I never thought there will be a day the banks will adjust their interest rates upwards again(DBS, UOB, OCBC). In 2018 period, the local banks came out with a great marketing program to give higher interest. It was heavily discussed. However, it was short lived as the banks slowly reduced the amount of interest.

Learning from the past lessons, I view that this interest increase as temporary in nature and you shouldn’t base your long term planning (insurance or investment) to increase your interest in your bank account.

In this article, I will take on several assumptions to decide which bank account is the best for you in 2022.

Assumptions Taken

- Only DBS, UOB and OCBC will be taken into consideration

- The Median Gross Monthly Income in Singapore is $4,680 (based on the year 2021)

- The Average Monthly cost of living in Singapore is $1,360 (without rent, 2021)

- Total eligible transaction $6,040 (For DBS Multiplier discussion)

- Total amount in the bank: $100,000

- Only Salary and Credit Card spending will be taken into consideration

Marketing Message From The Banks

This is the current marketing message from the banks.

- DBS: We increased our interest rates (Up to 3.5%) so you can save more with DBS Multiplier.

- UOB: Two simple steps to earn up to 3.0% p.a. interest

- OCBC: Earn effective interest rate of up to 4.05% a year and more on your first S$100,000

Based on the marketing message, OCBC sounds the best. It is also good to know that OCBC changed their program 1 month after DBS and UOB have made changes.

First Elimination

With our assumptions, we feel that DBS multiplier is the worst out of the 3.

Based on our assumptions, we will only hit 1 category in DBS multiplier. I feel that we shouldn’t increase our transaction categories just for the sake of the higher interest.

Effectively, there will be a higher interest on the first $25,000. Your interest of 1% will give you $250 annually.

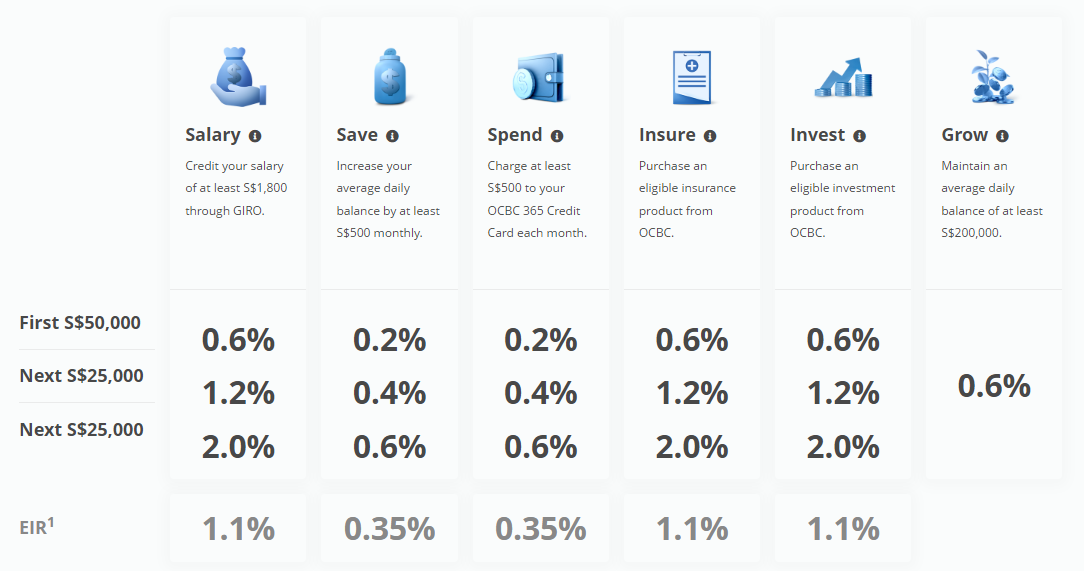

Best Fuss Free Bank Account: OCBC 360 Account

OCBC is rank the best fuss free bank account in my opinion as they follow a very simple interest tier model.

Following our assumptions for using only salary crediting and spending on credit card, the effective interest rates (EIR) 1.5% resulting in an annual interest of $1500.

