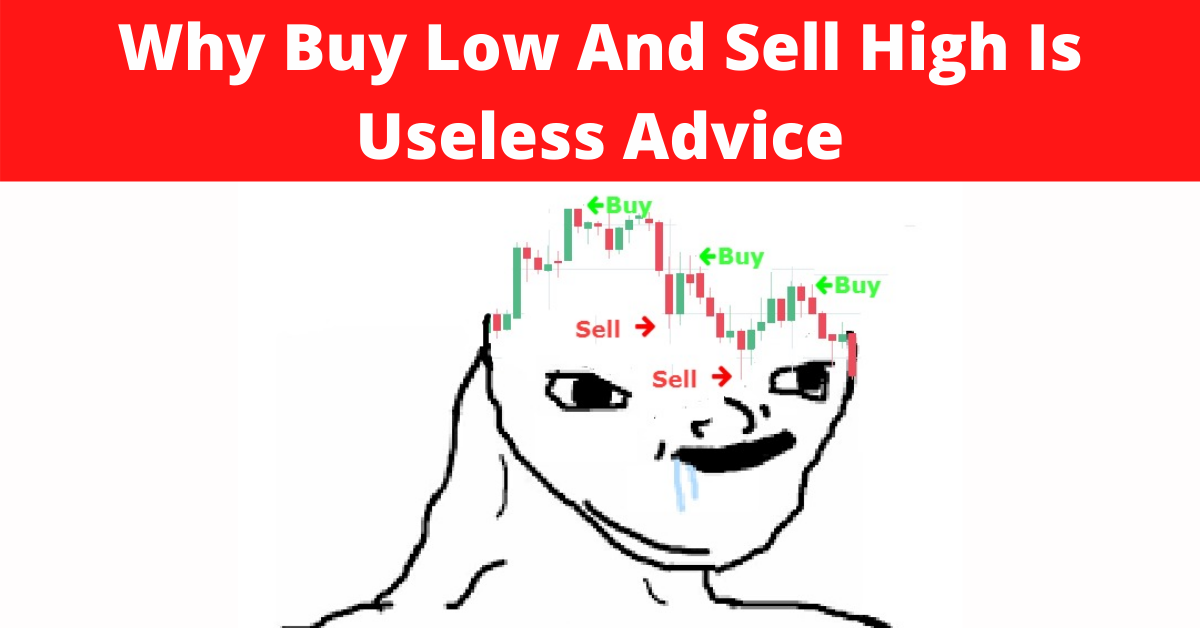

I hope this will be the last negatively titled article. So much bad advices have been given out of context by gurus such that I felt that someone have to make a stand when it comes to these advice. The previous article Why Buy Term And Invest The Rest Is Bad Advice captured many eyeballs but I would much prefer to build a personal finance site that is more positively charged.

Today, the article focus mostly on the strategy buy low, sell high and why it is useless.

What is Buy Low and Sell High?

The intention for investment is very simple. It is to make money (repeat this in your mind). When you make an investment, you must have every intention for your investment to grow in value in future. Take an example of Facebook (FB). In 18 May 2012, the share price of FB was $38. When you invest into FB at that time, you would have strongly believe it would grow. Today, 9 July 2021, the share price is $350. You would have made 816% by “buying low and selling high”.

This advice is often easy to say but in reality very difficult to do. Worse, there are many experts out there who will confidently claim that they have a secret system to buying low and selling high.

I offer you 3 reasons why this advice often does more harm than good.

It Assumes A Trading Mindset

If you see any guru who preach about “investing in the long run” and “buy low and sell high”, run away and run away fast. These 2 concepts simply DO NOT mix well together.

The notion of “buying low and selling high” suggests that there is a certain price that you would like to buy and let go. Often, these entry and exit points are obtain from the study of charts (technical analysis). In most cases, the timeframe of this strategy is shorter in nature to make a profit in the stock market.

If you have invested into FB for the long run in 2012, you would be in a lot of pain thinking when to sell simply because FB would have repeated tested the all time highs every few months. The whole intention of “investing in the long run” would be thrown off course because this person is constantly thinking when to sell. Simply put, “investing in the long run” and “buy low and sell high” do not mix well.

At this juncture, I would like to state that if this individual is having a trading mindset. The “buy low and sell high” make sense. It is the essence of his investment thesis as much as “trend is your friend”. But not if you are a long term investor.

It Assumes A Symmetry of Returns

The phrase “buy low and sell high” implies that the stock market goes up 50% of the time and goes down 50% of the time. I believe that it would work well in that situation.

However, in reality this isn’t the case. Bull market are persistent. Bear market don’t last very long. Therefore, the cost of waiting for the “low” is extremely high.

