CapitaLand shares was halted on Monday morning (22nd March 2021). Along with it, Ascott Residence Trust, Capitaland Integrated Commercial Trust, Ascendas Reit, CapitaLand China Trust and Ascendas India Trust, was also halted pending a released of an announcement.

On the same day, we got an answer. CapitaLand Limited (SGX: C31)is going to be restructured. In this article, we are going to figure out what is happening and also what is the good or bad about this restructuring. Should it be part of our wealth management journey or in our SRS portfolio?

Disclaimer: This is not a buy/sell recommendation. I do not hold any SGX:C31 shares.

Brief Information About CapitaLand Limited

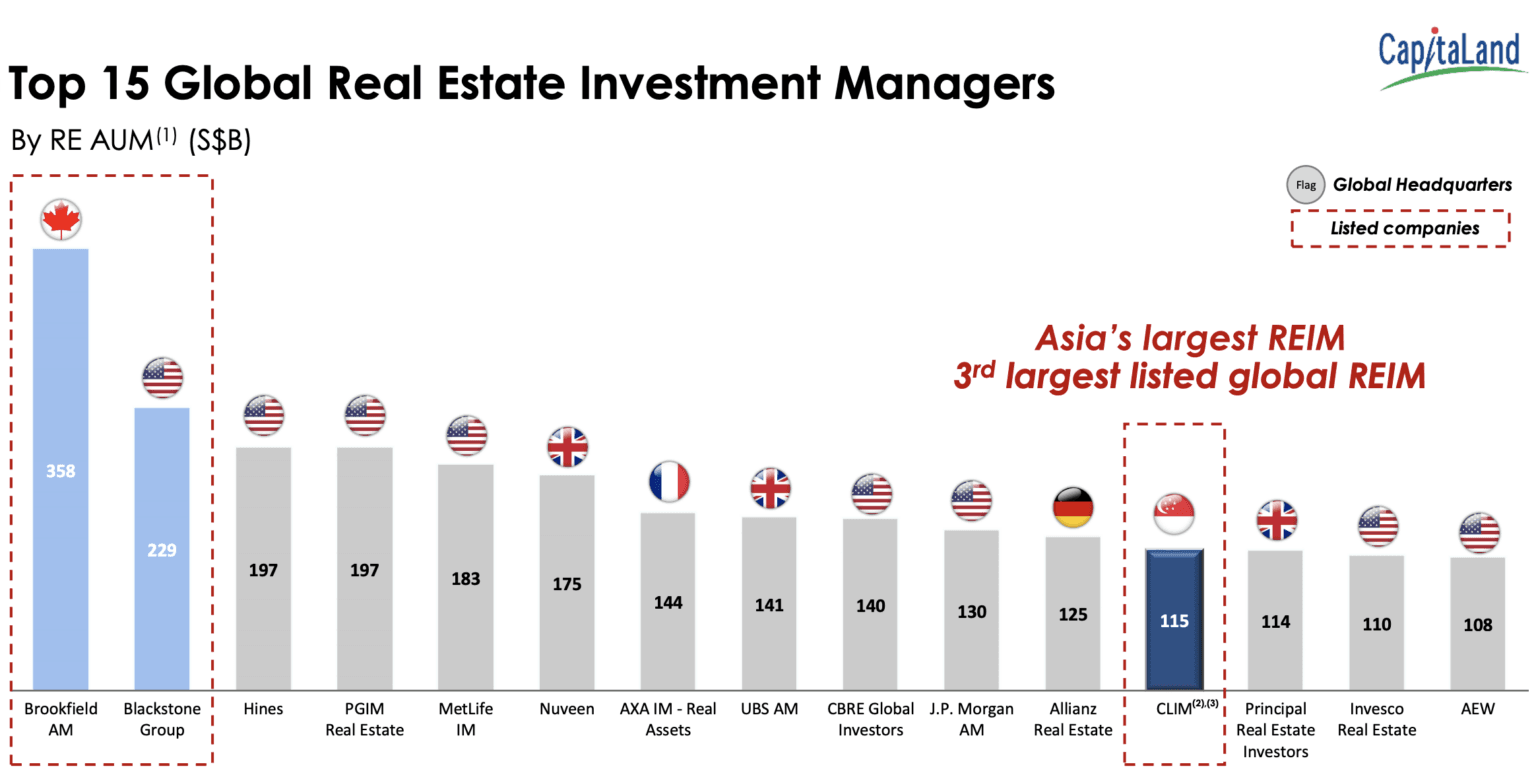

CapitaLand owns 1090 properties in 242 cities spanning over 35 countries (as of 23 March 2021). It is the 3rd largest listed global REIM and Asia’s largest REIM.

They own a stable collection of REITs and business trusts comprising of CapitaLand Integrated Commercial Trust, Ascendas Real Estate Investment Trust, Ascott Residence Trust, CapitaLand China Trust, Ascendas India Trust and CapitaLand Malaysia Mall Trust.

