We talk about building better relationship, having good wealth management but have we thought of having a better relationship with money (self-care)?

In Singapore, one thing that fly under the radar of the recent politics campaign is the high stress level of working. Do you know almost 100% of Singaporeans are stressed at work? (Source: Human Resource Director).

“Almost 100% of Singaporeans are stressed at work”: Survey

Welcome to the city where the cost of living is high, have expensive healthcare and unaffordable housing. Together with this economic situation after COVID-19, many young people struggle to find their first job after graduation. Though I agree we have our positive side, we must also recognized that these economic-social issues will affect our relationship with money.

Why are Singaporeans Stressed at work?

Top causes of stress for single, married and working mothers vary, but all mention personal finance, too much work and personal health.

According to a survey by Jobscentral, being overburdened with financial commitments (29%) is one of the biggest reasons Singaporeans don’t leave a job they hate. 25% cited fear of not being able to find a better job as their reason for not leaving a crappy job. (Source: 3 Big Reasons Why Singapore Employees Are Always Stressed Out!).

While money is not the only reason, it is a common reason for stress.

Where did this stress stems from?

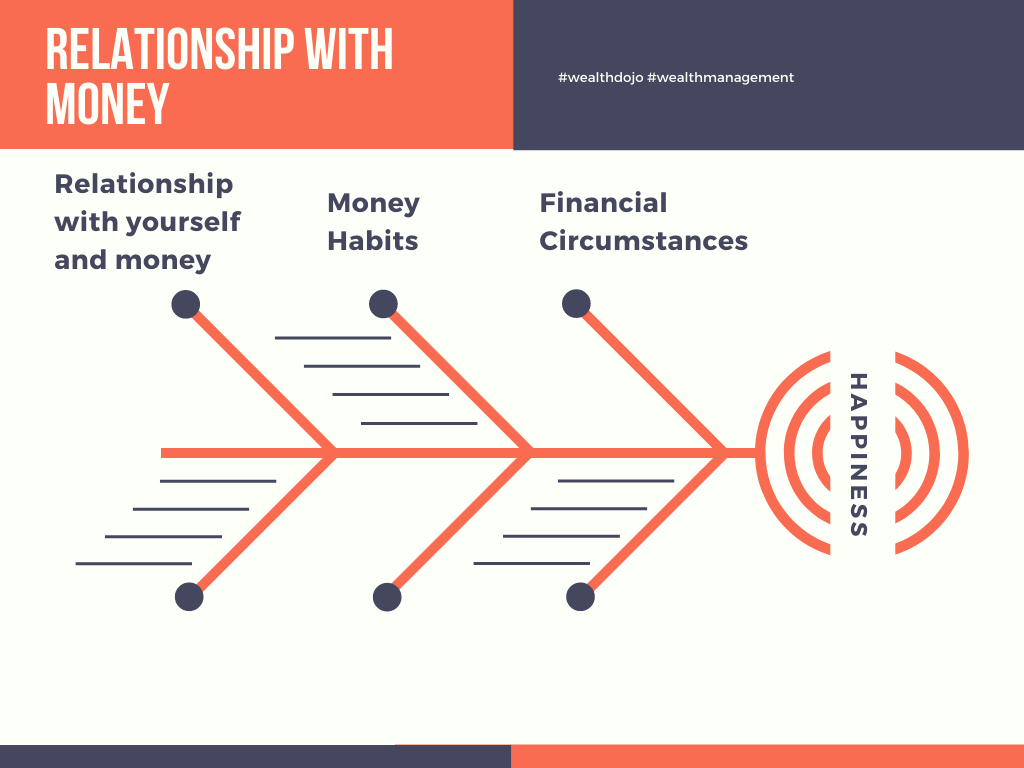

In my previous article about Self-Care and Wealth Management, I’m grateful to be able to ponder in depth on why people might become narcissist on self-care. It has to do a lot with their beliefs about money and I’m going to summarize it in the chart below.

