Life is a series of ups and downs. We go through different seasons in life, explore different emotions and without fail, we make mistakes in life. Some mistakes can be funny to remember, some cringe worthy and some.. just not worth it.

To prevent our life from going out of control, we have certain hedges that we placed on ourselves like not spend our entire bank account on one meal or slapping another person’s face when we are angry. Put simply, a hedge is a way of protecting oneself against financial loss or other adverse circumstances (the people you slapped could be a UFC champion). This protection is important for us to feel safe so that we can live our lives without feeling like it is out of control.

Let’s talk about Amy, her parents are avid gamblers. There was once her parents had to borrow money from her (at that time, we were just 18) to repay the loan sharks. Eventually, the amount that her parents owed was so large that they had to sell away their HDB in Toa Payoh to payoff the debt. In one night, Amy no longer had a roof over her head. Her life just turned 180 degrees and she live her life shuffling between different relatives at different times. That was the last I heard about her.

John Locke, an 17 century English Philosopher once said: “When there is no law, there is no freedom”. If there is no certain laws in place, life could be messy and out of control. Taking things a little recent, Ronald Reagan said: “Law and freedom must be indivisible partners. For without law, there can be no freedom, only chaos and disorder; and without freedom, law is just but a cynical veneer for injustice and oppression”. To use this one a personal level, I can rearrange the above to be “To achieve freedom, there are certain limits I have placed on myself.” (IE: How Can You Stop Buying Shit You Don’t Need?). Without going too deep, let’s limit the discussion to Investing hedge.

Investing Hedge

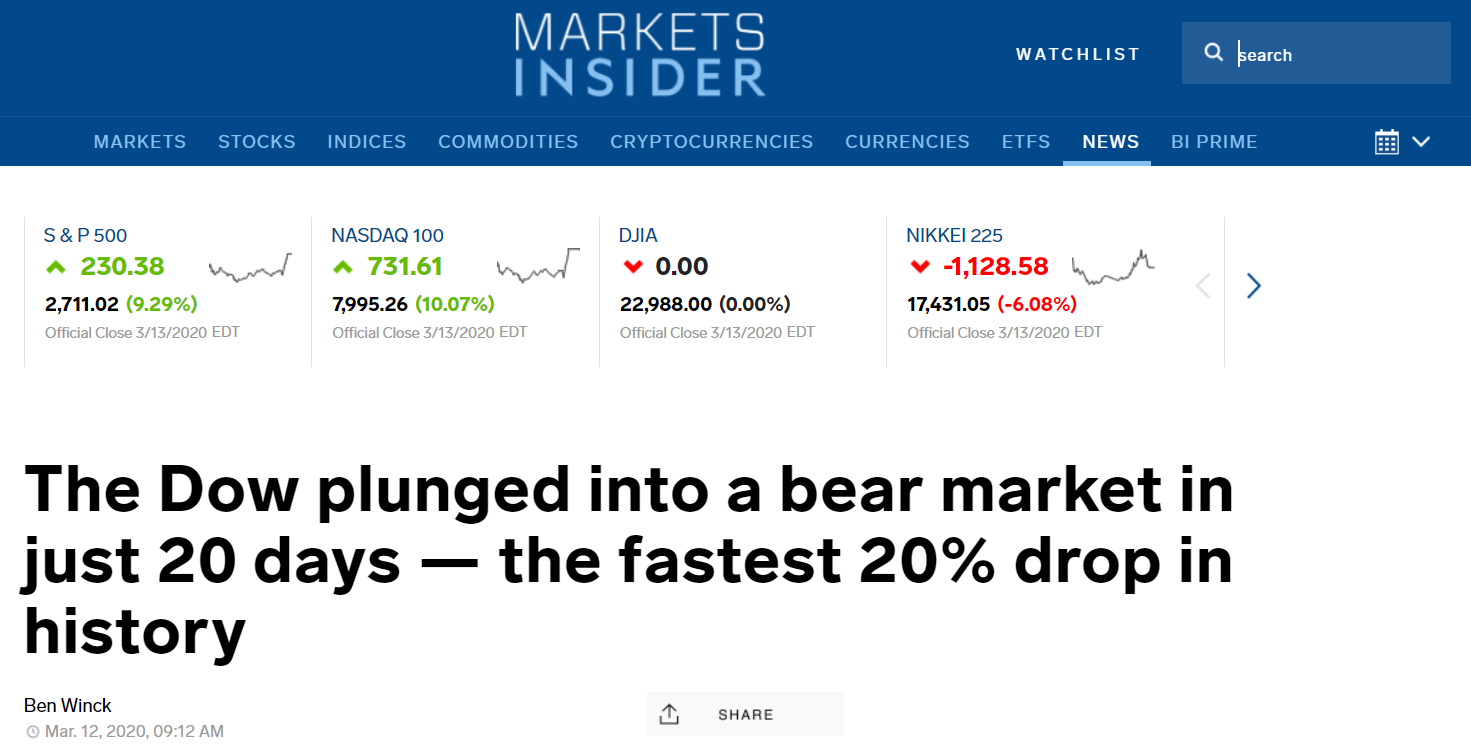

Unless you are living under a rock (you probably won’t be reading this), there was a global selloff in the market (Covid19) in the last 2 weeks. We are officially in the bear market territory. If you are a millennial, congratulations! You can finally boast that you will live through your first bear market!

