I was catching up with a friend wanting to find out how well he was coping with the COVID-19. I knew COVID-19 had a major impact to his job. His bonus was cut, his workload increased tremendously and he is praying that he would not have a pay cut.

“Fortunately, I still have a job.” He said with a bitter snigger. His facial expression was stiff as I looked at him over zoom.

Over the next 30mins, we chat on other things like where do we want to eat after all these is over, etc. Then, he mentioned.

“Have you been taking care of yourself? You know? Self-care. It is a difficult period of time. We should take care of ourselves.”

He then proceeded to show me a long list of things he had bought from Lazada, Shoppee, etc.

————————————————————-

If you have spent some time on Instagram, you might be familiar with the new trend of hashtags #selfcare #selflove. Most of the post feature beautiful young ladies enjoying themselves in a bubble bath with a caption similar to this.

“Just had to getting away for a while to take care of myself. #selflove #gratitude #blessed”

I smile as I can imagine their partners probably spend more than 2 hours taking 200 over photos just to make it look natural.

Self love is very powerful. In our Wealth Management Framework, we believe that Self-Love is necessary and vital in a person’s financial journey. However, Self Love was quickly corrupted by people’s narcissism and has became an excuse for indulgence. “Oh, why did I spend $3,000 on spa weekends last year? You know, self-care.” Meanwhile, their retirement account is doomed.

I’m not saying we shouldn’t spend money to have enjoyment. I just feel that it is not necessary a luxurious spa retreat or an over the top vacation (we can’t travel anyway now). To emphasize it again, spending money for self care is okay. I just feel there is another dimension to it.

Self love is not easy

Self love could be saving money for emergency. Self love could be going back to school to get your Masters. Self love could be reading a book to upgrade yourself. Self love could be letting a toxic friend go and not letting him/her affect your life anymore. Self love is getting yourself fit so that you won’t fall sick easily.

Financial Self Love is one of the hardest way to love yourself. I acknowledge that money adds stress to our life. That’s why we want to explore whether we can have it within our control. I believe that Financial Self Love isn’t about your net worth, but about taking control of your financial knowledge and, if possible, financial situation.

Financial Self Love could be…

Creating an emergency fund so that you can have a peace of mind when you need money.

Setting aside a budget for retirement and also for pleasure (Fun Goal).