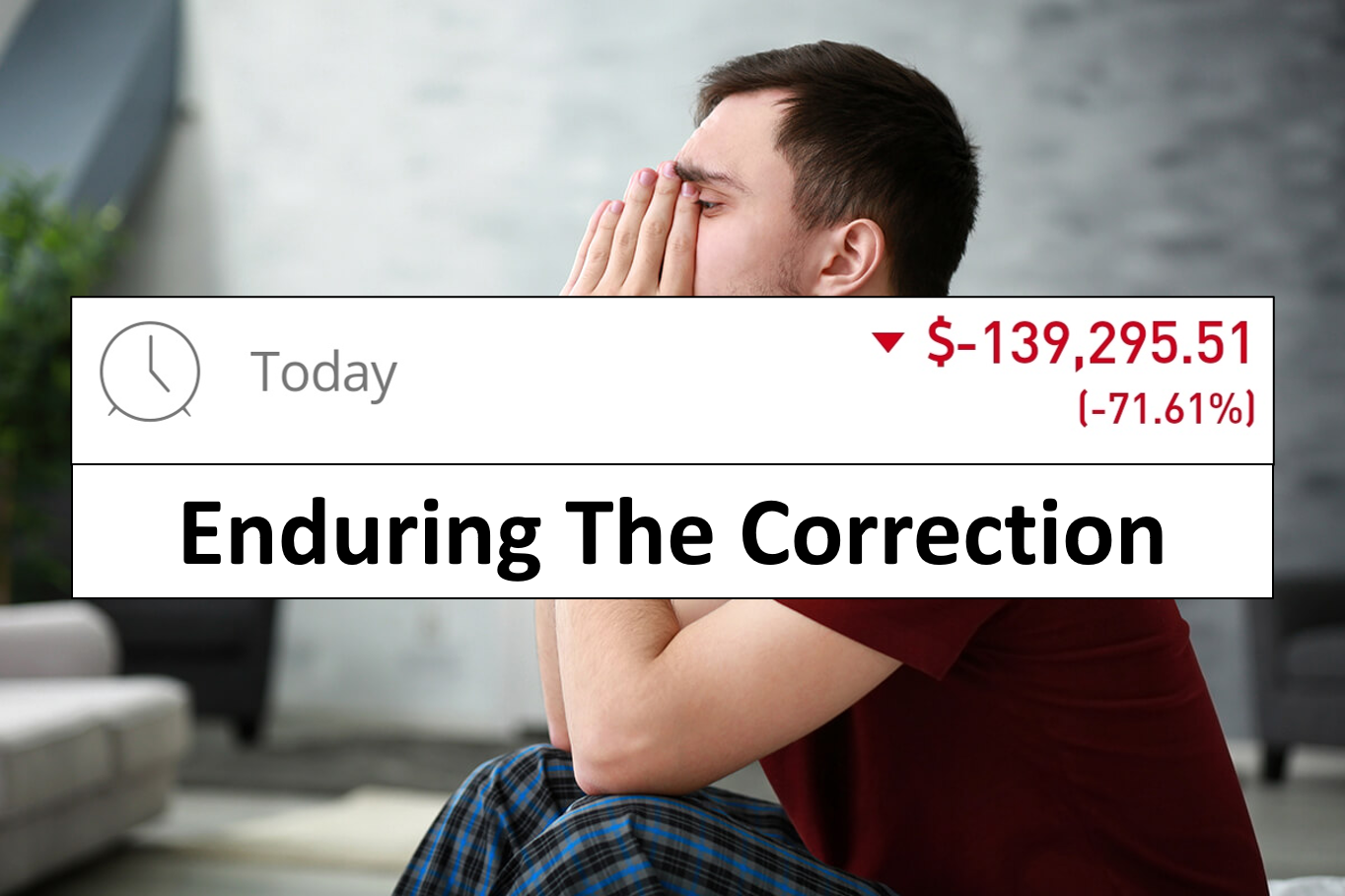

That being said, the share price trend has been extremely disappointing over the long horizon. Most investors probably bought into CapitaLand for it’s dividend yields.

