It was a tough change. It is no secret that medical inflation is raising in Singapore and is showing no signs of slowing down. Medical inflation is expected to rise to 10.1 per cent in 2020. In the midst of finding fault with greedy doctors, overpaid agents or kiasu parents, I prefer to find a solution to plan for medical expenses after 1st April 2021.

To provide some context to this, the MOH has welcomed insurer’s move adjust terms for full-rider IPs, require co-payment of hospital bills. This would mean that the day will come when there is no longer 100% coverage hospital plan. This will change the way we plan for our retirement and the associated hidden costs.

The Current Situation

The official news are already in. Majority of the companies are transitioning their customers to the co-payment riders.

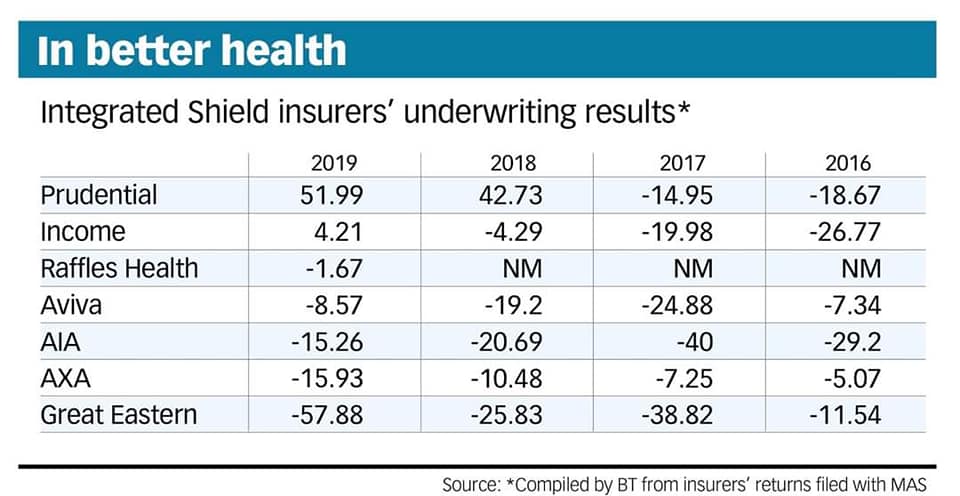

Reviewing the Integrated Shield Plan underwriting losses from Business Times, GE has the greatest underwriting losses in 2019 and it is likely for them to have the incentive to transit their customers to a co-payment plan. AIA has roughly the same underwriting losses with AXA. Although both companies have not officially reported the change (at least to the press), I believe they would have a strong incentive to do so.

For the people like you and me, we have to embrace the Co-Payment nature of the policy moving forward.

What is Co-Payment?

A co-payment basically it is out-of-pocket amount paid by an insured. In the context of shield rider in Singapore, there may be other conditions like going to list of panel doctors, pre-authorisation, deductive waiver pass etc. For discussion, we will assumed that those requirements are fulfilled (please check with your financial consultant for those requirements).

5% Co-payment for every bill, up to $3000 per policy year.

Case #1

First Bill is $10,000. No other claims in the policy year.

Client pays $500 (5% of $10,000)

Case #2

First Bill is $100,000. Second Bill is $100,000 in the same policy year.

Client pays $3000 for first bill. (Although 5% of $100,000 is $5,000, there is cap of $3,000 per policy year). Client pays $0 for second bill (max payment per year is $3,000).

Having a copayment will further encourage prudent use of healthcare services as the patient will pay part of the bill. It is worth noting that the maximum a patient will pay per year (assume the requirements are satisfied) is $3000. This should be incorporated into your emergency funds.

How to fund co-payment?

There are a couple of ways to pay for co-payment and these are 4 possible ways that you can consider.

#1: Medisave: There is a limit which you can pay using Medisave.

#2: Company Insurance: This is only applicable if you are currently employed.

#3: Accident Plan (Accidental Medical Reimbursements): For hospitalisation arising from accidents, the accidental medical reimbursement helps with the co-payment payment.

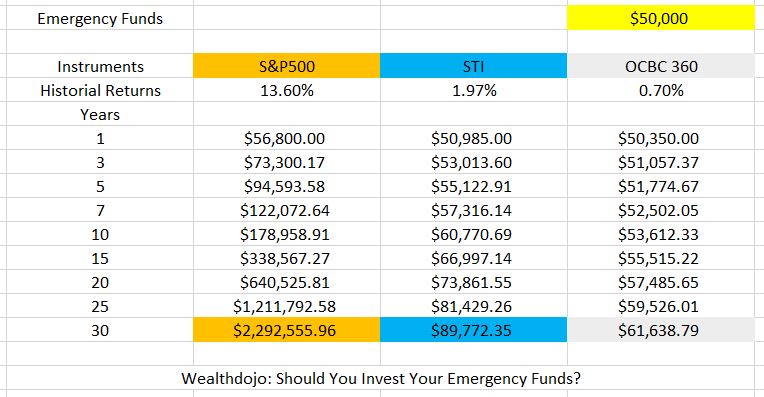

#4: Emergency Funds: It is important to set this up as soon as possible.

Final thoughts by Wealthdojo

Hopefully, this will be one of the final time that there is such a major change in medical insurance scene. This will definitely affect the way we plan for our retirement and also our emergency funds.

Please note that the terms and conditions for your IP may vary. It is best to talk to me or your preferred financial consultant on the upcoming changes on 1st April 2021 (if any).

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.