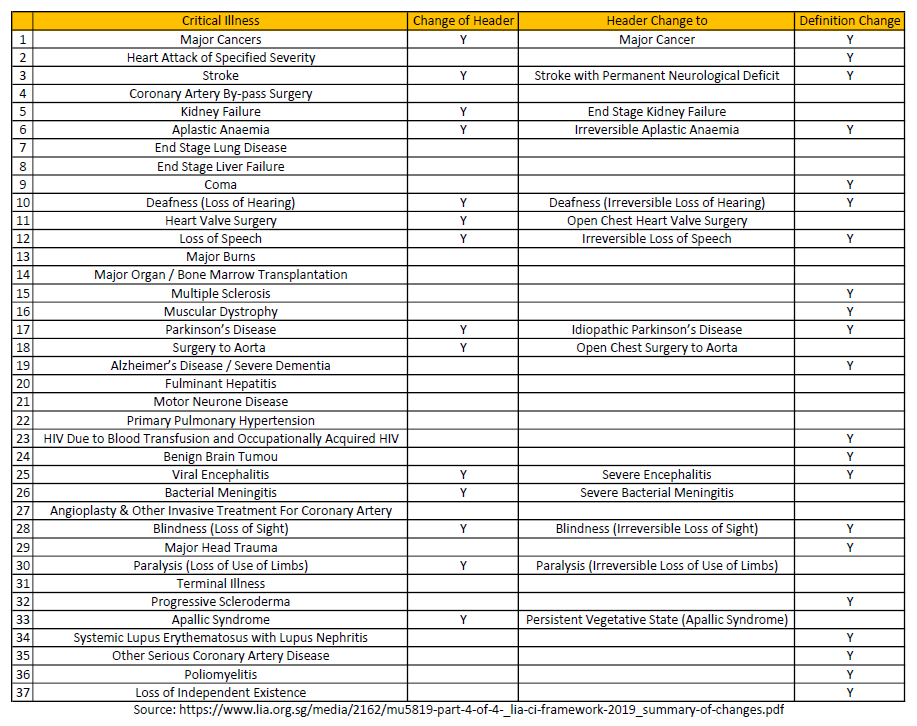

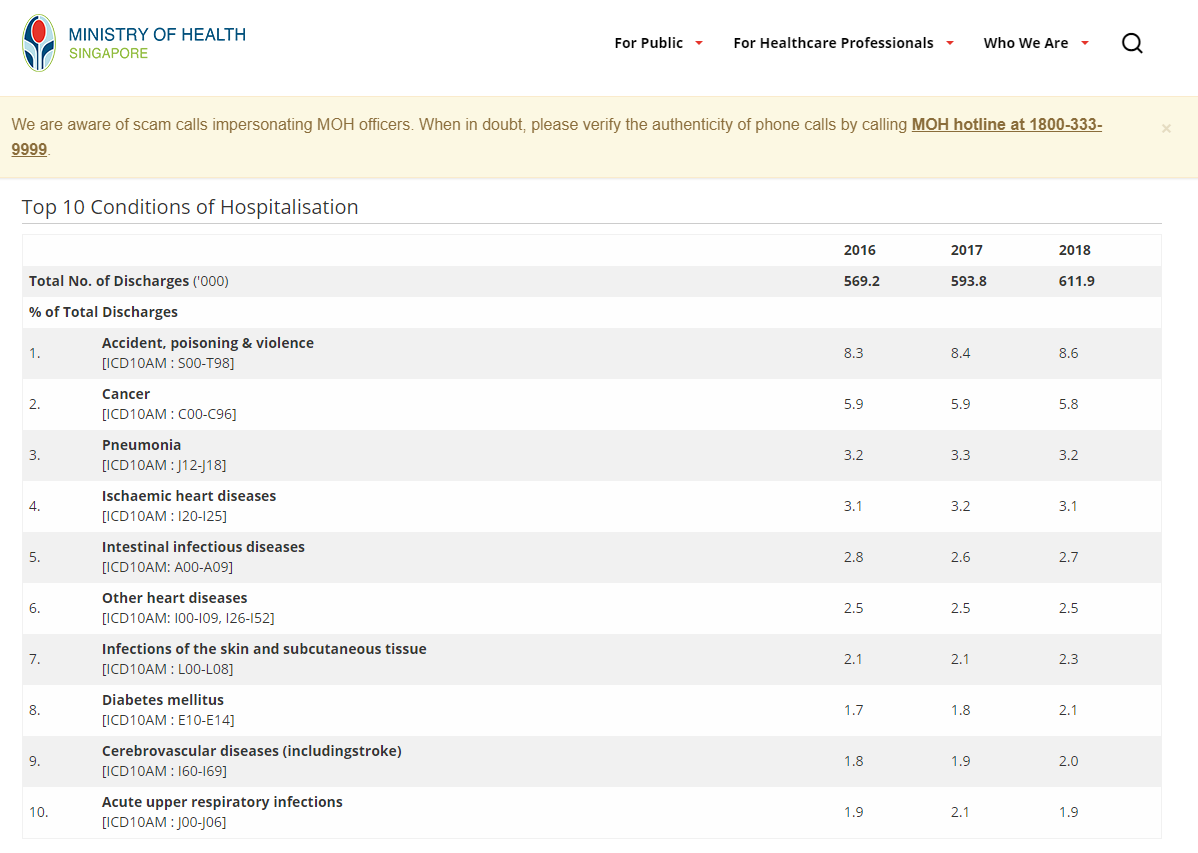

Creating an adequate insurance program so that your loved ones can pay the mortgage, bills, even education costs, after you are gone or suffer from critical illness.

