If you are reading this, you probably have an amount of money in your SRS account. As the interest in the SRS account is 0.05%, you are also probably thinking of investing that amount. In the 6 Levels Wealth Karate, one of the key pillars of your financial journey is building up your investment portfolio and that includes your SRS account.

If you are unsure what SRS is, please refer to comprehensive SRS guide that was written previously.

Start Here: The $1 SRS Strategy

Basic Knowledge: 5 things you need to know about SRS when you are 40 and older

Your SRS Overseas Retirement Guide: 3 things you need to know about SRS if you plan to leave Singapore

Today, we focus on the 10 Investments you can consider using your SRS.

(Disclaimer: We will be explaining each concept with a real life examples. Please note that, those are not buy/sell recommendations. The suitability of the investment vehicle depends on each individual. Please talk to a competent financial advisor for more details.)

Investment #1: Fixed Deposits

A fixed deposit is an investment vehicle that pays account holders a fixed interest in exchange for depositing a certain sum of money for a certain period of time. It is very popular among the older generation as it is virtually risk free as long as the bank doesn’t collapse. Even if it does, your deposits are still protected, up to $50,000, thanks to the Singapore Deposit Insurance Corporation.

I have pulled up an example to showcase fixed deposits. It is worth noticing that after the 13th month, the interest will become more significant. Also if you are putting your money for 6 months or less, the interest is 0.05% which is indifferent for you to not put into a fixed deposit anyway.

Investment #2/3/4: Singapore Government Securities

Singapore Government Securities are debt instruments that are fully backed by the Singapore Government. Singapore Government Securities includes Singapore Saving Bonds (SSB), SGS Bonds and also Treasury Bills.

For SSB and SGS Bonds, you will receive interest every 6 months. If we put the definition loosely, it means you are lending money to the Singapore Government to receive a interest.

For Treasury Bills, it does not issue interest/coupons. You will receive the face value at maturity. If we put the definition with an example loosely, you are paying $0.95 now to get $1.00 in a xxx time frame.

I have taken a screenshot of the detailed comparison of the 3 securities here. Do check out more information on the MAS Website.

DBS has also created an extremely useful step by step guide to help you in your purchase of the securities.

Investment #5: Bonds

Bonds are basically debt instruments as mentioned above. However, I have separated bonds with the above SSB/SGS bonds because bonds can issued by companies etc. In a simple nutshell, the better the credit rating of the bond issuer, the lower the returns (or the coupon rate).

There are 3 main ones that you can purchase. Firstly, individual bonds, Bond ETF Funds, and Bond Unit Trusts (more on ETF/Unit trust in a while).

A popular example of a bond is the Astra V PE Bonds Class A-1. It was popular because the bond was issued by Temasek Holding’s subsidiary, Azalea. It was offering 3.85% annual interest for it’s bonds and was 7.2x oversubscribed in 2019. In this bond, you can see their investment diversification on their website. (Again, this is not a recommendation)

Investment #6: Stocks

A stock (or equity) is a security that represents the ownership of a fraction of a corporation. Loosely define, you are a partial owner of the company when you purchase the company’s stock.

There are several methodologies that you can use to invest in stocks. Recently, the hottest topic around is whether Value Investing Is Dead Or Maybe Not. I have also written about a hidden gem in the Singapore Stock Exchange that might have short term capital appreciation in the next 6 months. If you are interested in banks, I have written about DBS business and opportunity.

The example I will be using is an evergreen stock in the Singapore Stock Exchange called Singtel. It is important to know what you are investing in. Most people only recognized Singtel for its’ mobile and data internet service, but do you know that >50% of their revenue comes from something else? Stock investing require greater skills and mental fortitude. I strongly encourage you to learn more about stock investing before dipping your toes into it.

PS: You can only invest in stocks listed in the Singapore Stock Exchange using your SRS.

Investment #7: Reits

Reits (real estate investment trusts) are the same as stocks except they invest only in real estate. They tend to have higher distribution yield as compared to stocks because of their consistent cashflow from rental. Similarly, you can only invest in a Reits that is listed in Singapore. At the end of 2019, Singapore has 35 REITs, six stapled trusts and two property trusts.