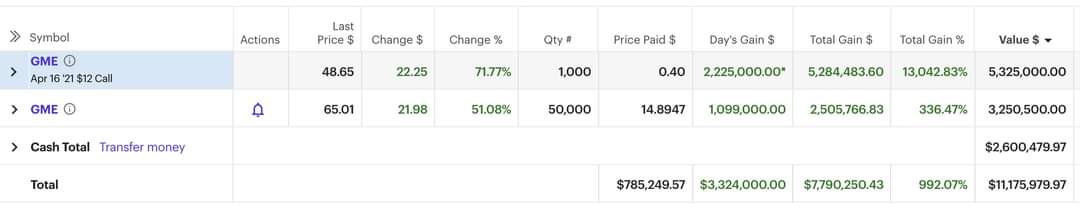

To illustrate this case, UBS demonstrated this with 3 portfolios.

#1: Buy and hold

#2: Sells when the S&P 500 hits a new all-time high, buying back into the market after a 5% drop

#3: Sells at S&P 500 record highs, buying back after a 10% correction

Starting from 1960, an USD$100 investment would be worth the following in 2018 (when the article was written)

#1: $28,645 (Yes. No typo here)

#2: $422

#3: $390

You can see that strategy #1 beats the other “buy low, sell high” strategy hands down. The cost of waiting is terribly high if you follow a strict “buy low, sell high” strategy.

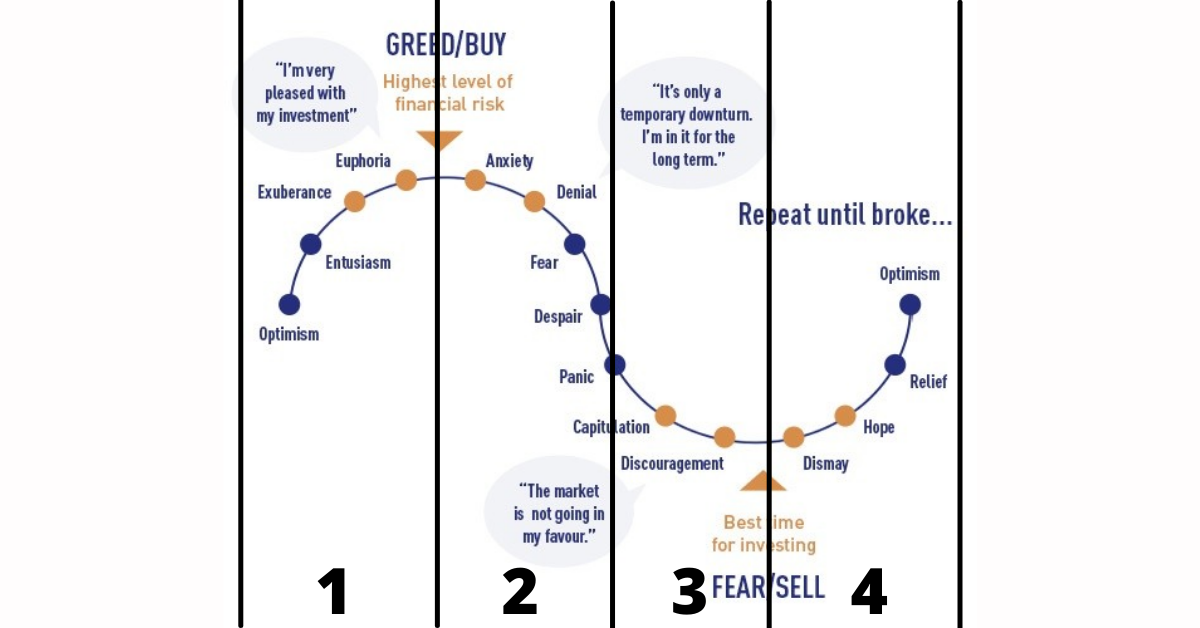

It Assumes A Strong Psychological Mindset

While, it is almost impossible to know when the worst days are, buying low is not easy at all. I will take the most current event as an example.

Disclaimer: This is not a buy/sell recommendation.

Alibaba (BABA) stock price plunged down to a new low at $205 (9 July 2021).

In 27 March 2018, revenue for BABA is 226.9 B Yuen. Share price was $192.

In 31 March 2021, revenue for BABA is 798.6 B Yuen. Share price was $229.

While revenue increased 250%, share price only grew 19%. This new low has been attributed to the CCP (Chinese Communist Party) clamping down on Chinese Technology Stocks. Several gurus are calling “sell” because of regulatory risk. Many bloggers are also selling BABA because of “opportunity cost” and believe that money could be put into other counters that is in momentum now. Honestly, I don’t blame them. It is not easy to see your stock price being beaten again and again. It isn’t psychologically easy when price is down. Nobody likes to be wrong. Nobody likes to be wrong for days, months or years. Often, people may even sell at a lost because it may be psychologically difficult.

Long term value investors however are adding into BABA. Among which, Charlie Munger and Mohnish Pabrai are the more noticeable names that are adding into BABA.

Final Thoughts

Disclaimer: I have mentioned some companies above for illustrative purposes. These are not and should not be taken as a buy/sell recommendation.

Personally, I think “buy low and sell high” is an over-simplistic investment thesis. While, it is easy to explain it in theory, reality often paints a different picture. I feel that you should focus on simple, actionable and personalized investment thesis to help yourself achieve the financial freedom that you want.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.