Ant Group IPO has been halted! Does it have problem with the Chinese government or does it present us more time to understand the company?

Is Ant Group an overhyped? Ant group announced that it would want a market valuation of USD $200B and later raise it to USD $313B. In the latest valuation I can find, Ant is going to be listed at HKD$80 on 5 Nov 2020. It will be listed on Hong Kong and Shanghai and will be the largest IPO of all time. We aim to find out if Ant Group is an valuable company to invest in.

Disclaimer. Please read. To set the context right, in the 6 Levels Wealth Karate, investing in an excellent business at an overvalued price is a lousy investment idea.

Introduction

Ant Group is started as Alipay created by Alibaba in 2004 as a payment tool of online market place. Besides logistical issues, there was a lack of something important in the internet space: Trust. It is not hard to imagine people losing their money via scams. Hence, people were generally more skeptical towards online payment at that time (probably even today). To create trust, Alipay did something different. Alipay held the buyers payment first. They then released it to the sellers after the buyers confirmed that they have received and are happy with the purchases. This deterred fraud and scams.

To further build trust, Alipay launched a campaign in 2015. If a user were to suffer a lost due to an online fraud/scam while using Alipay services, Alipay will compensate them.

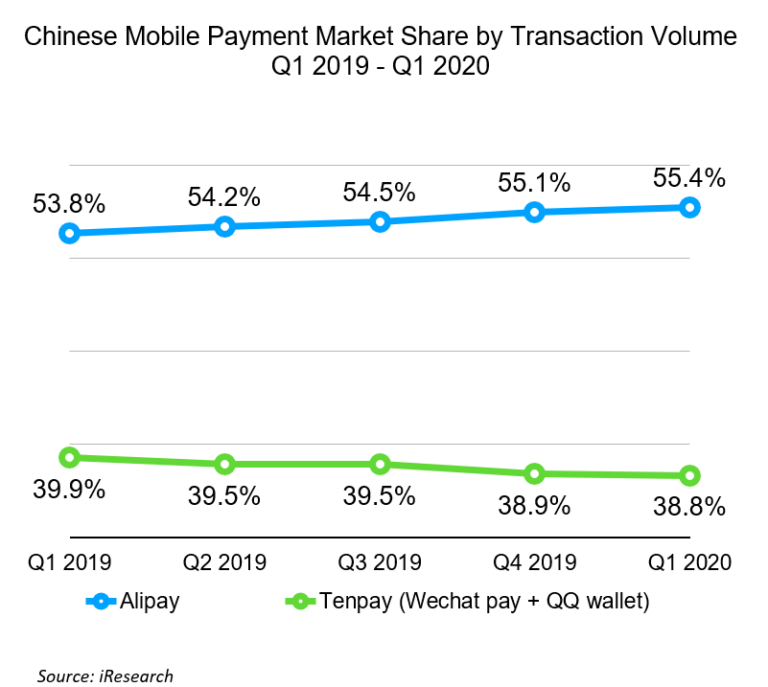

Today, Alipay has 1.3B active users with a 55% Chinese Market Share for mobile payments. The only significant rival: Wepay and QQ Wallet with 40% combined.

