In the most recent webinar that I conducted, I asked the participants what are they concerned about when it comes to investing in the long run?

I thought that most people’s answer would the lack of time or the inexperience in the market. It turns out that for most people, they are not too sure if they are doing it right.

If you think about it using a proxy, it is like a person driving on the roads but unsure if they driving properly. If this is not risky, I don’t know what is.

The Why

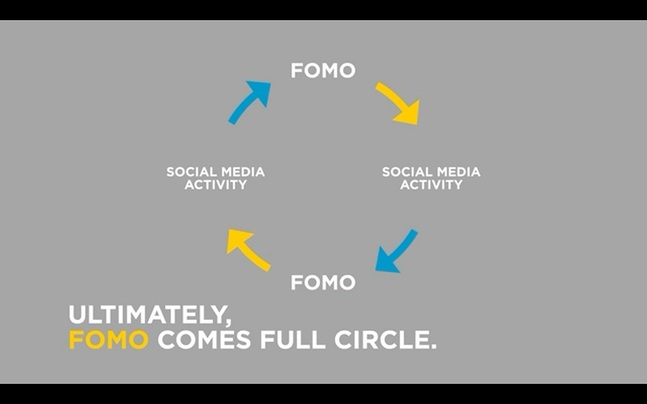

As we get more plugged into the internet, social news gets spread very quickly. With more people getting stuck at home during the COVID-19 period, we log in more to these social platforms to keep updated on the world around us.

One popular topic is how people are getting rich during the pandemic. Topics like Bitcoin, NFTs, Value Investing or Growth Investing gets thrown around. Because it seems that every Tom, Dick and Harry is doing it, people fear missing out and started participating into these.

Redefine Basics

Investing is the act of allocating resources (usually money) to buy an asset, in hopes of reselling it later at a higher price (Definition from Investopedia).

For most people, they get the concept that they will make money when the price goes up. I believe there is a certain form of Social Investing (a term that I just made up) going around in the recent market. Reddit has made certain stocks like Gamestop pop. Elon Musk has certainly contributed to the popularity of Bitcoin and Tesla. One thing for sure is that prices seems to be influenced by social pressures.

While it has created some millionaires, some people are unsure what they are doing anymore.

The art of investing starts from buying an asset. This concept seems to have lost its’ way in this season.

Our Mind Plays Tricks

Let’s play a game. Find a place to record your answer for Quiz A and B.

Quiz A

Choice #1: You get a 100% chance of getting $50.

Choice #2: You get a 50% chance of getting $100, 50% chance of getting $0.

Write down which one will you choose?

Quiz B

Choice #1: You get a 100% chance of losing $50.

Choice #2: You get a 50% chance of losing $100, 50% chance of losing $0.

In a 1979 experiment by Daniel Kahneman and Amos Tversky, it is discovered that most people choose Choice #1 for Quiz A and Choice #2 for Quiz B.

However, if you understand it mathematically, you should be indifferent between all the 2 choices in Quiz A or Quiz B. The expected value of both Choices in Quiz A are the same (i.e. +$50), while the expected value of both Choices in Quiz B are the same (i.e. -$50), so there should be no difference (at least mathematically) between the Choices in either Quiz. (Thank you Kok Ming for your help)

This tells us that as humans, we feel losses more keenly than gains (loss aversion). That’s probably the reason why you might have taken gains off the table early out of fear and hold onto large losing positions in the hope that they will rebound.

Our minds are not wired to maximise performance but to minimize regret.

Anyway, that’s just one problem. These are other cognitive bias we need to overcome as investors.

So What Can You Do?

Now that you understand that the society and your own mind is against you, what can you do? I would humbly like to suggest 3 steps.

#1: Get financially educated and informed of the investment process.

#2: Focus on the controllable.

#3: Consider a multi asset class portfolio to minimise drawdown.

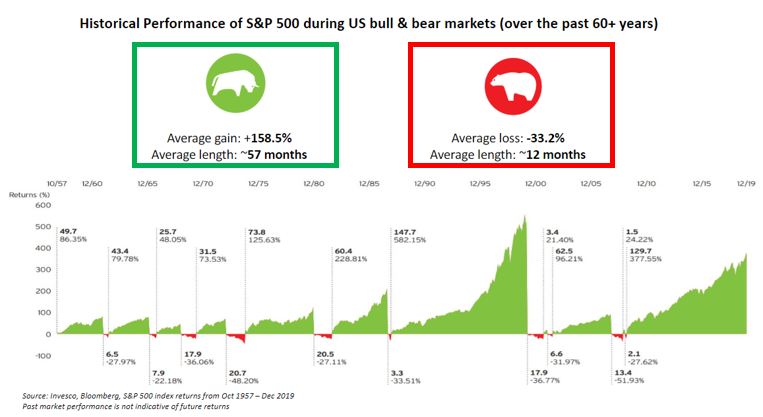

This graph records the S&P500 gains and losses over the past 60 years. The stock market can be considered like the following season (Spring and Winter). The average period for Spring (we love Spring don’t we) is 57 months and the average period for Winter (we don’t like the cold) is 12 months.

IF we are in a crisis now, it typically takes around 12 months before it is spring again. In the more recent COVID-19 crisis, the winter lasted around 6 months (Feb21 to Aug21) before roaring back into Spring again.

It is what you do during winter that determines your financial results. Getting financially educated allows you to prepare for such opportunities.

