This might be an uncomfortable read for some. If you might take umbrage at what you are going to read, I suggest heading to other friendlier parts of my website such as “what’s holding us back in our wealth management journey”.

The market don’t really make sense on a day to day basis. Benjamin Graham, father of value investing famously said this. “In the short run, the market is a voting machine. In the long run, the market is a weighing machine.” Personally, I agree with this and that you should really invest in the companies you want to see grow in the long run.

Alas, in real life we have plenty of distraction coming from our friends, “Gurus“, Gamestop, Bitcoin, Elon Musk (just to name a few).

On the ground, here is a story of bullshit that I hear one investor says and here’s how to identify them.

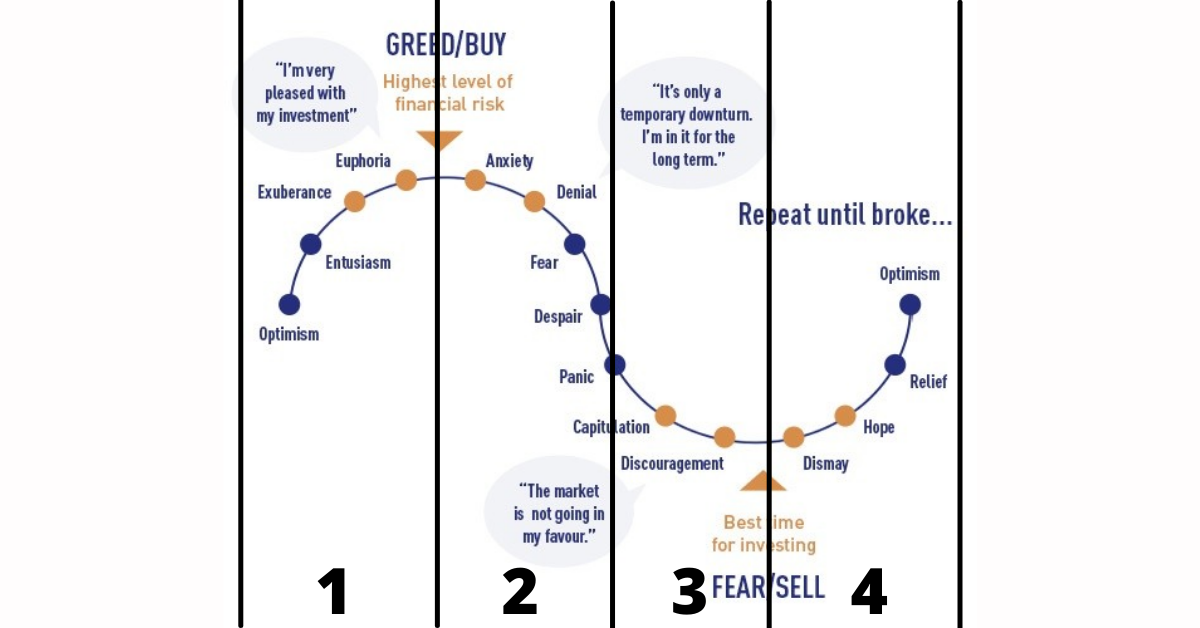

There are 4 stages of Bullshit that you get to hear. It follows very closely to the market cycle.

The most noise happens typically at stage 3. One recent example would be the market crash of March/April 2020. Let’s start here.

Stage 3: This time is different. Wait for confirmation.

As Sir John Templeton puts it, this time is different is the 4 most dangerous words in investing. During March/April 2020, the stock market crashed. People were pulling money out of the market because they felt that COVID19 was going to have a significant impact of the economy.

During a crash, the best thing to do is to keep calm and learn how to endure the correction. As easy as it may sound, it is not easy to do. I know of people who are pulling out or adopting the stay at the side saying “this time is different”. The crash will be longer than usual and this is the first time (not really) that a virus has made it’s way worldwide. Every sensible country is in a lockdown. The entire economy is in a standstill. This situation will drag on. It is better to keep some in cash.

Most people don’t do anything (if they have the capital) or they may take losses to protect their capital because “this time is different”. This is bullshit because this is the best time to invest in companies you always wanted to.

Stage 4: Some leverage is good debt. Let’s 10X our capital.

Things are recovering right now. People are starting to enter the market. At this stage, most people would be making money from the stock market easily. If you know someone who have invested from May 2020 to Dec 2020, they will be bragging how they can be financially free in no time. They are looking into leverage instruments because they are looking to 10X their capital!!

This is the time to go long because economies are recovering. Some sectors have benefited and it is obvious (in hindsight) that they are benefiting (WFH stocks like zoom). You are a little late but there is still some time to enter. People all around somehow are making money and you don’t want to left out.

More bullshit because greed is now fueling the stock market. This is the easiest time to make money no doubt. Talk is cheap, people are showing off their results on Facebook. Almost everyone is making money here.

Stage 1: Value Investing is Dead. You got to pay more for quality.

This the most scary part of the cycle (in my opinion). The market is over-heated and valuation are rich. The narration here is “you got to pay more for quality”. As more and more people starts to pay more, the price of the stocks starts to go higher and higher. Cathie Woods starts taking central stage here in 2020 with her ARK funds outperforming all major indices. People starts to buy into the idea and invest with higher prices.

The ultimate bullshit because prices are going to the moon now. No one is concern about fundamentals. Everyone is waiting for the stock to gap up and celebrate until…

Stage 2: You need to have diamond hands. Valuation is everything.

For some reason, earning beats don’t increase the stock price anymore. Although the results are fantastic, stock prices are dropping. Stock prices drops and people start to think that there is a “sector rotation”. Here, you will need to have diamond hands as you have bought the stocks are “good prices” already.

However, stock prices continue to drop. Warren Buffett takes central stage again. Gurus are saying valuation is everything. Prices continue to go down and people gets worried. People begin to sell in companies that they have less conviction in.

Bullshit because it is too late to notice that valuation was too rich before.

Final Thoughts By Wealthdojo

The cycle continues on. I heard this bullshit in the last one year all from the same investor. I cannot imagine how inconsistent his/her investment strategy is and how many people have lost money because of him/her.

To put things into context, the above advice are good advices except that it is adapted conveniently to sound smart in the market. Investment is not all rosy and sunshine. It comes with rains and storms. We need to learn when is the best time to plan the seeds, when is the best time to wait and when is the best time to celebrate. A far sighted plan is needed to prepare oneself in their investment journey. Average investors learn from their own mistakes over time. The best ones learn from other people’s mistake using their time and experience. Investment is not complicated. You just need to learn from the best and apply it.

All the best to everyone enduring this correction.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

[…] hope this will be the last negatively titled article. So much bad advices have been given out of context by gurus such that I felt that someone have to make a stand when it comes to these advice. The previous […]

[…] hope this will be the last negatively titled article. So much bad advices have been given out of context by gurus such that I felt that someone have to make a stand when it comes to these advice. The previous […]