Your relationship with money will determine your money habits that you have and it will led to the financial circumstances that one will go through and finally happiness.

Example #1: You are undeserving of money / reward.

I had a classmate, Karen who scored straight As for her primary school examinations. One year, another classmate shared with us that he just came back from a trip to Australia because he had good results in the last year. Karen decided to tell her parents about it. Her parents told her that if she continued to score straight As, she will be able to go for the trip.

Eventually, Karen had the straight As. But, the trip didn’t happen.

As a child, Karen held a belief that no matter how much effort she puts in, she will not get a reward. Today, Karen is a hardworking individual and put in a lot of effort in her work. Despite her hard work, she was unable to climb the corporate ladder and have mediocre salary. Personally, I feel that she still believes that she’s undeserving (relationship with money), other people are luckier and so passed on several opportunities (habits). This lead to her living a miserable life (financial circumstances)

Example #2: Believe that People With Alot of Money is Evil / Money is the root of all evil.

When I was young, I asked my parents why my classmate could go to Europe to travel while we only went Genting. My Mom told me that my classmate’s father was a businessman and he have to spend a lot of time on entertainment. He have to do a lot of “funny/bad things” that as children, we won’t understand at that age. Lots of Taiwanese/Korean dramas also reinforce this belief that you have to ruthless to earn money.

When I grew up, there was a period of time I judged people for earning a lot of money instead of being happy for them. If I learnt that they were earning more money, I felt that they done a lot of “funny/bad” things to achieve their goals.

I felt that earning a lot of money is evil (relationship with money), I would try not to earn over a certain threshold (habit) and that led me to living a normal life (financial circumstances).

This is ridiculous.

Your relationship with your money is largely influenced by the money lessons you learned from your primary caregivers and mentors, as you were growing up. While it is on no fault of theirs, we need to identify and be aware of the beliefs you have on money so that we can break out of this trap.

I challenge you to write down a list of your money beliefs. It could be “Money is never enough”, “Investing is risky”, “I need to spend money to feel good” etc. Ask yourself, does this money belief serves you or hinder you. If it hinders you, spend sometime to process why has it been affecting you and make a decision to change the belief.

We wish you good luck and stay safe.

No one will care about your money as much as you do.

In Wealth Management, it is important to Pay yourself first. Beware of scams. Before you invest in any company or popular investment opportunity, be sure to do your own due diligence. If you wish to learn more about investment, I hope to nurture genuine relationships with all of my readers. Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page or my Telegram Channel! Or subscribe to our newsletter now!

[…] On average, your “survival” running cost (minus the university fees) will be $800 to $1100 per month depending on your choices that you make. […]

[…] Do you remember the day when you first met money? Perhaps it was when you went to the store with your parents. Or perhaps it was before entering primary school, when an adult or older sibling sat you down to learn how to use the various metal discs and paper slips to buy a meal at the school canteen. Adults never seemed to have enough of these coins and notes and it was what they suffered at work for. With other priorities in life such as catching the next episode of your favourite cartoon, you did not think much about how money would affect your life. Little did you know then, that from the time that you were born, you have already involuntarily entered an inescapable relationship with money. […]

[…] Do you remember the day when you first met money? Perhaps it was when you went to the store with your parents. Or perhaps it was before entering primary school, when an adult or older sibling sat you down to learn how to use the various metal discs and paper slips to buy a meal at the school canteen. Adults never seemed to have enough of these coins and notes and it was what they suffered at work for. With other priorities in life such as catching the next episode of your favourite cartoon, you did not think much about how money would affect your life. Little did you know then, that from the time that you were born, you have already involuntarily entered an inescapable relationship with money. […]

[…] focus on relationship (you can have the same with wealth) inspires me and I hope that it will be my greatest achievement in my life […]

[…] on “saving money on the Starbucks” or “stop buying the avocado toast”. While it certainly makes financial sense, it is also certain that it will be a miserable life. Let me give you a real life […]