Why do you need early stage critical illness coverage in Singapore?

Generally, critical illness insurance typically pays a lump sum in an event of a diagnosis of the critical illness. This amount of money is typically used to replace a person’s income and sustain their lifestyle. This is because it will not be easy to work straightaway after suffering from a critical illness.

One of my client recently asked me this question.

“Do I need an early stage critical illness since I have a critical illness insurance already?”

To answer this, we first have to ask ourselves this question.

What is early stage critical illness?

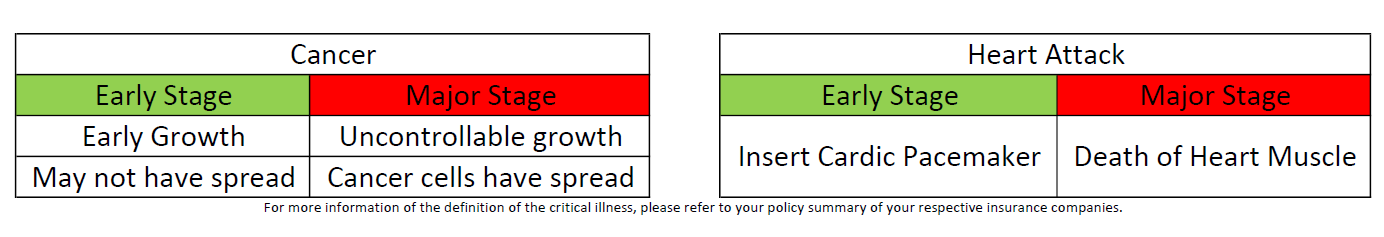

An early stage critical illness (to put simply) is an illness that is discovered at the very beginning. I will be giving 2 examples that are common in Singapore.

While it is true that an early stage critical illness is “less serious” that a major stage critical illness, a person might also need to be away from work for a short period of time (probably a year). This will lead to the second question.

Why do I need an early stage critical illness coverage?

While we take time away from work to recover to be well again, our lifestyle still carry on. Our utilities bills, our mobile bills, our daily commute and our daily food consumption still continues. The sudden lost of income from resting may start to DIG HEAVILY into your savings (that is meant for retirement). Worrying about money usually creates more stress and it may kill you more than the illness itself.

How much early stage critical illness coverage should I need?

Everyone is different. For Wealthdojo readers, we recommend your early stage critical illness coverage to be at least 1 year of your annual income. This means that if you are earning $100,000 a year, a recommended coverage you should have is at least $100,000. Premiums for early stage critical illness is usually higher as compared to the other protection plans in the market. This coverage was made popular in 2010 (The New Paper. 31 August 2010. She has 3 policies but no coverage) after a lady was unable to claim from her critical illness coverage even though she was paying high premiums ($600/month). Those were the times early stage critical illness coverage was not widely available.

Nowadays, insurance companies covers for early stage critical illness.

While critical illness definition has been standardized in Singapore (Read: Life Insurers to change definition of Critical Illness), there is no standardized definition for early critical illness.

In Wealthdojo, we strongly encourage you to talk to your Insurance Financial Planner once a year for a review so that your protection needs can be taken care of adequately. (Click here to contact us to help you with your Insurance Financial Planning).

We believe in bespoke financial planning. Whether it is money maximization, insurance or investing, we believe that everyone is different and the planning should be suited for you.

All opinions above are my own. Please view our disclaimer page to understand more.

I hope to nurture genuine relationships with all of my readers. Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page!

Now that you’ve read about learnt about how to benefit from What you can do about price hikes for public transport in Singapore. I challenge you to read this article (Careshield Life: Disability Insurance Singapore )to push your understanding further!