Being in the investing scene for a while, I met different types of investors. There are people celebrating this moment and they are also people panicking at the moment (Investing Mistakes I wished I knew).

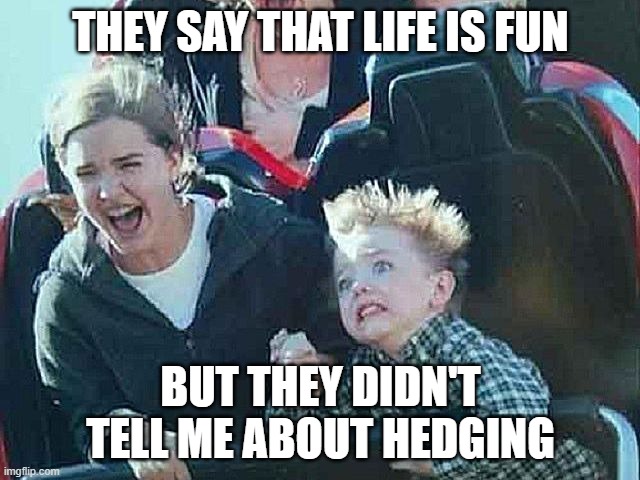

Ivy is a newly minted investor. She started investing in July 2019 after attending one of the investing programs in Singapore. On 31 Dec 2019, she looked at her P&L (profit and lost) for the year and smiled to herself. Ivy made 35% that year and she started in July. Ivy thought if she could do this for a few years, she could retire in 5 years time. She shared her results with a few of her friends and she REALLY felt good doing so. The happiness continue until the coronavirus came in early 2020. Initially, she saw her portfolio went down by 10%. She thought that was just a small drop and it was normal. After that, her earnings last year was wiped out. Ivy started to feel regret as she didn’t take profits earlier. On 12 March 2020, she saw her portfolio is at -30%. She is starting to feel that investing is a mistake. During my conversation with her, I asked if she had any hedging strategy. She said she was 100% invested as she felt it was a good time to invest. She refused to open her trading account now and feels like investing is like a roller coaster ride! Poor Ivy!

Excellent investors I know have a Plan B. Plan B is a plan to allow us to enjoy the ride. Excellent investors knows that the market will present certain opportunities for them and because of that, they can take certain actions to allow them to enjoy the ride. In this way, they feel excited even when the roller coaster takes them up or down! They do so in three ways.

-

A Cash Hedge

Excellent investors know the importance of having money during a sale. Can you imagine if the $1,000,000 Dream Condo that you want to buy is now worth $100,000? How many will you buy? Or rather, the more important question is, how many can you buy? When life presents you with the opportunity of the lifetime, are you ready to buy and are you ABLE to buy?

Imagine if you seized the opportunity and bought 5 $100,000 Condo units. When the market recovers and the price reverts back to $1,000,000. You will now be $4,500,000 richer! -

An Alternate Asset Hedge

Some assets class have an inverse co-relation to the stock market. It means if the stock market prices go down, these assets prices will go up. Some people use gold, bonds or bitcoin as an hedge to the stock market. Personally, I don’t think they are perfect hedges. But they work generally well most of the time (disclaimer here). Ray Dalio is famous for his “All Weather Portfolio”. He believes that by combining different asset classes together in different percentage, he can beat the market by doing a re-balancing of his portfolio due the co-relationship between the asset classes.

-

Buy a put option on the stock market

Put Options is a derivative which advanced investors use to protect their portfolio during a crisis. Essentially, it is like an insurance contract. You pay a premium for a certain protection that we call a strike price. If the stock falls below the strike price, the put options buyer will have to pay you the difference of the strike price to the actual price. This allows their portfolio to remain stable during a crisis. Eventually, they will close their put option contract and allow their portfolio to go back to their previous prices.

Wishing you the best in this period of time. We hope that everyone can remain calm and healthy during this season. It is a season of crisis but it is also a season of opportunity. Invest with what you have and don’t borrow money to invest in this period of time. If you are new to investing and need help, do talk to me using the contact form or any methods listed below.

God Bless.

If you read until here, thank you again for your patience and your support over in 2019. I hope that in 2020, Wealthdojo can continue to value add you. Let us know what you think in the comments below. This is a working article. The above doesn’t represent my stock recommendation in anyway. Please read our disclaimer for more information.

I hope to nurture genuine relationships with all of my readers. Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page or my Telegram Channel! Or subscribe to our newsletter now!

good sharing!

Thank you for your kind reply Agnes =)

[…] the previous post on Life Hedge: how to prevent your life from being a roller-coaster, we talked about investing hedge and how you can use various tools to hedge on your investing […]

[…] the reason why you buy insurance in the first place. By having an emergency fund, you are preventing your life from being a roller-coaster. There are certain things that are unpredictable and could affect your family […]