The Update

Things were not pretty over the last few days.

- Hedge Funds had to closed their short positions taking in huge losses. Melvin Capital (the guys that have shorted GME) have not announced how much losses they suffered but Citadel and Point72 have infused close to $3 billion into Melvin Capital to shore up its finances. They have also deny going into bankruptcy but supposing have been bailed out.

- Several brokerage companies started to restrict trading. On 28 Jan, they only allowed people to sell their shares of selected companies. On 29 Jan, they allowed people to buy only one share of selected companies. This came as an outrage as if you restrict people to only sell. There is only one direction the company can go.

- Robinhood started to draw up to $600 million from their line of credit. They have also raised more than $1 billion from existing investors. It is to pay customers who are owed money from trades and also fulfil regulations. They probably did not manage risk properly by allowing those shorter to short too much.

From this episode that is still ongoing, I hope to share 3 important lessons that we can learn as retail investors.

Leverage

Time and again, this word comes out to haunt the financial market. If you can remember the 2008 financial crisis, lines of credit is so easily available that even a prostitute can take a dozens of mortgage loan (Unverified information from Netflix: The Big Short).

When you leverage, you are using money that you don’t have to purchase a stock.

Leverage example:

You have $100,000. You want to invest in ABC shares (assume it is $1) because you believe the share price will double for whatever reason in the next few days. You leverage by borrowing another $100,000 to invest paying an interest (we are going to ignore interest in the calculations). You buy 200,000 shares using your $200,000.

When ABC shares doubles (now $2), you would have $400,000. You pay back $100,000 and your portfolio is now $300,000.

If you didn’t leverage and borrow, your portfolio only grows to $200,000.

Your money grows “faster” when you leverage.

However, if ABC shares drops to 0. Your original $100,000 is now 0. However, you now owe $100,000.

If you didn’t leverage and borrow, your portfolio just suffers the maximum lost of $100,000 but you do not owe people’s money.

The above is a 1:1 leverage. It is possible for you to have a 50:1 leverage in the financial market. Imagine how scary it is if the trade don’t go according to plan. That’s 50x of $100,000.

Investing with margin or leverage is the fastest way to lose all your money. We won’t deny the fact that it is also the fastest way to make more money. Ideally, you should only invest with the money you already have. I believe we will see how this spans out in the days ahead especially if there are big hedge funds using leverage in their GME positions.

Prisoners Dilemma

I never thought I would see this happening after my university days. Readers of Wealthdojo will probably know I’m a behavioral economics fan. Seeing prisoners dilemma play out in real life is somewhat very fulfilling.

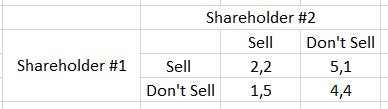

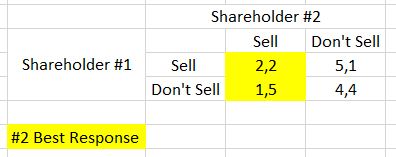

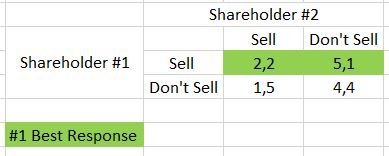

Shareholder #2 best response is to sell. This is because if Shareholder #1 were to sell, Shareholder #2 is better off selling than not selling (2 > 1). If you sell but other investors don’t sell, you win but other investors lose. If Shareholder #1 were to not sell, Shareholder #2 is better off selling than not selling (5 > 4).

Similarly, Shareholder #1 best response is to sell. This is because if Shareholder #2 were to sell, Shareholder #1 is better off selling than not selling (2 > 1). If Shareholder #2 were to not sell, Shareholder #1 is better off selling than not selling (5 > 4).

Motivation

I have learnt that in investing, different people will have different motivation. I find it bizarre for people to randomly ask someone on their opinion and whether to invest in the stock market at this moment of time.

If you ask a trader, he will say yes because the S&P is upward trending.

If you ask a value investor, he will say no because valuations are crazily rich.

If you ask a growth investor, he will say yes because there is still growth.

If you ask Warren Buffett, he will just buy back his own shares.

If you ask Elon Musk, he will tweet Gamestonks!

If you ask me, I will sit at the sidelines and continue to collect excellent companies and a sensible price.

For the people at Wall Street Bets, they are there to send a message.

If you decide to follow any of them, make sure they have the same motivation as you. Otherwise, you might find yourself in an awkward position.

Final Thoughts By Wealthdojo

When you thought 2020 was an epic year, 2021 came as another surprise. This episode definitely hasn’t closed yet. Who knows this might be a trigger for another financial crisis. If it comes, the question is “are you ready?”.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

Very interesting topic, appreciate it for putting up.

Have you ever thought about creating an ebook or guest authoring on other sites? I have a blog based on the same topics you discuss and would really like to have you share some stories/information. I know my subscribers would appreciate your work. If you are even remotely interested, feel free to send me an e mail.

Hey Dockers, I would love too. How can you be contacted?