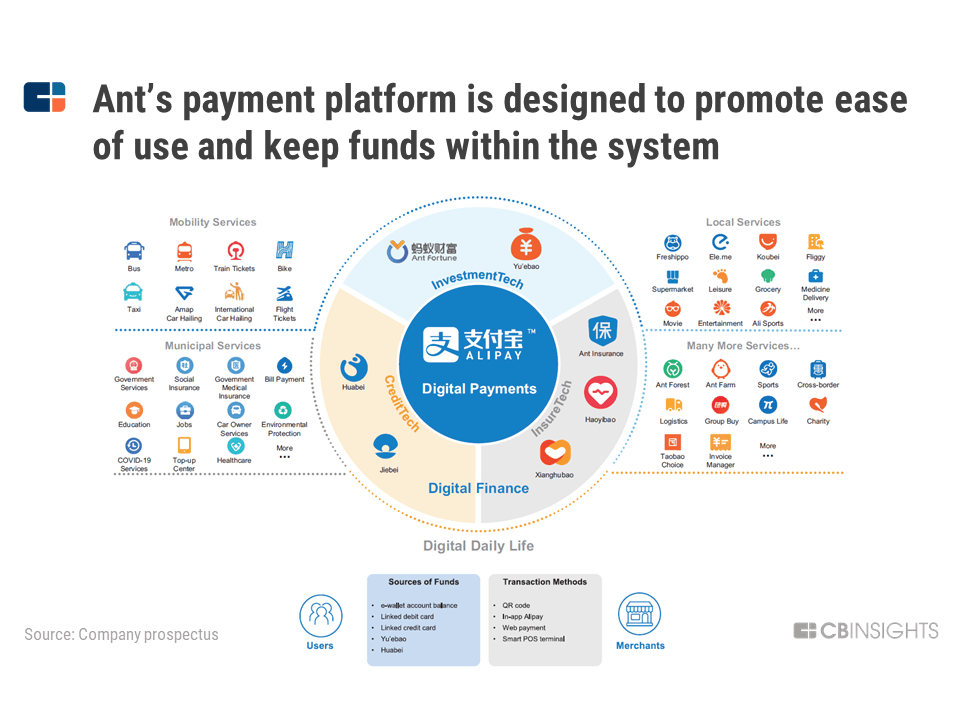

It has also gone from being a digital payment (wallet) to having digital solutions (place to spend money). Ant Group is a middle man who is working with service providers (bank/insurance companies/investment funds). Consider this an expansion of the current application at Alibaba where people buy products from companies. With 1.3B active users, I cannot imagine the amount of transactions going on with this application.

Today, I present the following reasons why I think Ant Group is an excellent company to be invested in.

#1 – Ballie Gilford is invested in them

Call me bias. Ballie Gilford has been investing in growth opportunities since 1908. They are an early investor into some of the world’s most valuable private and public tech companies, boasting a roster of portfolio companies that includes unicorns from nearly all generations in modern tech, including everything from Amazon, Google and Salesforce to Tesla, Airbnb, Spotify, newly public Lyft, Palantir and even SpaceX.

I got to know about this company when it first made its’ appearance when it partner with AIA. After looking at Ballie’s growth investing strategies and its’ track record, I am more confident of Ant Group.

