Insurance companies will be showing lowered illustrated rates after 1st July 2021. Although there is no real impact because the rates are illustrated after all, you might be wondering why is this happening? I think the most important question that you have will be this.

“Will this affect my returns in the years to come?”

What is a Participating Fund?

To understand your returns better, you first need to understand what is a participating fund. You can take a look at LIA: Guide to Participating Fund. I will be summarizing some of the points in the guide.

Participating policies (such as endowment, life, retirement) are life insurance policies which provide both guaranteed and non-guaranteed benefits. The aim of a participating policy is to provide stable medium to long-term returns through the combination of guaranteed benefits and non-guaranteed bonuses. Participating funds can invest in a range of assets, including equities, in search of potentially higher returns.

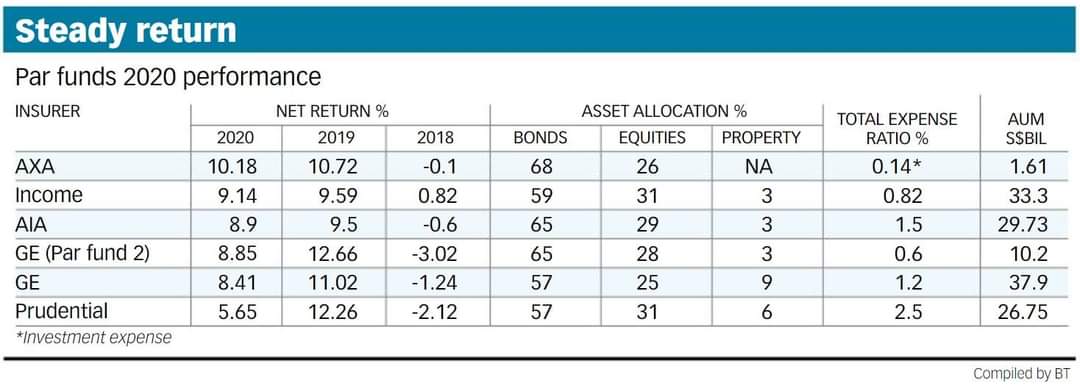

This means that the participating fund need not be conservative. Equity positions in the 5 companies (as shown above) is around 30% of the entire fund. However, we need to note that insurer need to provide a guaranteed benefits.

The Search For Guaranteed Benefits

To back the guaranteed returns of participating policies, insurers typically invest around 70% with bonds (Side note: investing in bonds does not mean that having guaranteed returns). In the persistent low interest environment (plus the RBC2), it becomes an problem for insurers. I believe (this is my guess) that insurance companies might offer newer plans with lower guaranteed benefits in future.

Will It Affect My Overall Returns

That being said, I believe the overall returns for participating funds will improve. This is because insurers has already shown trends to shift more of the assets into equity (read my last article on the data).

However, this would mean that we need to be understand returns on a participating policy may also be volatile in future.

Final Thoughts

I do not think that having a lower guaranteed benefit is necessarily bad. This is because when the participating policy has a lower guaranteed benefit, it means it only needs a lower proportion of assets goes into bonds. This will free up some capital to invest in other assets such as equity. This investment mix might provide greater potential/returns for long term investment.

As mentioned above, we need to be understand returns on a participating policy may also be volatile in future. You should be instead focus on your financial needs and whether these plans (participating or not) can serve you in your financial planning.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

Technical Mambo Jambo: RBC2

This section is only for those that are interested in the technical stuff.

Insurer are required to adopt RBC2 from March 2020. Monetary Authority of Singapore (MAS) expects the guaranteed cash flows from assets invested by the Par Fund to match the guaranteed insurance liabilities, i.e. the guaranteed benefits of the par policies. Insurers are required to hold higher capital requirements if that is not the case.

As we are in a persistent low interest environment, it would mean that the insurer have to hold even more bond positions to match the guaranteed benefits. Thus, reducing their ability to invest in the equity market. Thus, potentially reducing overall returns.

As a result, we might see new participating policies with lower guaranteed benefits. As explained above, it may be a good thing and a blessing in disguise.

Here is a 1 hour video to explain the mambo jumbo.

What MAS did is just to review & formalise an investing practice known as “Liability Matching” which has been used by insurers for 1,000 years and by big Uni endowment funds for 100 years.

Nothing new here.

The guaranteed insurance liabilities is not really the column of guaranteed cash surrender values or annual bonus payouts. Yes it includes these things.

But the main liability that MAS is talking about are the insured event payouts e.g. death, TPD, CI, arm chopped off, house burn down etc. You know, the actual reason for insurance in the 1st place.

You can’t have money invested in 60% volatile assets like stocks if you are providing insurance 24/7. It’s not like longterm investing for retirement where you won’t withdraw the money for 20-30 years & can hold till payday in the far distant future.

So for those insurance where the liability payout is high compared to premiums e.g. $100K sum assured compared to annual premium of $2K, insurance companies will STILL maintain their traditional asset allocation. No choice … liability matching. Unless the world invents stocks that won’t crash & can deliver 6+% annually.

In insurance, you have to be able to pay out $100K in the first year, even though you only collected $2K premium so far.

The lowering of illustrated returns is a reflection of REALITY today. This will change if real rates are to go up again.

For those insurance products where there isn’t any insurance e.g. in event of death or TPD, the company will just return the higher of accumulated cash values OR all your past premiums with maybe 1% or 2% interest …. then yeah, the insurance companies may allocate such monies into a new par fund which is riskier & higher allocation to stocks or private equity. And of course reduce the column of guaranteed cash values.

You should also look at the various insurer’s claims payouts ratios. Those with higher payouts may change their way of doing things more drastically.

Dear Sinkie,

Welcome back again. Thank you once again for this wonderful comment. I think you manage to highlight accurately the liability of the claims on the Par Funds. I couldn’t have explained it clearly.

I especially like this part in which you mentioned “You can’t have money invested in 60% volatile assets like stocks if you are providing insurance 24/7.” Indeed, the purpose of the participating fund is to provide stable returns and at the same time pay for claims etc (simplified definition). However, I do notice a trend that insurers are allocating more into equity. On the same note, I also agree that investing 60% into volatile assets such as stocks is unwise.

Looking forward to see you back again.

Chengkok

nice post, thank you for sharing

[…] interest rate environment has changed many areas of finance. Firstly, it has already affected the insurance companies’ participating plans. Secondly and more importantly, it has lead to the erosion of […]