You made it! You have made it either through the grueling A-levels or becoming the very best of your polytechnic cohort. We welcome you to the top 23% of students in Singapore. We also welcome you into the Wealth Management world of debt.

This article is jointly written with one of the finest young man I have met: Frugal Youth Invests.

The World Of Debt

University will be shell shocked for you. Especially, for Junior Colleague buddies out there. Your teachers won’t be chasing you for homework. You will decide what modules to study. You will have to do everything yourself. In the next 4 years, your financial life will be deciding on textbooks to buy, how to printing your lecture notes, how to save time and money from transportation, what kind of food to eat in school and perhaps how to survive in your student hostel. Once you finished the 4 years, you will graduate with a $30,000 loan which you have to pay off.

My University Financial Journey

I graduated from Nanyang Technological University in 2013 with a Bachelor of Science (Major in Mathematics and Economics). Coming from a humble family, I decided to complete my university in 3.5years (instead of 4 years) so that I can save on one semester of tuition fees. I want to share with you the cost of my university life so that you can be prepared when the time comes.

On average I take between 5 to 7 modules a semester (I was chionging modules). This would mean that you would have taken at least 35 to 42 modules in your university life. Each module would be run for 13 weeks which means there would be 13 sets of notes to be printed.

Textbooks

Typically, we are encouraged to buy a textbook as a recommended read. You can choose not to buy but you will definitely feel there is a feeling of “missing out”. I remember the first book that I had to buy was Calculus, John Steward, 6th Edition. A new book cost around $200+ and a used book cost around $100. Some of the tutorial questions are from the textbook so it is a must that we have some access to that textbook. This soon became one of the most expensive investment in my university days. On average, I would spend between $500 to $600 per semester on books. In total, that would mean $3500 to $4200 in my entire university life.

Printing

Printing costs varies a lot. To save money, my default printing was 4 slides on 1 page, double sized to “optimize” my writing space and also my eyesight. It cost me easily $100 per semester. Total cost over 4 years: $700. You can save printing cost if you wish to read the notes on your IPAD/Computer etc. Personally, it is easier for me to study when I print the notes out.

Transportation

If you have lessons every single day, you would need to go to university. I used the concession pass in my university days. It cost $90/month. Total cost over 4 years: $4320 .

Food and beverages

Food cost varies as well depending on what you eat and how many meals you eat in school. I typically have 1 to 2 meals in school. Assuming that each meal cost $6. It cost $180/month. Total cost over 4 years: $8640.

Student Hostel

If you are staying in a student hostel, per-person-per-month basis for a single room or a twin-sharing room ranges from S$265 – S$605. Let’s take the average cost of $435 for calculation. If you stay in a hall for the entire university life, it will cost $20,880. I had the opportunity to stay in the hostel for 4 semesters (2 years out of the 4).

University Fees

I paid $20,034 for 3.5 years of my university education. If I were to complete my university in 4 years, the cost will be around $24,000.

In total, you would have spent around $60,000 based on the above estimates.

On average, your “survival” running cost (minus the university fees) will be $800 to $1100 per month depending on your choices that you make.

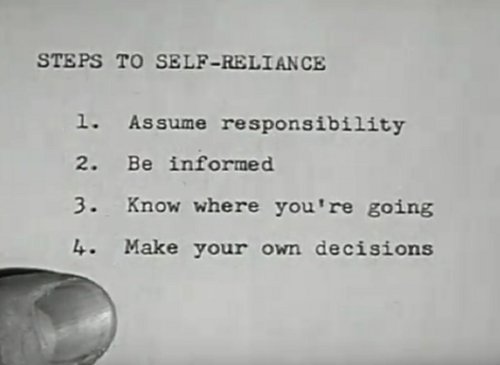

Your University Self Reliance Fund

The reason you are still reading this is because you want to be self-reliance and be independent. You want to make money for yourself so that your parents will not be burdened by your expenditure. Frugal Youth Invests will be talking about VES and STC schemes in National Service that you can take after your ORD. I will be sharing with be a personal one on how I survived and thrived during university financially.

Voluntary Extension of Service (VES)

Voluntary Extension of Service (VES) is a scheme where servicemen can extend their service immediately upon ORD on a voluntary basis to meet organisation need if necessary, for a period not exceeding 9 months. Such examples of organisation need include completing Special Project Work or to finish overseeing a batch of trainees as an instructor.

For NSFs who decide to VES, they will continue to receive the same benefits accorded to all NSFs. Personnel who VES will be paid NS allowance for the extended period, receive the same medical benefits and be eligible for 14 days of annual leave per calendar year, pro-rated by the duration of extended service (rounded up to count as a full day).

