When the government announced the Enhanced CPF Housing Grant, it was a mixed reaction. Those in the sandwich generation cheered, some were disappointed. The question is, how do you benefit from the Enhanced CPF Housing Grant?

Let’s first start by asking ourselves, what is the Enhanced CPF Housing Grant all about? (Read more: Make The Most Of Your CPF)

HDB Eligibility

The Enhanced CPF Housing Grant that is going to streamline current Additional and Special CPF Housing Grants as an attempt to make public housing affordable and available for everyone.

Firstly, the income ceiling for buying the HDB has increase to $14,000. This means that HDB will be available for more people to buy. Currently, those that are “earning too much” is not eligible to buy a HDB. To put it really simply, if your average gross monthly household income is less than $14,000, you are eligible to buy a HDB.

Enhanced CPF Housing Grant Eligibility

Now that you know you are eligible to buy a HDB, the question is how much grant are you entitled to for the new Enhanced CPF Housing Grant. The answer is, it depends. It will depend on the followings.

- Average Monthly Household Income (The higher your Household Income, the lower the grant)

- Lease Coverage (To get full grant amount, the flat must have enough lease life until you and your spouse is 95)

Typically, the average monthly household income in Singapore for First-Timer Families (Assuming a couple who graduated from an University and working now) will be around $5000, this brings the grant amount to $40,000.

There are many permutations as to how this new Enhanced CPF Housing Grant will affect people. There will definitely be people who will compare between the old scheme and the new one. For Wealthdojo, we believe that it is better to well understand your own situation rather than compare your grant to everyone else. You could always consult the HDB Board to better understand your situation.

How will this affect Property Prices?

In Wealthdojo, we are a platform for people to make informed financial decisions. We want to understand how this Enhanced CPF Housing Grant will impact our financial journey as a whole. The below are my personal opinions and strictly my own.

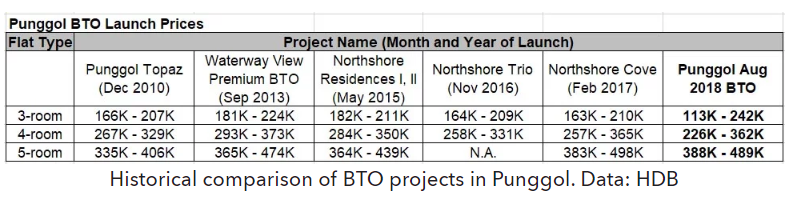

- There will be an increase in property prices. A grant makes buying the property affordable for a selected group of people. It doesn’t mean the price has dropped. Loosely speaking, we are not taking into account location and various other consideration for buying a property. An isolated trend table for Punggol shows that over the years, there has been an increase in price for BTO flats.

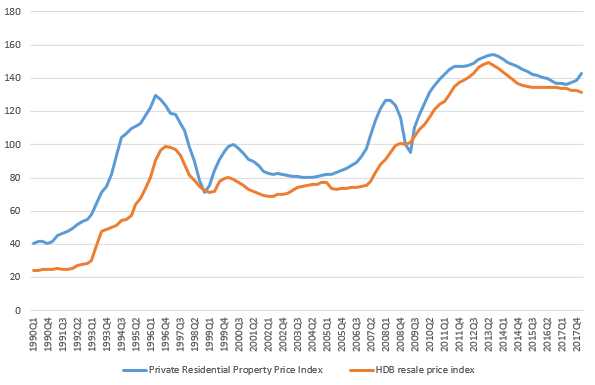

Enhanced CPF Housing Grant BTO Price Changes - Private Property Prices will increase. A simple chart like this show that there a simple positive correlation between private and HDB prices. Logically, if we compare a similar size HDB and a Private Property in the same area, the price of a private property will be higher.

Correlation HDB Private Properties

Insurance for Properties

Buying a property might be the biggest purchase for most people, it is also important to plan for insurance for your properties. (Read more: Insurance for Investors). In a simple nutshell, these are the 3 insurance that you have to get for your property.

- Fire Insurance

If you are living in a HDB, it is compulsory to get a fire insurance. As the name suggest, it covers for fire BUT the scope of the coverage is very small. HDB fire insurance compensates for damage to the building (ONLY). As a general rule of thumb: If it wasn’t already there when you got your house keys, then it’s not covered by HDB fire insurance. That’s why we need to have content insurance.

- Home Content Insurance

In a fire, naturally the items in the house will get damaged. This will include items like Air-Con, the fridge, the television, the sofa, the bed, etc. Not only do you need to purchase these items again, you will need to renovate the house again to bring it back to living conditions. Most home content insurance covers for renovation and also home content.

- Mortgage Interest Insurance

Most people will get a loan from a bank to finance their property. For banks, they will need an assurance that you will be able to pay for the loan. That’s why they assess the loan amount from your salary. The biggest risk a bank (and yourself) will take is if a person is unable to finance the loan. What happens in an event of a critical illness (Read More: Life Insurers to change definition of Critical Illness) such as heart attack and it robs away the ability for a person to earn money? Would this be extra burden on your partner? The bank has the right to claim back the property leaving your family on the streets. Would you want that to happen?

In summary, there will be new changes in the future too. Some things will change while others will remain the same.

In Wealthdojo, we believe in bespoke financial planning. Whether it is money maximization, insurance or investing, we believe that everyone is different and the planning should be suited for you.

All opinions above are my own. Please view our disclaimer page to understand more.

I hope to nurture genuine relationships with all of my readers. Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page!

Now that you’ve read about learnt about how to benefit from the Enhanced CPF Housing Grant , I challenge you to read this article (Careshield Life: Disability Insurance Singapore) to push your understanding further!

[…] learnt about how to benefit from Save Money on Transportation I challenge you to read this article (How to Benefit from the Enhanced CPF Housing Grant )to push your understanding […]

Hi, very nice website, cheers!

——————————————————

Thank you for your kind reply.