I thought I had a conclusion deciding between Cashback or Airmiles when using a credit card. However, the existence of CardUp might change the entire equation all together.

[If it matters, this is not a sponsored post.]

What is CardUp?

CardUp is a platform that enables payment and collection of big expenses using existing credit cards, in places where cards are not accepted today. Example of such expenses includes rent, income taxes, educational loan, insurance (usually points are not applicable for insurance) etc. CardUp allows you to use credit cards to pay for those bills.

One of my friends shared with me that he had to PayLah his landlord his monthly rental of $1000. Unfortunately, most landlords do not accept credit cards. $1000/month is a big expenditure and if he is able to use a credit card, he might be able to collect cashback or airmiles along the way.

How does CardUp work?

Basically, CardUp acts like a middleman. You pay CardUp via credit card, CardUp will pay your vendor/suppliers/landlord for you.

In doing so, you get to collect cashback or airmiles which will otherwise be lost if you make a normal bank transfer. CardUp is currently a plug and play system. Simply sign up for an account, enter the details of your preferred credit card/s and you can start to make and schedule payments.

CardUp will take a processing fee of between 2.25% to 3.3% for that transaction. Typically, it will take around 3 business days for your recipient to get the money. However, if you need a next day transaction, an additional 0.3% fee applies.

Currently, CardUp is able to perform transaction for the following.

- Rental payments (to a landlord)

- Rental deposits (to a landlord)

- Condominium Maintenance Fees (to a MCST or property developer)

- Tuition/School fees (to Singapore based schools or education centres)

- Insurance Premiums

- Income Tax/Property Tax/Corporate Tax/GST/Stamp Duty

- Season Parking

- Car Loans

- Electricity

- Helper Salary

- Miscellaneous Payments

- Payroll

- Supplier invoices

I believe CardUp will expand their services in the years to come. I have bold a couple of expenses in bold because I believe those are the more general expenses that everyone will pay. We will be using it to illustrate whether it is worth it to use CardUp or not.

Is it worth it to use CardUp?

We have to set a few assumptions and context to see if it is worth it. In my previous article on whether you can afford cancer, a typical medium income in Singapore is $56,550. I will draw a few assumptions from this income.

Example #1: Eric (Single. Stays with parents. Pays some of the household bills)

Eric is working as a marketing executive in a SME. His annual income is $60,000. His annual income tax is $1950 (we are assuming he do not have any other income nor reliefs). He lives with his parents in a 4 room HDB flat and is paying for the electric bills (Annual Electricity Bills: $1608. Source:Average monthly electricity bill of a 4-room HDB household). He pays around $9000 annually to an insurance company.

Total Annual Recurring Bills: $12,558 (or $1046.50/month)

As you can see in the above screenshot, Eric will have gotten a net saving of $130.

If Eric were to choose miles, he will have 17,178 Airmiles which he can use to change for an airticket once he have accumulated enough. (I’m putting $12,000 into income tax for simplified illustration purposes only)

Example #2: Joseph (Married with one child. Bought a house with wife. Pays some of the household bills)

Joseph is working as a teacher. His annual income is $60,000. His annual income tax is $1950 (we are assuming he do not have any other income and excluding reliefs). He lives with his wife in a 4 room HDB flat and is paying for the electric bills (Annual Electricity Bills: $1608. Source:Average monthly electricity bill of a 4-room HDB household). He pays around $9000 annually to an insurance company. He also pays for his son’s childcare fees of $800/month (Annual: $9600). He also pays for the helper of $700/month (Annual: $8400).