However, I like this more as this is fuss free. If you don’t want to hit the credit card spending of $500 monthly, the salary option will have an EIR of 1.1% resulting in an annual interest of $1100. This is great for people who do not want to keep track of their spending for the sake of the extra interset

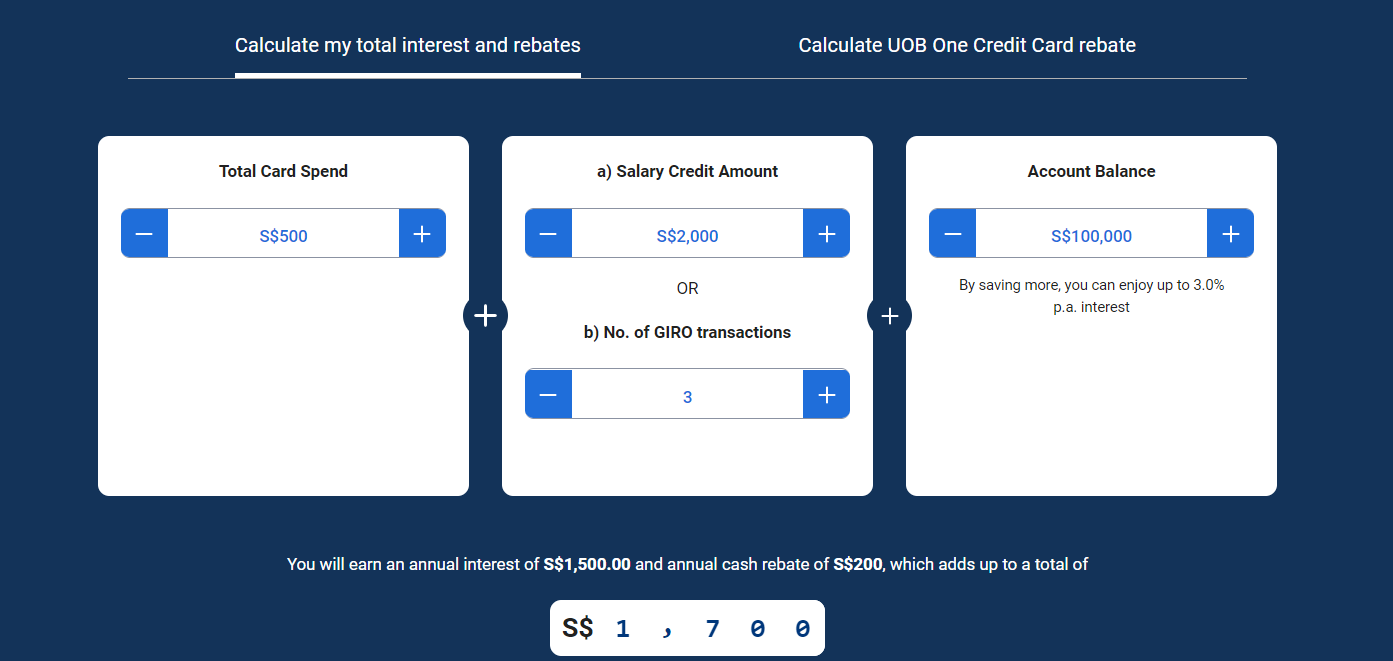

Best Higher Interest Bank Account: UOB One

UOB and OCBC comes up very close but UOB wins because of the ease of understanding of their UOB one card.

The emphasis of UOB is the credit card spend. If you do not hit the minimum of $500/month, then the interest be affected. Hence, this will only work if you are certain to be able to hit the monthly eligible credit card spend of $500.

The total annual interest (inclusive of cash rebates) from UOB One account and UOB One Card is $1,700 making this the best higher interest bank account for now.

Final Thoughts

There you have it. Personally, I’m went with the OCB 360 account because of the ease of use.

I believe that choosing your bank account is one of the first steps to plan for your finances. At the same time, I will avoid buying products just to get that extra bit of interest as the interest might change in future again.

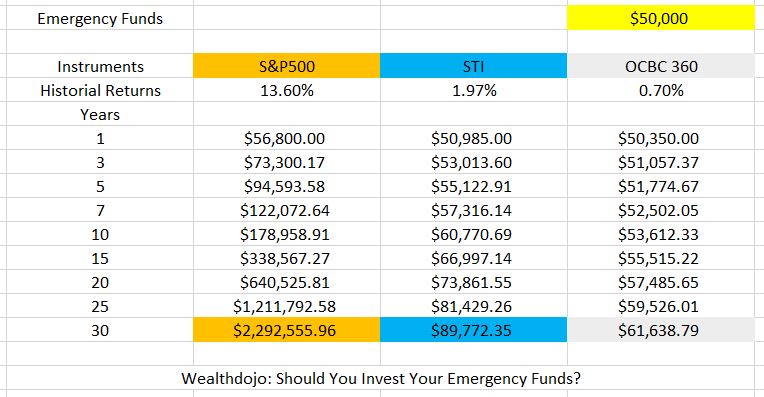

That being said, you should always have a long term perspective when it comes to planning. I will recommend you to use the retirement calculator to have an idea how much you need for retirement.

I wish you all the best! Take care.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.