Interest rate in the bank is at the all time low. The time where you are able to get 2% per annum in high interest account is over. With the market at all time high, one question I get is if you should invest your emergency funds?

“The interest in the bank is so low. I should use the power of compounding and invest in the stock market”.

This is the current narration in Singapore right now and I don’t blame them. Most of us are literally looking at our money stagnant. If you are like me, you might feel frustrations keeping the money in the banks which is “not doing anything”. Here is a quick introduction of compound interest.

Compound Interest

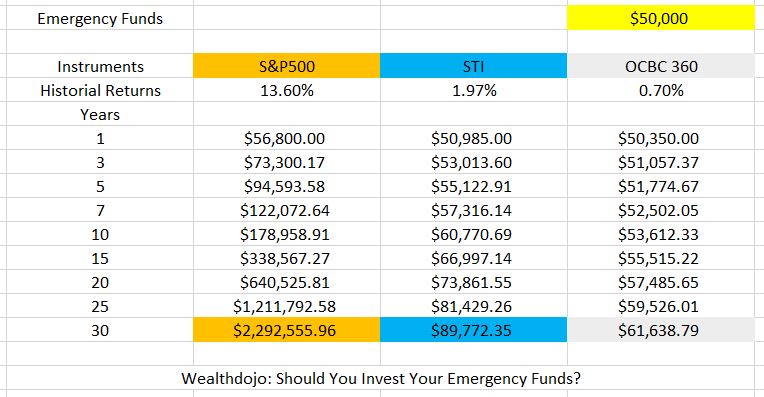

Let’s assume that we have $50,000 that we are keeping as emergency funds. We will be using the following numbers for our illustration.

The S&P500 10 years historical returns: 13.6%

The STI 10 years historical returns: 1.97%

Current OCBC Account EIR (Salary Only): 0.7%

As you can see on the above future value formulation, the difference is simply ridiculous on a 30 years time horizon. If you have invested the $50,000 in the S&P500, you would have gotten $2.29 million (think about that for a moment). If you invested in the STI, you would have got $89K and if you just leave it in your multiplier account, you would have gotten $61K.

How is it not tempting to invest your emergency funds?

So why not invest and keep it as cash?

In life there are many what ifs, that’s the reason why you buy insurance in the first place. By having an emergency fund, you are preventing your life from being a roller-coaster. There are certain things that are unpredictable and could affect your family drastically.

If you desperately need cash then and if the market is NOT in your favor. That would mean that you will need to take a loss without giving it time to bounce back. Ask yourself, do you want to sell at an unfavorable time?

Some reasons to have emergency funds are job loss, medical emergencies (especially with the changes in the hospital plans: Co-payments), your family member’s medical emergencies, car repairs or home repairs.

“You will never know when you need the money”

