In Singapore’s Budget 2023, Deputy Prime Minister and Minister for Finance Lawrence Wong announced the changes in CPF moving forward. He have highlighted 5 changes that will impact Singaporeans. In this article, I will give some insights on the changes and how it will impact your journey to retire confidently.

Increase in monthly CPF salary ceiling to $8000

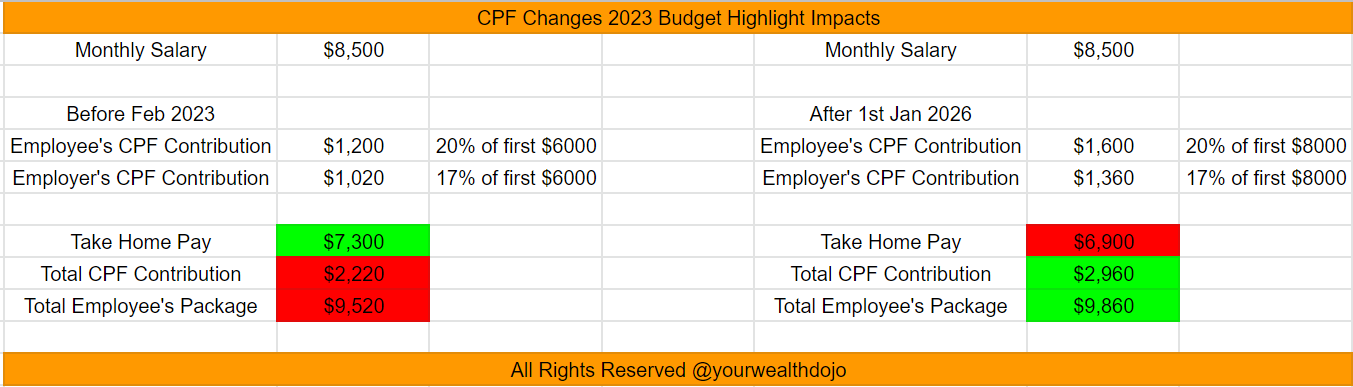

This is the most talked about among my peers as I guess this impacts them the most. There will be 4 years of adjustment (until 2026) to realised the full impact of this increase. The annual salary ceiling of $102K will not be changed for now.

You will feel this impact if you are earning between $72,000 to $102,000 annually. There are 3 obvious impacts from this change. Firstly, our take home pay will be lower. Secondly, our total CPF contribution will be higher. Thirdly, our overall package will be higher.

This will directly raise our ability to fulfill the Full Retirement Sum (FRS) as there will be more contributions. In 2021, 66% of CPF members have hit their Basic Retirement Sum (BRS). While this is a good sign, this will increase the number of people hitting BRS or even FRS.

If we were to go one step deeper into the analysis, this might be the first of many steps to address prolong inflation. As we see the prices of goods and services increase in the last 2 years, our current BRS / FRS may not be able to allow people to retire with confidence. By increasing the monthly salary cap upwards to $8000, this will give some leeway to increase the rate of increase of BRS / FRS in the years to come so that there is enough CPF monies to allow you to retire with confidence.

Senior Workers Initiative

Increase in CPF Contributions

There will be another increase in CPF contributions for those that are age 55 to 70. The first two steps of increases took effect on 1 January 2022 and 1 January 2023 (Read More: 4 Things From Singapore Budget 2022 That Will Affect You and Me). The Government will continue to raise the senior worker contribution rates in 2024 with a long-term target to have the full increase rolled out by 2030.

RSS (Retirement Sum Scheme) Increase Payout

From June 2023, the minimum payout from RSS will increase from $250 to $350 per month.

Easier to receive CPF-Life Payouts from CPF-OA and CPF-SA

If you have not achieve FRS and are still working (getting CPF contributions), CPF board will automatically annuitised your CPF-OA and CPF-SA for higher CPF LIFE payouts.

Some of these changes are not new. They have been around for a while and we are beginning to see the implementation of it now.

Final Thoughts

There are also other initiatives that are welcome. I personally like the part where there will be extra CPF grant for eligible first-time buyers to buy resale HDB flats. This will relief some pressure in the property market and at the same time give families an affordable and more “immediate” home.

Do you like the new changes? Let me know.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.