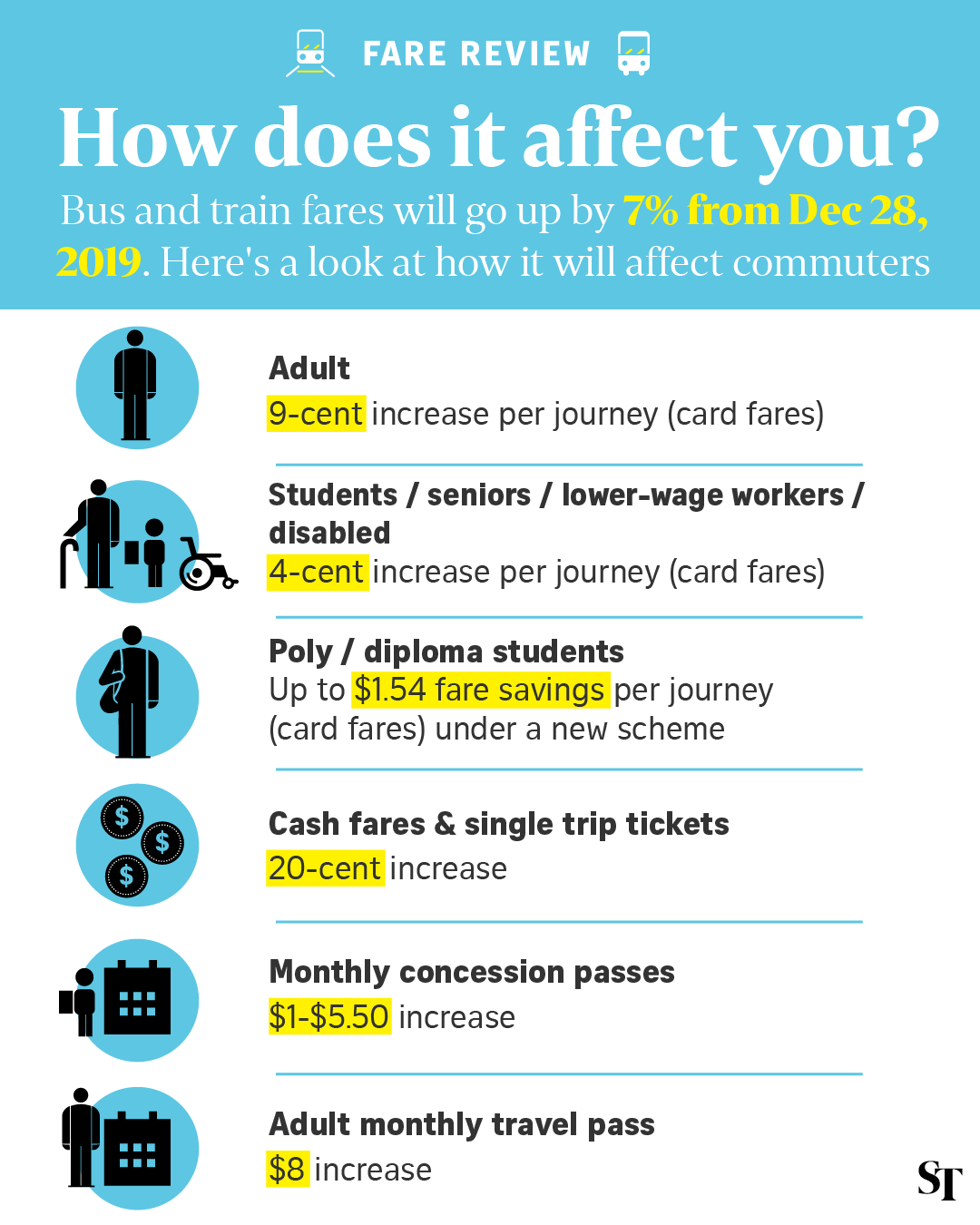

Price hikes for public transportation in Singapore is set to increase. This will include the buses and trains fares that majority of Singapore takes every day to work or school. The public transport counsel has hinted the fares could go up by 7% after they have conducted their fare review exercise. (Read More: Fare Exercise Review)

The reasons cited for the rates increase has been put on the increase in energy prices, rail reliability and also introduction of new buses and MRT over the last few years. This isn’t a shock to me at least. Over the years, fare price hikes has been slowly increasing. (Read more: Public Transport Counsel Chronology). As a nation progress, there will be need for a more reliable public transportation and this will result in higher cost of maintenance over time.

