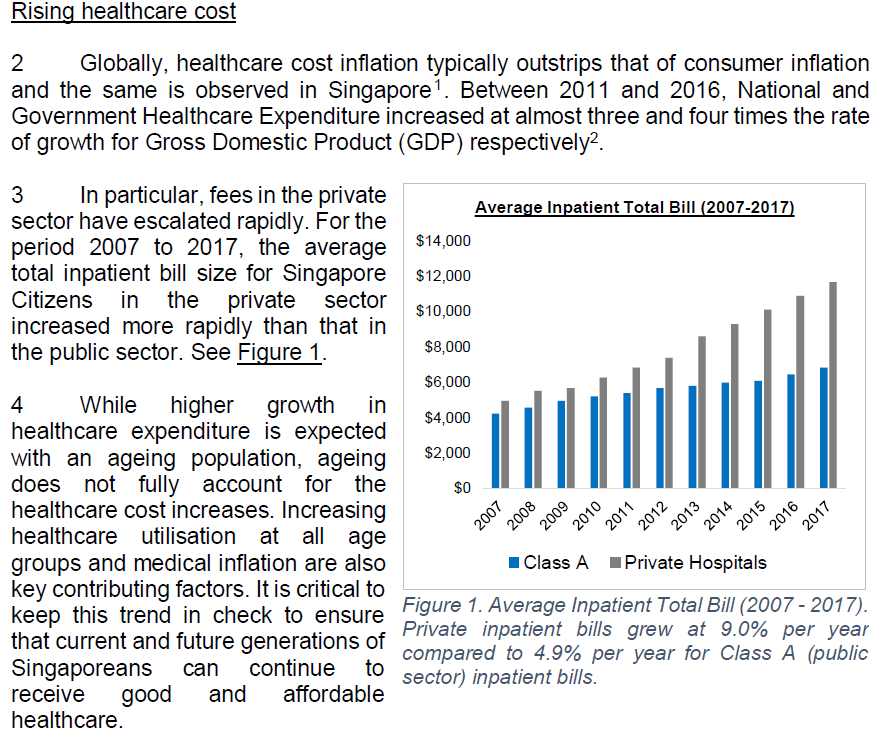

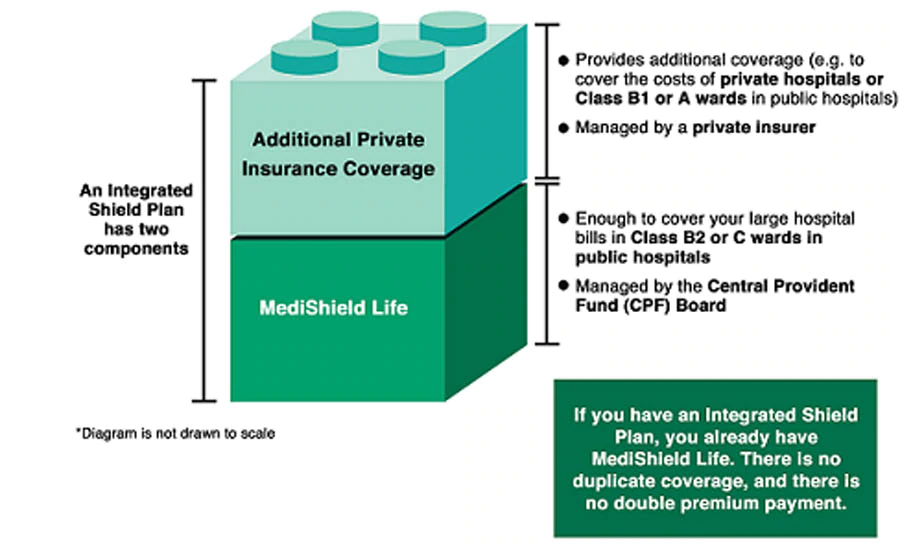

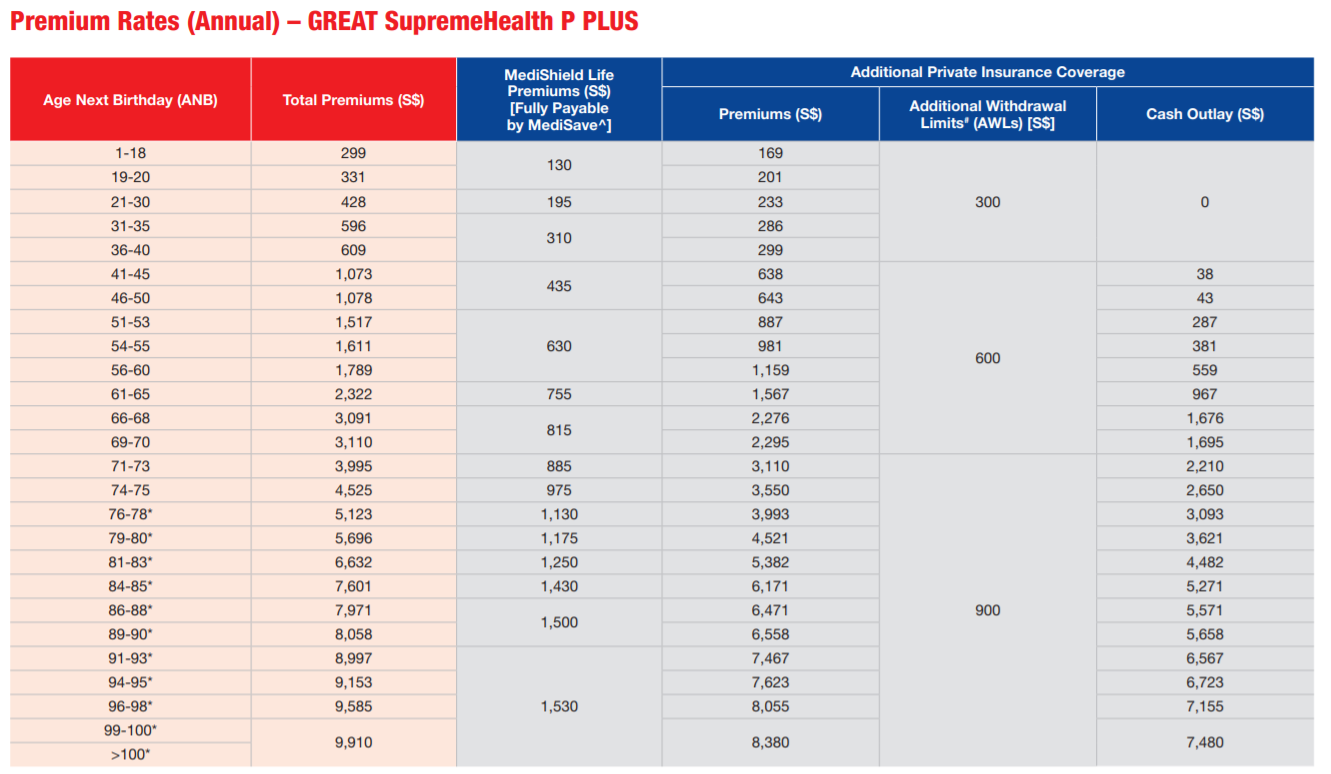

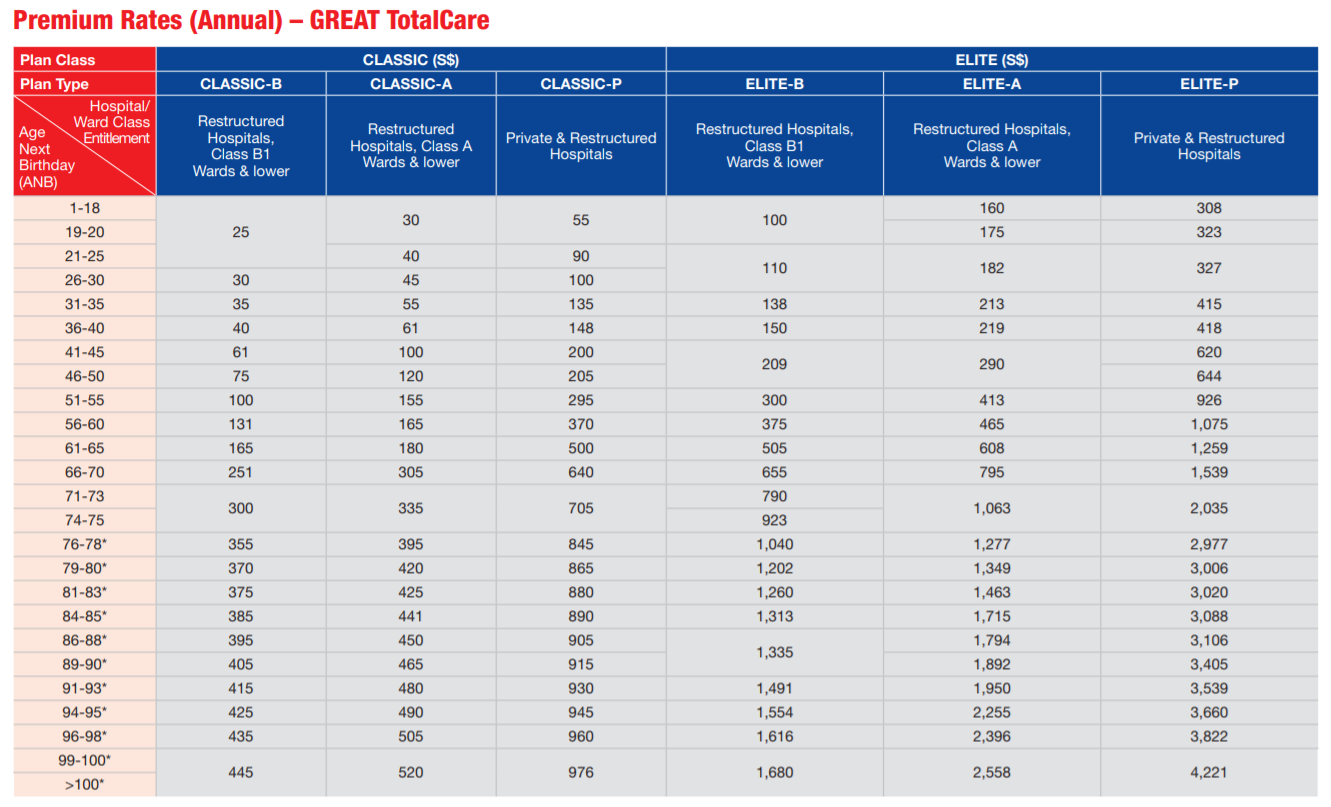

#3: Upgrade your Medishield Life to an Integrated Shield Plan

I cannot emphasize more on the importance of medical insurance. With the new adoption of the co-payment structure of our medical plan, you can also interpret it as medical costs are getting more and more expensive.

It is important to get a medical plan that suits your needs especially during retirement age where the chances of hospitalisation are a lot higher. Having a strong medical plan is a risk management to help you remain a CPF millionaire.