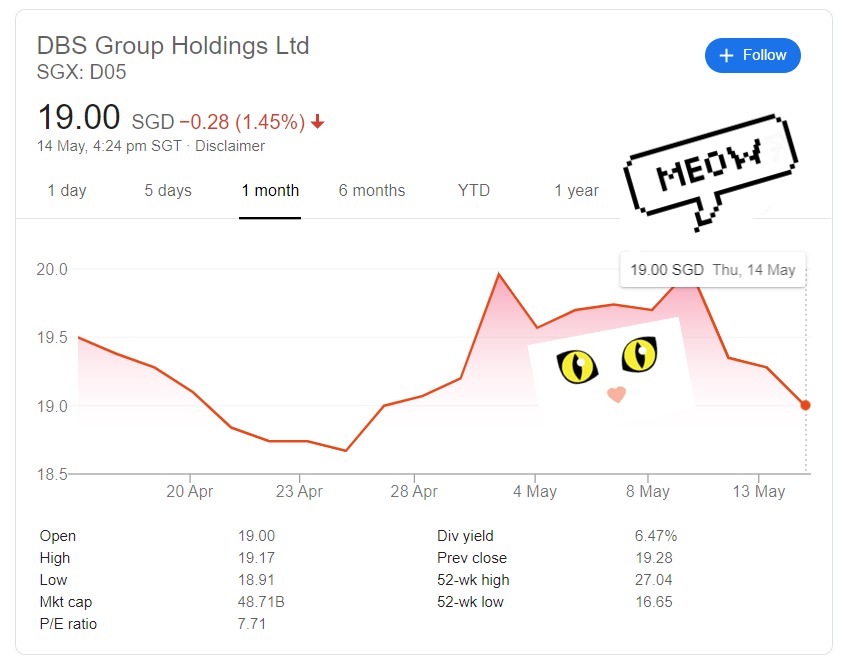

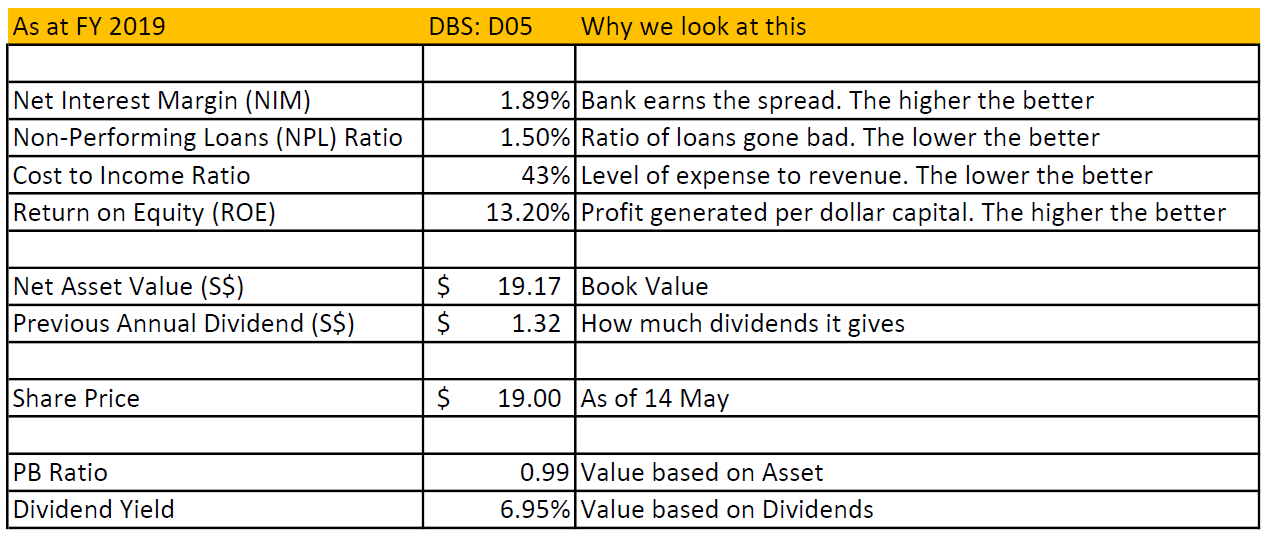

Learning how to invest so that you don’t make the mistakes so that you don’t need to work forever (Get Educated).

The list goes on.

Conclusion: It is okay to spend money for self love =)

Take care of yourself during this tough period. See you at another article.

No one will care about your money as much as you do.

In Wealth Management, it is important to Pay yourself first. Beware of scams. Before you invest in any company or popular investment opportunity, be sure to do your own due diligence. If you wish to learn more about investment, I hope to nurture genuine relationships with all of my readers. Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page or my Telegram Channel! Or subscribe to our newsletter now!