For majority of us, the amount of money we spend on public transportation will soon increase in December 2019. We can either lament all we want about the $0.09 increase per journey or we always do something about it. (Read More: Sandwich Generation: Is it still possible to be rich?)

Money Maximization: Transportation

Readers of Wealthdojo are in luck. We were just exploring on ways to save on transportation in the previous article. (Read more: Save Money on Transportation Singapore).

We have created a system to help an individual save up to 5% a year on transportation cost. This comes in timely as it can “cancel out” the effect of increase just by following this system.

If you can’t beat them, join them

I’m always excited about companies that are able to increase their prices even during a recession. While we are somewhat in a economy that is slowing down, there are a few companies that are STILL ABLE to raise prices and people have no choice but to pay for it! This is what we called Pricing Power. Investing in companies with pricing power are the ones that can survive and thrive. As Wealthdojo believes in dealing with real life situations, please refer to our disclaimer section for more information.

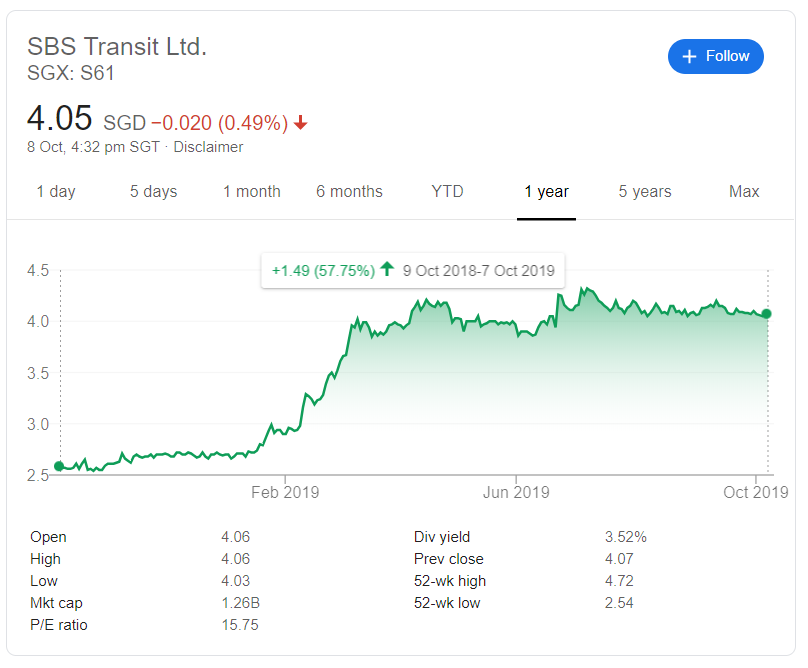

Everyone in Singapore probably knows of this company called SBS Transit (SGX: S61)

Basically, they are our train and bus providers in Singapore. Over the last 1 year, this humble share has increase 57%. I have talked about in our Facebook Closed Group (Contact Us to be invited to the Facebook Group). It is a simple business, easy to understand and has a certain pricing power in Singapore. Just to point out an illustration, will you walk all the way to Changi Airport by foot just because your bus fare has increase by $0.09? 99.99% will definitely continue using this service.

In addition to the 57% increase this year, the dividend yield is at 3.52% right now. While it isn’t the highest yielding dividend stock out there, this is clear about our inflation rate this year.

I recommend everyone to study more into this stock before making a decision. This is not a buy/sell recommendation.

We wish you the best in your financial journey.

In Wealthdojo, we believe in bespoke financial planning. Whether it is money maximization, insurance or investing, we believe that everyone is different and the planning should be suited for you.

All opinions above are my own. Please view our disclaimer page to understand more.

I hope to nurture genuine relationships with all of my readers. Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page!

Now that you’ve read about learnt about how to benefit from What you can do about price hikes for public transport in Singapore. I challenge you to read this article (Things To Consider Before Investing In Foreign Dividend Stocks )to push your understanding further!

[…] (S61) first caught my eye in December 2018. At that time, the public transport counsel announced that fares will be going up soon. It soon […]