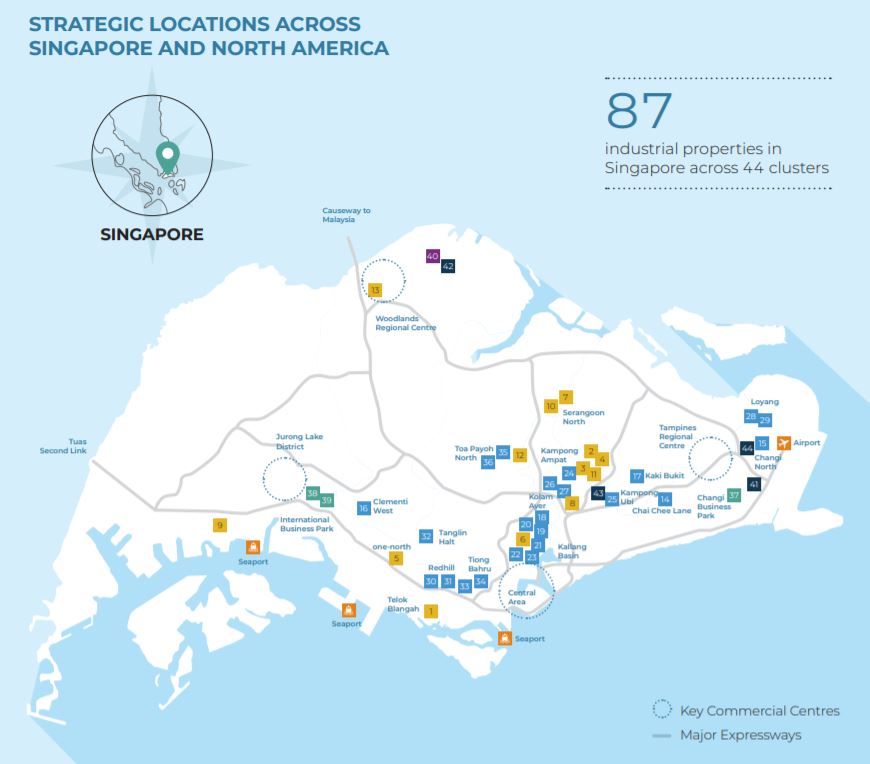

An example is the Mapletree Industrial Reits. Its principal investment strategy is to invest in a diversified portfolio of income-producing real estate used primarily for industrial purposes in Singapore and income-producing real estate used primarily as data centres worldwide beyond Singapore, as well as real estate-related assets.

As at 30 September 2020, MIT’s total assets under management was S$6.6 billion, which comprised 84 properties in Singapore and 27 properties in North America (including 13 data centres held through the joint venture with Mapletree Investments Pte Ltd). MIT’s property portfolio includes Data Centres, Hi-Tech Buildings, Business Park Buildings, Flatted Factories, Stack-up/Ramp-up Buildings and Light Industrial Buildings.

Investment #8: ETFs

ETFs are called exchanged traded funds. An ETF typically replicates a specific index (for example, the Straits Times Index or the Singapore Market). The main feature of an ETF is that it is passively managed and do not try to outperform the underlying index. They usually have lower fees and charges as compared to actively managed investment funds such as unit trust.

Currently, there are 39 ETFs listed in the Singapore Exchange.

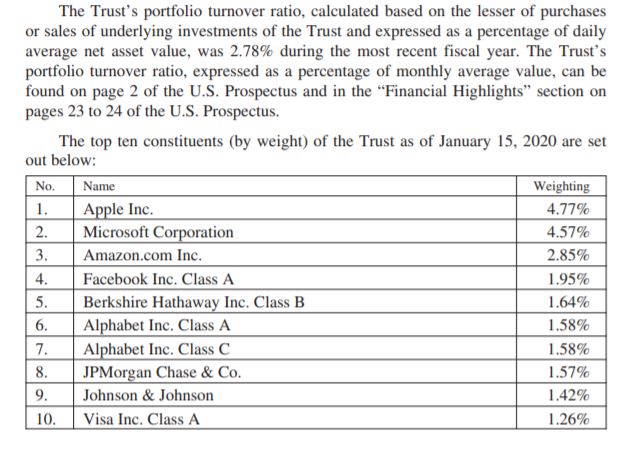

One example is the SPDR® S&P 500® ETF Trust (S27). They are investing in the 500 companies in the S&P500. You can take a look at the top 10 holdings of this ETF.

10 SRS Investments to Consider Especially if you are 40 and older SPDR ETF

Investment #9: Unit Trust

Unit Trust is a fund that invested in a portfolio of assets according to the fund’s stated investment objective and investment approach. It is usually more active than ETFs. Unit trust could be diverse because there could be infinite investment approaches in the world.

You could invest in a dividend fund, a growth strategy fund, a commodity fund, a growth strategy in emerging countries, a dividend strategy fund in a developed market (I think you get the point now), etc. Because unit trust is so broad, we will not be giving an example. I feel it is best to work with a financial advisor to discuss and find the most appropriate unit trust for you.

Investment #10: Single Premium Insurance Product

A single premium insurance are usually retirement/annuity/accumulation products. Not all insurance products can be bought using the SRS.

There are 2 strategies in general. One being a lump sum payout at maturity or a stream of income in the future, starting from a date of your choice. A portion of your investment returns are guaranteed as compared to investment #5/6/7/8/9. This appeals to those that are seeking a more conservative and steady income stream during retirement. There is also a possibility of bonuses that are non-guaranteed.

Please feel free to contact me to have more information on these.

PS: An article isn’t complete unless there is a photo of retirement with 2 loving elderly =)

Final thoughts by Wealthdojo

Whichever the financial vehicle that you are deciding, it is important to understand and know your risk profile, knowledge level, budget, income etc to make a good investment decision.

I wish you all the best in your investment. Do contribute to your SRS before 31 Dec if you wish to have tax benefits for your financial year.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.