Dividend investing shares a close resemblance to what Stereotypical Asian parents’ advice on wealth management.

Get a good job in a big company -> Invest in big stable company

Get a decent salary -> Get a decent dividend yield

Life is more stable -> Your returns have little volatility and you can expect stable returns

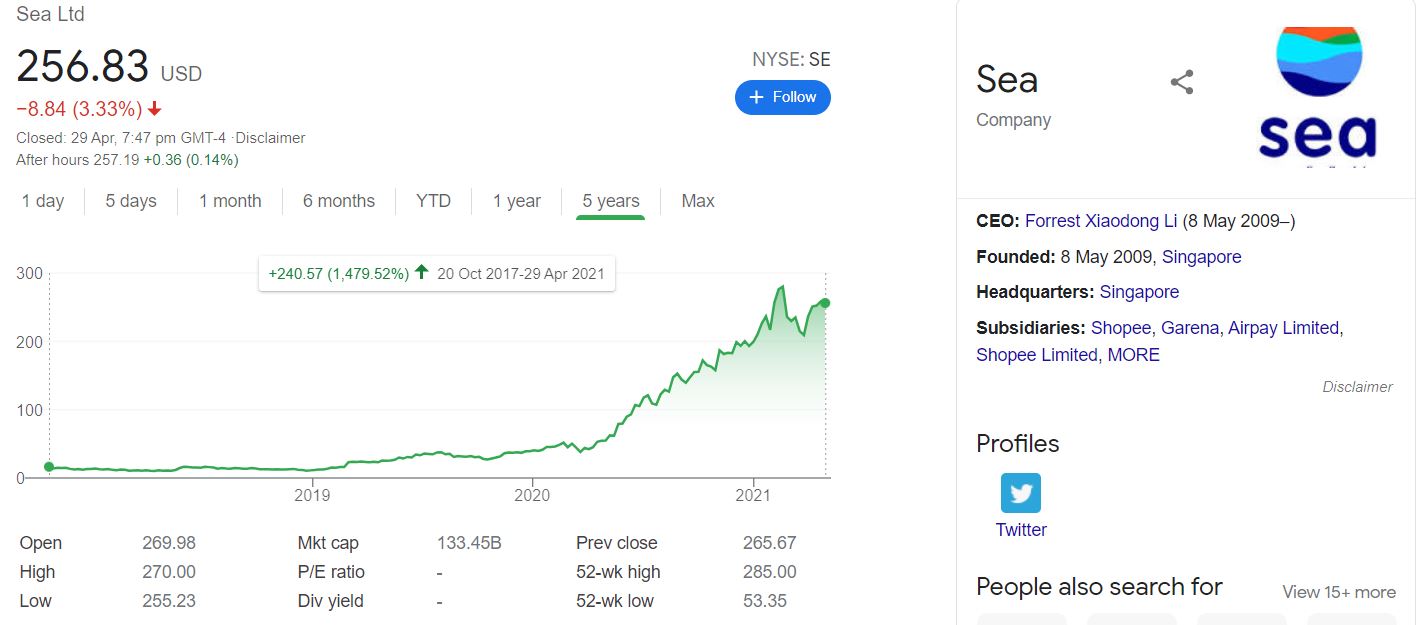

Probably that is why the Straits Times Index (STI) consists mostly of “good, stable” companies that gives “good, decent” dividends over the years. Companies such as Grab (headquarters in Singapore), SEA Group or more commonly known as Shopee (Founder Forrest Li is a Chinese-Born Singaporean) and Razer Inc (Singaporean-American multinational technology company) are heading or have headed over to other countries to list their companies.

Are you missing out?

What is Dividend Investing?

A dividends is a payout from the company’s net profit. The payout comes in fixed frequency, often quarterly or half yearly. You can choose to receive the dividends in cash or reinvest into the business with your dividends.

Take for example: DBS Singapore (SGX: D05).

I did an analysis last year on DBS. Click here to read more. DBS is currently traded at ~$30 (30 April 2021). The dividend yield is 2.45%. If you invested $1,000,000 into DBS, a dividend yield of 2.45% means that every year you can expect to receive $24,500 from DBS. This is a decent money of money for your retirement.

It is wise to assume that mature rational companies will only payout dividends when there is a positive net profit. They are already beyond the growth phrase where they might need to reinvest into R&D etc. (Do note the following if you are investing in foreign companies for dividends)

However, if you look at the price trend from 1 Feb 2000 ($21.30) until today 30 April 2021 ($30). This works to be 1.64% CAGR for the last 21 years (without taking into account dividend yield). Is this method of investing outdated?

Dividend Investing Is Not Fast Return Game

Dividend investing typically require a large amount of capital. To get a return of $24,500, you would need $1,000,000 worth of capital. It would take approximately 40 years for you to break even from your investment. However, this might be suitable for people who have a large amount of capital and are passive when it comes to investing.

Upon identifying a matured company that is giving good dividends, you will be able to enjoy the dividends for years to come.

Looking at the way industries are disrupted now, it is more relevant than ever to identify matured companies that still keeping up to date.

Stock Price Is Still Relevant

Even if the company is decent, share price still matters. You do not want to see a company whose share price is going down. Psychologically, this is proven to be extremely hard for most people. I know of people who are unable to sleep at night because of a 10% drop in one of their position.

Secondly, your capital is being depreciated as the share price goes down. Dividend investing requires one to have a steel resolve (as much as those invested in growth companies).

Quality Company Matters

At the end of the day, picking quality companies matters (whether it is a value or growth company). You would want to invest in a company that has a long term horizon, preserving its’ market share or even growing its’ market share. This would mean that your dividend will probably increase as the companies serves more market.

Final Thoughts By Wealthdojo

Dividend investing is still relevant to those investor who seeks out dividends as a way of generating passive income. At the end of the day, it matters more on the quality of the company than the dividend it is currently giving.

Growth investing and value investing are the most popular themes in investment market today. Some people prefer one over the other. Personally, I would say why not both?

There are many instruments and assets that are available to you. Are you aware of them?

Wishing you a good May Day.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.