#2 – They are profitable

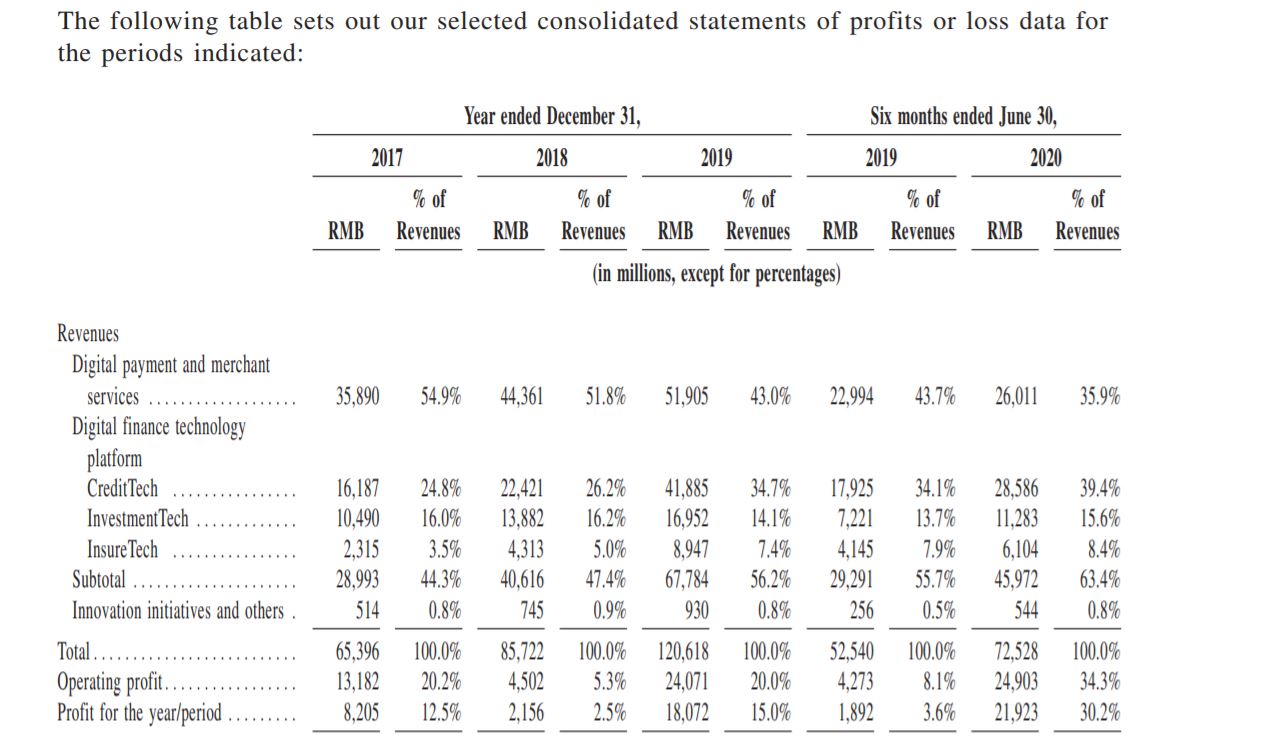

This speaks volumes. In the current trend where people don’t mind investing in non-profitable companies, Ant demonstrated that there is real demand and there is REAL money being made. There is so much to interpret from this table and I hope you can look closer at it.

Ant Group has been in profits since 2017. Though it has not been a consistent trend, it is unlike the other unicorns who are not in profits yet.

Secondly, digital payment and merchant service has seen increasing revenue. However, the percentage of revenue has been reducing. This means not only digital payments (their original bread and butter) has been growing, their new technology platform has been picking up even faster! People are starting to get credit, investment and insurance using Alipay.

Thirdly, who knows what other businesses they can complement with which leads us to point 3.

#3 – They do not compete. They complement.

Ant Group is a middle man and the ultimate place to do business. Instead of starting a bank or insurance company, Ant Group partners them to provide their services. Ant Group takes less risk and yet is able to command a profit whenever someone needs a service with a bank or an insurance company.

They are the ultimate middle man that is impossible to remove because you would need to do your trusted payment using Alipay. In many investment courses, we call this an efficient scale moat.

Their only direct competitor is Wechat. The good news is that there is a tread that Alipay has been chipping away Wechat’s market share slowly.

#4 – Valuations are reasonable

I wanted to get into an Pre-IPO deal. However, my broker from CGS-CIMB wasn’t able to get a retail placement for us. Being >800X oversubscribed, that is understandable.

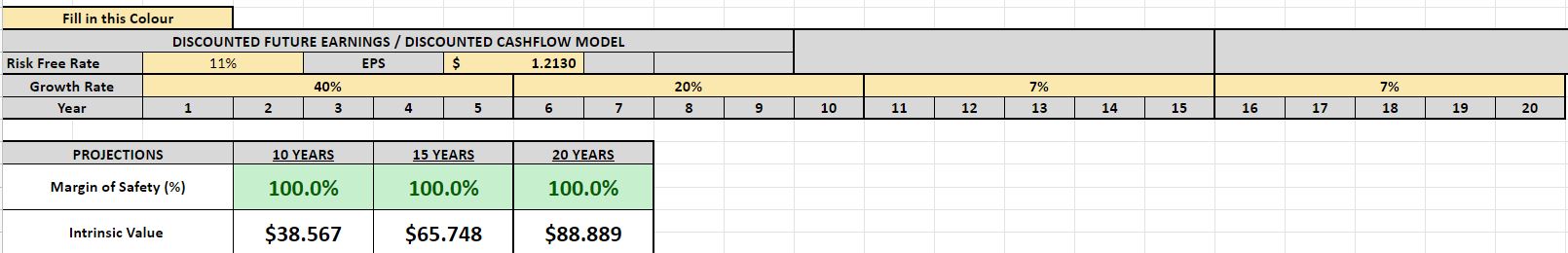

Currently, Ant Group profits are USD$3B for the first 6 months. If we assume that their profits will be the same in the second half of the year, it will mean that their profits are USD$6B in 2020.

In a simple analysis, the PE ratio for Paypal (02 Nov 2020) is 86. This gives a valuation of $516B. The current valuation is $313B.

For some of the advanced folks who have been following my blog and webinars, you know that I use the discounted cashflow frequently to valuate companies. Using a discount rate of 10.5% and the growth rates assumptions, my 20 years DCF shown a figure of $88HKD.

All these points to that fact that the valuations are reasonable.

Final thoughts by Wealthdojo

It is always fun and exciting when a company IPOs. Please treat your investment seriously. My wish is for everyone to invest wisely. If you have not started investing, there are basically 2 ways to do so.

- Do it Yourself (DIY) – Learn about investing successfully and invest on your own.

- Do For You (DFY) – Get someone who can invest successfully to invest on your behalf

We wish you good fortune for the rest of 2020. It is not too late to start.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.