Your emergency fund is not designed to be a wealth builder

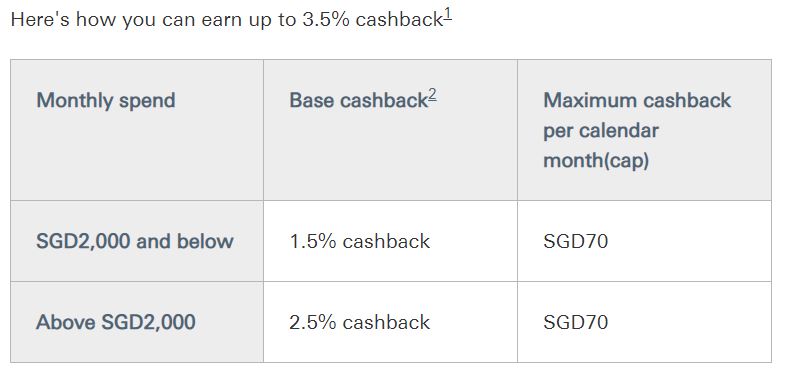

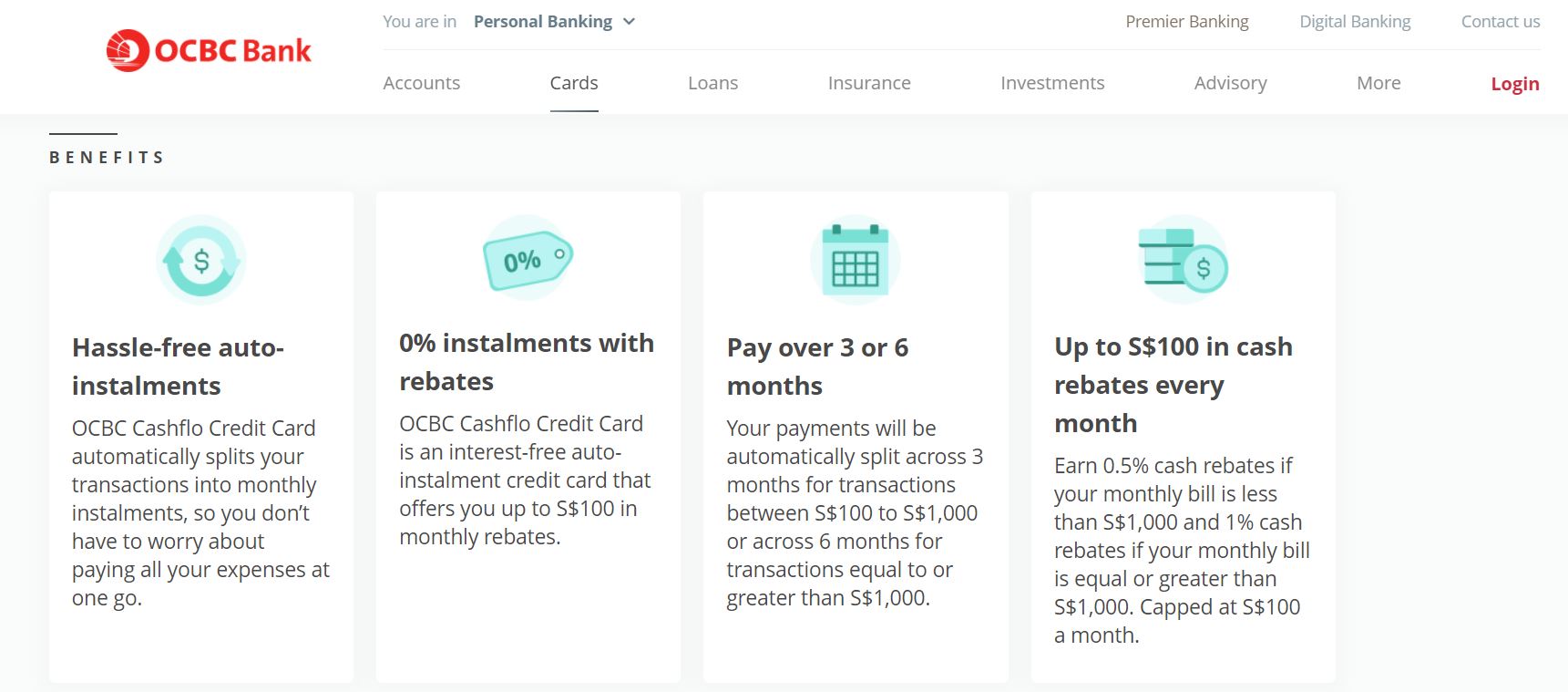

Not everything is designed to be a wealth builder. Sometimes you need the liquidity as a “personal insurance policy” for yourself and your family. I know some that uses credit cards (which might be suitable credit card for emergency) to design their emergency funds, but that’s another topic all together.

Final Thoughts By Wealthdojo

Your emergency fund is not designed to be a wealth builder. For those that wish to read about how I spend my money, you can read one of my best article: The Ultimate 4 Quadrants Shopping Guide Especially If You Are 28 and Older.

Till next time!

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.