Total Annual Recurring Bills: $30,558 (or $2546.50/month)

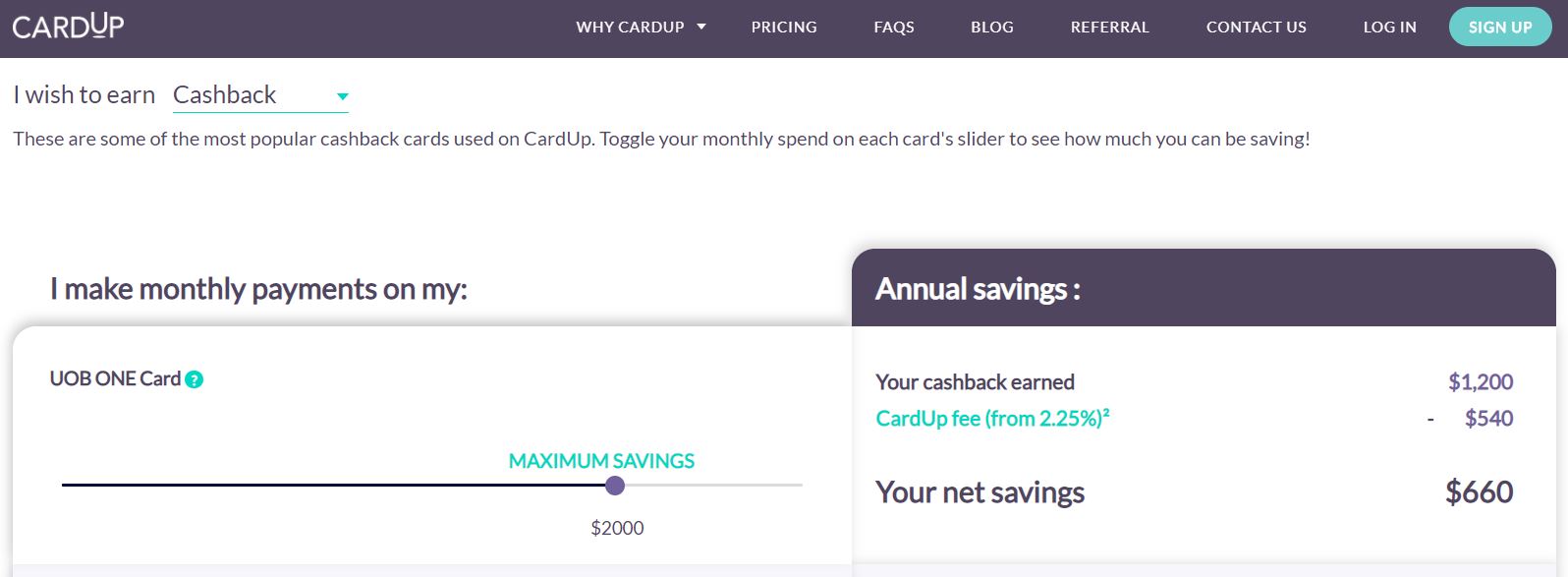

As you can see in the above screenshot, Jospeh will have gotten a net saving of $660.

If Joseph were to choose miles, he will have 42,945 Airmiles which he can use to change for a Business Class Airticket to Bali worth $1,154. His flight savings is $557. (I’m putting $30,000 into income tax for simplified illustration purposes only)

Conclusion

If the recurring bill amount is smaller, cashback might be the preferred option as you probably have to wait another full year to get enough airmiles to fly. However, if the recurring bill is larger, you might be slightly indifferent towards airmiles or cashbacks.

In whichever your preference, CardUp will help you collect cashback or airmiles which will otherwise be lost if you make a normal bank transfer.

Some last words of advice: CardUp dependent on the bank’s credit card benefits. Any change in the rules of credit card benefits / airmiles redemption will affect the calculation as of above. We are writing in the view of a personal finance perspective. We recognize there might be other cashflow benefits for businesses to use CardUp. The information is update on 12 Aug 2020.

No one will care about your money as much as you do.

In Wealth Management, it is important to Pay yourself first. Beware of scams. Before you invest in any company or popular investment opportunity, be sure to do your own due diligence. If you wish to learn more about investment, I hope to nurture genuine relationships with all of my readers.

Check out my most popular blog post in 2020 so far: 5 mistakes people make using their CPF.

Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page or my Telegram Channel! Or subscribe to our newsletter now!