#4: Choosing The Appropriate CPF-Life Option

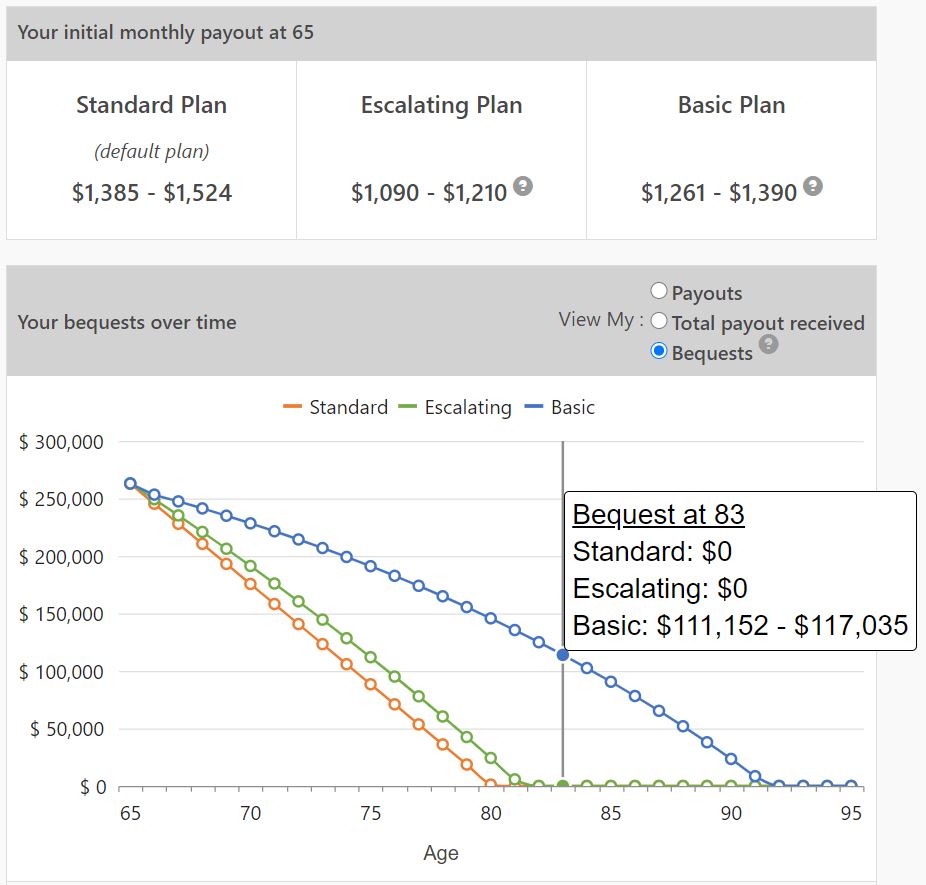

Big shoutout to families here. Do you know that you can increase the amount of money you leave behind to your loved ones if you select the appropriate CPF-Life option?

If you don’t select the CPF-Life option, it will be a standard plan. Let’s look at the difference between the standard plan vs the basic plan.

Difference Between Standard Plan and Basic Plan Monthly: $124 (taking the lower estimate)

Difference Between Standard Plan and Basic Plan from Age 65 to 83: $26,784

The reason I’m using age 83 is because that is the accepted mortality age in Singapore at the moment. This is means that we are expected to live until age 83 (life is short isn’t it). For an extra $124 a month (the cost of one meal a month), your family might lose out potentially $84,368 (because $111,152 – $26,784) worth of bequest. This “extra” bequest may help your loved ones become a CPF Millionaire.

I hope this word gets out to more families out there.

#5: Using cash to pay for your mortgage

CPF was set up years ago as a retirement vehicle. In 1968, the government finally allowed the use of CPF for the downpayment and to service the monthly mortgage loan instalment. This means that less will go into your intended retirement (not taking accrued interest into account).

Using more cash to pay for your mortgage will leave more money that will be compounded for your retirement so that you can become a CPF Millionaire.

Final Thoughts By Wealthdojo

The decisions above serves as a guide and shouldn’t be taken as advice. The main emphasize is to consult an expert to see if any of the decisions above serves you. Most of the decisions circle around keeping the monies in the higher interest account (which is CPF-SA) at the moment to let it compound for the future.

Wishing you all the best to be a CPF Millionaire.

If you would like to benefit from CPF more, I have put together a free webinar to share my knowledge on it. Limited seats only. Join us with the link here.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.