Summary of Restructuring: The Development Arm is going to be Privatized

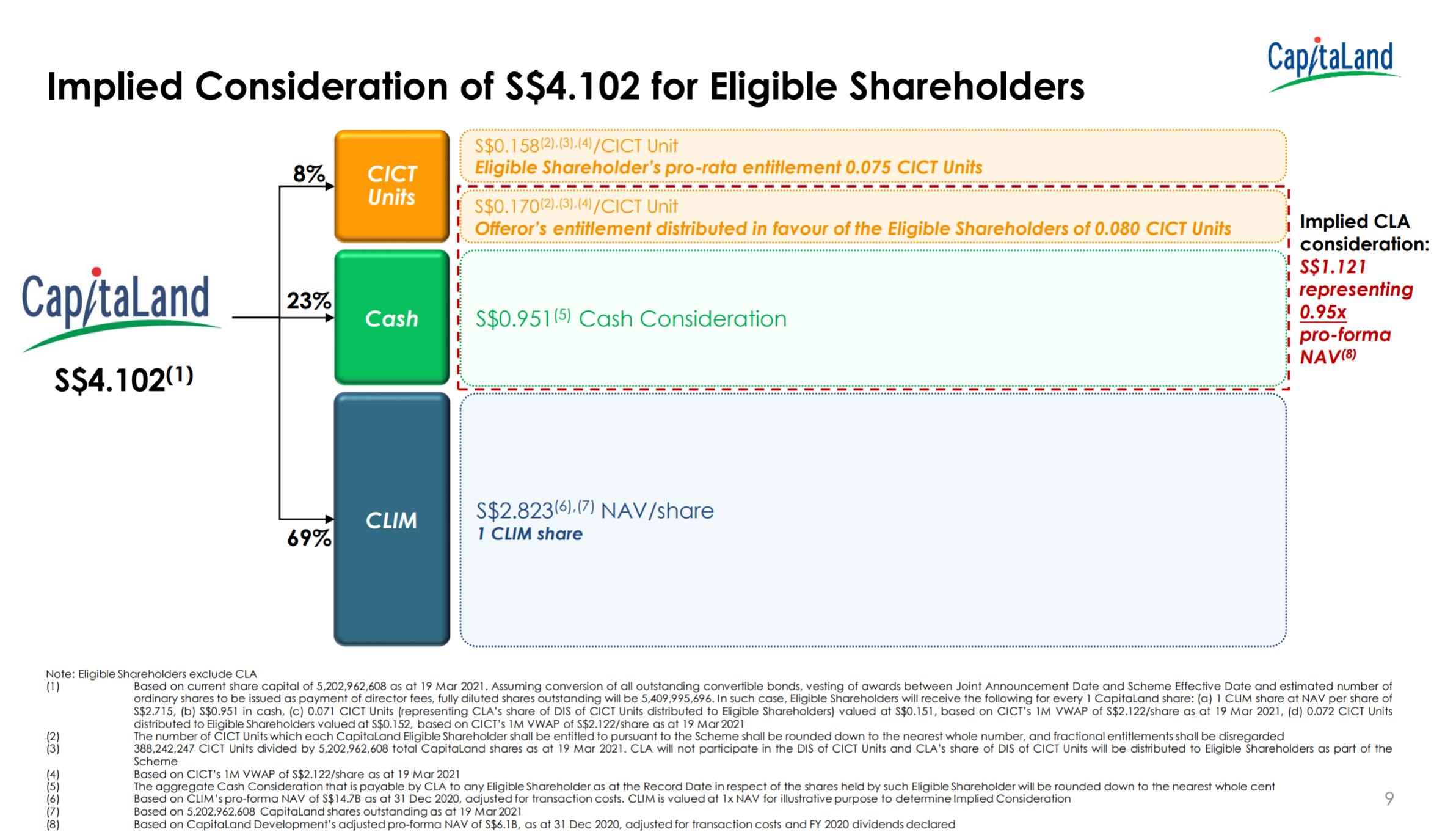

Shareholders will now see the development part of the business privatized. They will be “compensated” with a combination of $0.951 cash, 1x CLIM (CapitaLand Investment Management) shares and also 0.155x CICT (CapitaLand Integrated Commercial Trust) shares. It does sounds like a very good deal.

(The assumption here is that CLIM trades at a fair value of 1x NAV. I’m trying to find data to share how CapitaLand has traded on NAV over the years. Do let me know if you can find the source for this.)

According to the Chairman of CLA Real Estate Holding response in the news release, the privatization will provide flexibility for the development business to pursue longer gestation and capital-intensive projects.

This is where I felt a bit uncomfortable with the restructuring which I will explain below.

The Good Part About The Restructuring

Firstly, I believe that the restructuring is excellent if you think about the conglomerate discount that CapitaLand may be facing. Conglomerates often trade at a discount versus companies that are more focused on their core products and services.

Mr Lee Chee Koon, Group CEO of CapitaLand Group says the same thing but in another way. As listed REIMs generally trade at a premium to their NAVs in the capital markets, we are confident that CLIM will be able to drive returns for our shareholders given its scale, capabilities and a strong ecosystem.” (Developers are usually traded at a discount).

Secondly, for those that feel that the development part of the business is hard to analyze or “risky”, this new structure becomes a “cleaner” and easier to analyze. There is more certainty in CLIM and probably that’s what local investors want. They will be paid a mixture of cash and CICT stocks for the development part of the business.

The Not So Good Part About The Restructuring