For personnel extending their service, they are serving in the capacity of an Operationally Ready National Servicemen, thus it counts towards servicemen’s ORNS but not as a high key in camp training. As an ORNS, personnel will be eligible for recognition accorded to NSmen, such as NSmen tax relief, in which during any assessment period when the personnel is serving VES, he will be eligible for a higher quantum of tax relief.

NSFs who are keen to volunteer their service beyond their ORD should inform the units of their intent verbally, in writing or email. Application for VES should start at least one month in advance of the NSF’s ORD. Personnel on VES can choose to end their voluntary period of extension before the intended due date. Personnel will have to inform their Personnel Management Centres in writing at least one month in advance, and serve a notice of one month.

Short Term Contract (STC)

Similar to the intention of VES where it allows units to meet organisational needs, Short Term Contract (STC) allows units to temporarily fill a position to meet organisation needs. In light of the current uncertainty and unfavourable job market, STC is a safe, stable and short term employment for NSFs who are about to ORD and looking for employment. With this scheme, servicemen can earn a regular salary and receive medical benefits accorded to a regular.

Even though STC is open to all vocations, it is up to the unit to decide to allow STC on a particular vocation. For example, STC is usually not open to Admin Support Assistance vocation as the resources are not scarce compared to other combat vocations.

The Traditional Part Time (4 out of 5 friends gave tuition)

I was funding my lifestyle by giving tuition. I was charging $30/hour for mathematics tuition for secondary school and $50/hour for mathematics/economics tuition for junior college. It was not easy getting tuition right at the start. A typical lesson plan for the students would be a 2 hours session a week. This would mean 8 hours a month. Doing the math, you will be rewarded $240 per student that you have in a secondary school. To “survive” in university, you might need to take 3 to 4 students. You probably need to give tuition during weekends.

Some of my friends were doing part-time work at restaurants. Their pay would be on average $7/hour. To survive, you have to work 100hours/month or 25 hours/week or 4hours/day.

It is not hard to imagine that most of us ended up giving tuition during our university days.

I also had the opportunity to work at a local bank in a tele-sales role. Inclusive of CPF, I was paid around $3000++/month (which is quite attractive for a person in his 20s). This employment helped me fund my university fees. Of course, I had good financial budgeting knowledge and I did not YOLO my pay away.

In the current market, some part time employment opportunities that one can look for will be food delivery riders, temperature screener, clerical, digital marketing blog posts or packer related jobs which pay at an average rate.

Final Thoughts By Frugal Youth Invest

Before discussing whether to choose between VES or STC, one must understand that due to cohort equality, personnel who ORD in November as they were enlisted in January, will not be allowed to disrupt for further studies. This means that they have at least 8 months before starting on Uni. This gives them a lot of time to find employment outside. However, in this unfavorable job market, it might be difficult for NSFs to look for meaningful jobs outside.

We understand that the majority of NSFs find their allowance meagre and really want to get out of the Army as soon as they ORD. However, if a NSF does not mind the regimentation of the Army, one should consider short term employment through STC if their unit offers based on their vocation. This is because STC is a safe, stable and short term employment during times of uncertainty. In addition, it offers a regular salary, which is higher than any part time job salary, and personnel will receive medical benefits accorded to a regular.

As for VES, there is not much of an incentive to volunteer to extend service as one is paid NSF allowance. It will definitely be a turn off for some who are already complaining about the meagre allowance and wanting to get out of the Army as soon as they ORD. Therefore, this leaves us to take on either STC or part time employment outside.

I believe that the question to ask about deciding between part time employment and STC is how meaningful can either path be? For example, when choosing STC, STC is meaningful and worth a try because one can continue to contribute to national security and roles like being an instructor can be meaningful as one will feel a sense of accomplishment after seeing his trainees graduate from the course and be competent in his vocation. I think that it is very difficult to replicate such a contribution and sense of accomplishment working part time outside.

That being said, it does not mean that working part time outside is not of any value, but it is what kind of job that one is looking for that matters. I do not see any value in working as a food delivery rider or temperature screener in terms of personal development. What can one achieve at the end of the day other than earning money? Does one pick up new skills that will aid them for their studies or will it build one’s portfolio or resume for scholarship or full time job in the future?

I think these are some questions to think about when deciding between part time employment and STC. It is really what each individual would want to achieve at the end of the day and this article is merely guiding the decision making process.

Final Thoughts by Wealthdojo

Once again, congratulations for reading thus far. I believe you are responsible person and I wish you all the luck. The journey ahead seems like a scary one and I want assure you that you will definitely get through it. Although it seems overwhelming, I want to assure you that you will learn and discover many things about yourself. Your choices will ultimately be part of your youth.

Whichever self reliance funding that you choose, believe in yourself and enjoy this part of your youth.

Special thanks for Frugal Youth Invests. Thank you for your special appearance. Wishing you all the best too!

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.