It is ironic for a finance blog to write about spending money when it is supposed to preach about saving and growing money. Recently, I had a friend who just purchased a bed for SGD$7000. This IS a lot of money for a bed. Personally, I think it is a good purchase because we will spend a good 30% of our lives on a bed. I believe it is a great investment.

For those who wishes to read about how I spend my money, you can read one of my best article: The Ultimate 4 Quadrants Shopping Guide Especially If You Are 28 and Older.

In my research, I present to you one way to save money on big ticket purchases.

Disclaimer: This is not a sponsored post. All information accurate on 7 Jan 2021. If you feel the information has been helpful, I have referral bonus for Citibank.

Big Ticket Purchases

To clarify what big ticket purchases in this context, these are items that are often necessary but expensive. We are looking at a couple of categories such as the following.

Furniture: Bed, sofa, chairs, tables etc

Home appliances: Oven, fridge, standing lights, TV, fans, air-con etc

Work/Electronic appliances: Laptop, headset, smartphone etc

Travel: Air ticket

These items typically ranges from hundreds of dollars to thousand of dollars. They are usually pre-planned (why would you buy a sofa suddenly?). The most common would be laptop and smartphone. After doing a survey, I realised there is a trend to change them every (approx) 3 years. Because of the predictability and the large amount, we can make use of one tool in the market to help us.

Cashback on credit cards.

Those who have been following me for a while know that (1) I’m a cashback person and not a miles person, (2) I don’t really like the concept of credit cards in my journey of wealth management. However, if the credit cards can be used for one off purchases such as the above. I think it is well worth it. I hope these 3 credit cards can help you. Once again, this is not a sponsored post.

#1: Citi Cash Back+

I will be straightforward. The one thing that attracted me to this card is the generous cashback.

- 1.6% Cashback for on all your spend

- No minimum spend required & no cap on cash back earned

- Get 4.5% cash back on up to S$5,000 spend (up to S$225 cash back) in the first 3 months.

This means that if I have a predictable spending of at least $5000 coming up. I get a 4.5% cashback on this card.

If you think this is good for you, I would appreciate if you can use my referral link: My Referral Link.

Please check out the T&C on the website for more details.

#2: Amex True Cashback

Amex is one company whose customer service seems to be on the highest level. Although I have never used their services, I do hear raving reviews from them.

- 1.5% Cashback on all purchases

- No minimum spend required & no cap on cash back earned

- 3% Cashback on up to S$5,000 spend in the first 6 months.

I rank this number #2 because of the lower cashback amount and also AMEX may not be accepted in some places in Singapore.

Please check out the T&C on the website for more details.

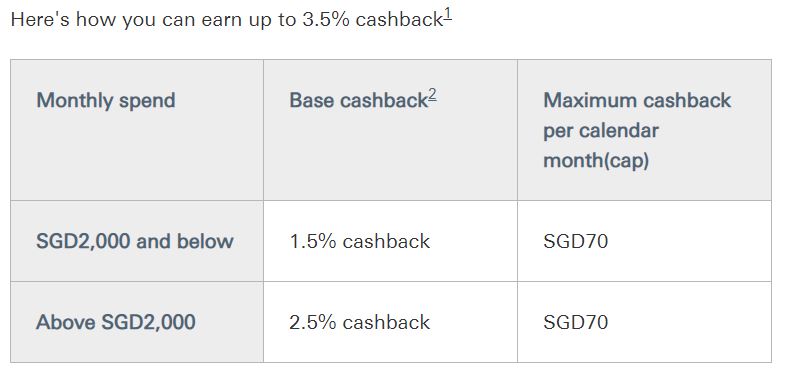

#3: HSBC Advance

HSBC comes in number 3 due to the conditions needed for the cashback.

- Up to 3.5% cashback

- Limited privileges with Entertainer.

Please check out the T&C on the website for more details.

Final Thoughts By Wealthdojo

A credit card is like a double edged sword. Use it well, it will serve you well. Use it badly, it will come one round and hurt you. We wish you the best of luck in 2021. I appreciate your support and thank you if you were to sign up the Citibank card because of this website (there are no obligations). This is my referral link again: My Referral Link.

If you are thinking whether credit cards will be disrupted, you can read my article on bitcoin and whether it is too late to invest in it. .

Till next time.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

[…] a streaming device to enjoy them on a screen bigger than your phone, tablet or monitor (Read More: How To Save On Big Ticket Purchases). You can safely cut that cord and still find plenty of entertainment to consume with friends and […]