The growth driver of the company (CLIM) is now gone and the price CLA is paying is cheap (in my own opinion). I personally feel that the $1.279 (cash + CICT shares) are a cheap price to pay for the development arm of CapitaLand. Effectively, if CapitaLand were to grow in future, they have to then acquire new development property from (guess who) the CLA. I have no figures to back any statement down below so treat the following opinion with caution.

At this moment, the price for the development arm is not priced in or in fact, unknown to a retail investor.

I’m certain in the distant future that CLA will sell and offload some of the properties that they are developing now back to CapitaLand. According to FY2020 CapitaLand results, the development arm is pivoting towards ‘new economy’ asset classes. S$3.4 billion of new investments were made in business park, logistics etc. There are mentions of investing in Japan’s logistics sector (completing in 4Q 2022), Korea Data Centre Fund 1 (invest in an offmarket data centre development project near Seoul in South Korea), Two Class A tech office properties in San Francisco, etc. I believe these are interesting developments which may be sold back to CapitaLand in future.

Since the development arm is privatised, we will no longer have a visuals or information on properties/land that are developed. It might be difficult to see if the cost are justifiable or not.

There is also no more vested interest for CLA to give CLIM a good price for those properties. This means that properties that are acquired by CLIM moving forward may be more richly valued and CLIM may need to fund these properties using issuing of new shares.

Final Thoughts By Wealthdojo

On a business point of view, I personally feel that CLIM may not be as attractive as before.

On a share price point of view, I believe if people value CLIM differently moving forward, we may see the share price performing better.

If you do have any other views, whether it is similar or contrasting, I would love to hear from you in the comments below.

Invest safe.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.