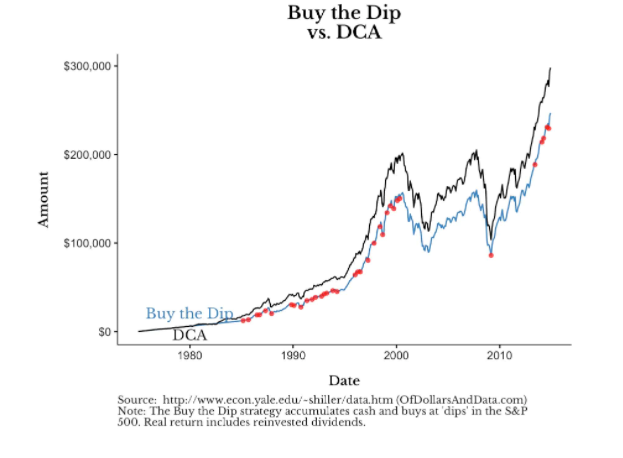

Let’s assume that you can predict each and every dip (technically impossible) and buy them (further assuming you have the mental resilience to buy at the lowest). Do you know that Dollar Cost Averaging (DCA) beats buying the dip in this time period? Instead of focusing on the unknowns or black swan events, why not focus on what’s controllable which is doing simple Dollar Cost Averaging?

Source: NovelInvestor.com

Source: NovelInvestor.com

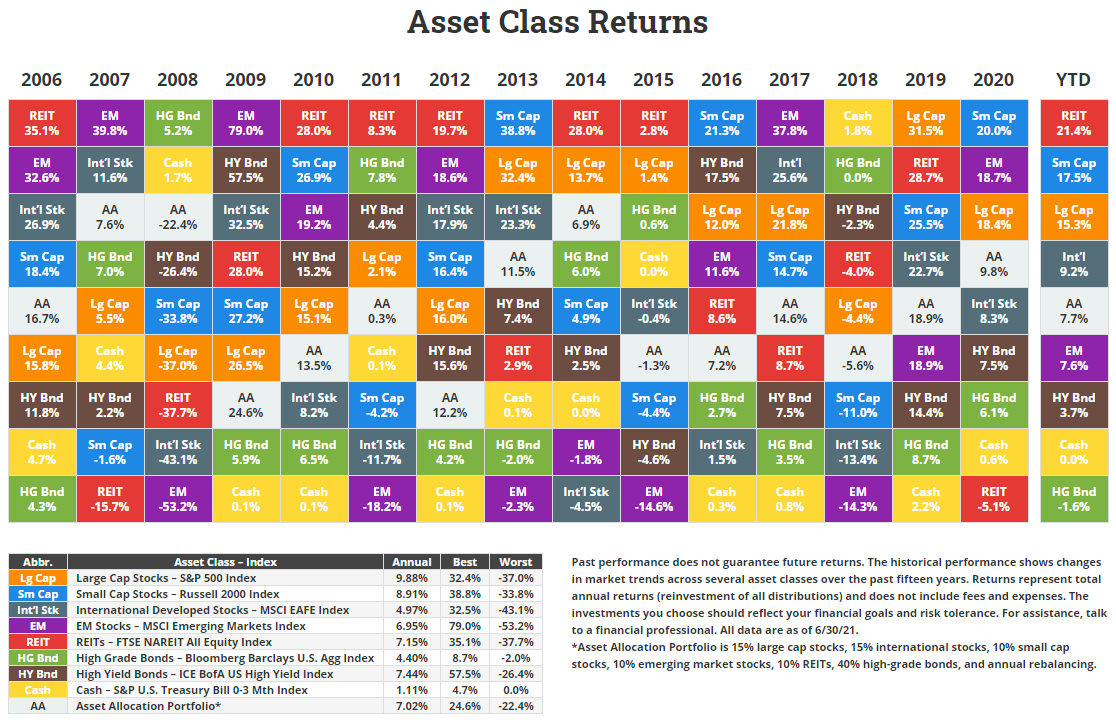

As you can see, different asset class performs differently every year. Because our minds are loss averse in nature, we might not be able to weather through each storms if we are only into one asset class. Consider a multi asset portfolio might make it easier for our minds to weather through each storms when it comes.

Final Thoughts

Personally, I’m invested in the long run. In investment, there will be volatility and it is something we have be comfortable with either through education, experience or both.

Do you related to the above? Let me know in the comments below.

Chengkok is a licensed Financial Services Consultant since 2012. He is an Investment and Critical Illness Specialist. Wealthdojo was created in 2019 to educate and debunk “free financial advice” that was given without context.

Feel Free To Reach Out To Share Your Thoughts.

Contact: 94316449 (Whatsapp) chengkokoh@gmail.com (Email)

Telegram: Wealthdojo [Continuous Learning Channel]

Reviews: About Me

The views and opinions expressed in this publication are those of the author and do not reflect the official policy or position of any other agency, organisation, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the author.

In your article you stated that for both “Quiz A” and “Quiz B” the “expected return of all 4 choices are $50.”.

I think what you meant is that the expected value of both Choices in Quiz A are the same (i.e. +$50), while the expected value of both Choices in Quiz B are the same (i.e. -$50), so there should be no difference (at least mathematically) between the Choices in either Quiz.

Dear Kok Ming, thank you for the comment. Indeed, you are correct and that was exactly what I meant.

Appreciate your wonderful feedback!