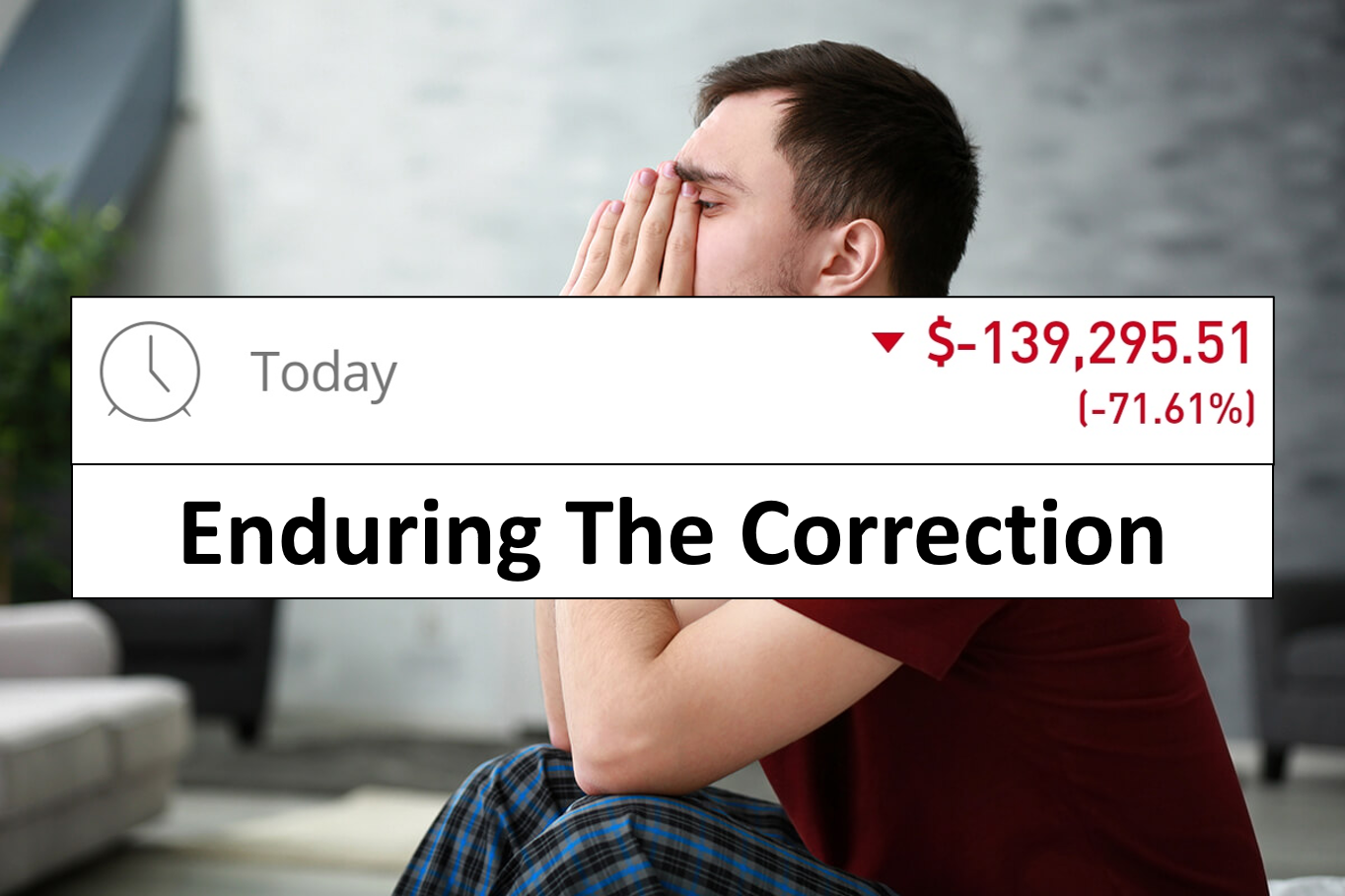

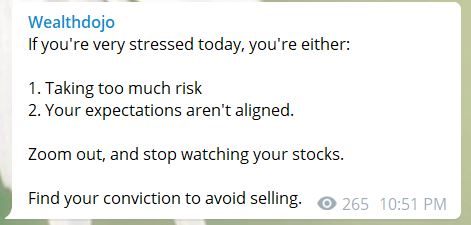

The last few days was beginning to spook investors. Global investors are concerned about rising inflation, coupled with raising 10 year Treasury Yield. This send the S&P500 down with growth stocks taking the lead. You might have the same concerns seeing your portfolio dipped. There were many people that reached out to me. Enough of them for me to put out a message in my telegram channel.

For those of you who started investing in March 2020, this might be your first major correction / bear market (if it is coming). If you feel uncomfortable to see losses, rest assured this is very normal. No one likes to lost money.

Instead of sharing logical data of how each correction ends up higher, I have consolidated a few great quotes from investors I respect. In your wealth management journey, investment is both logical and also an emotional experience.

Enjoy the ride. Hope you find strength in these quotes.

“Stock prices are not business prices. The company you have invested in will not stop/pause to sell their products just because their share price dropped by a few dollars. Whether there is a correction or not, invest in quality companies/portfolios that continue to grow” – Chengkok, Founder of Wealthdojo.

“Unless you buy a stock at the exact bottom (which is next to impossible), you will be down at some point after you make every investment. Your success entirely depends on how dispassionate you are towards short term stock price fluctuations. Behavior matters.” – Joel Greenblatt, American hedge fund manager.

“I deleted my (brokerage) app from phone yesterday so (that) I don’t see again and again. I will (continue to) add money every month and wouldn’t sell a share. I have quality in my portfolio and would evaluate things in 2021 Dec whether to sell anything.” – Rajeev, Singapore Investor.

“In times like these, the best thing to do is to research companies… and then come away with optimism that “wow… so much growth yet to happen!” – Ser Jing, Portfolio Manager of Compounder Fund.

“The principles have not changed. #1 Buy great companies #2 Buy them at fair value.” – Dr Daniel Kao.

“Rotation is the lifeblood of any bull market.” – Ralph Acampora, Director of Technical Analysis at Prudential Securities.

“Market is just price movement, it is never about the whole business. Where-else the underlying asset which the company that provide the goods and services is the real deal biz to the industry.” – Singapore Investor #2.

Final thoughts by Wealthdojo

Once again, I would like to thank all who have contributed to the above quotes. Enjoy the ride.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

[…] there is a market correction, Gamestop insane strike or a bullish run in the market, it is a basic to have a brokerage account […]

[…] last 2 weeks was a bumpy one for China’s stocks. Technology companies ranging from Alibaba, Tencent, Didi and all the way to the educational sector […]

[…] I get more and more about how to invest in a bear market, I hope this article will be able to share with you some bear market survival tips to prepare […]