In the previous post on Life Hedge: how to prevent your life from being a roller-coaster, we talked about investing hedge and how you can use various tools to hedge on your investing portfolio specially during times of the recent coronavirus. In this article, we will talk about something more personal and how to prevent our lives from being a roller-coaster.

Look around you, there are many things in life that we can be grateful for. Just by having a roof over your head, you are richer than 75% of the world. (Source: Elephantjournal). If you are reading this article, it probably means you have assess to the internet, a phone, a laptop, an electricity source and money. Despite that, most of us might feel that life is not enough and demand more of it.

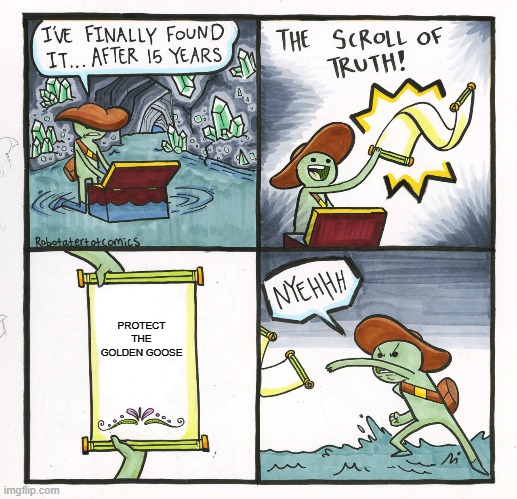

The question that we can ask ourselves is this. Why are we demanding for more even though we know we have enough? This reminds me of a story of The Golden Egg which I will replicate below.

Story of The Golden Egg

Once upon a time, there lived a cloth merchant in a village with his wife and two children. They were indeed quite well-off. They had a beautiful hen which laid an egg every day. It was not an ordinary egg, rather, a golden egg. But the man was not satisfied with what he used to get daily. He was a get rich-trice kind of a person.

The man wanted to get all the golden eggs from his hen at one single go. So, one day he thought hard and at last clicked upon a plan. He decided to kill the hen and get all the eggs together.

So, the next day when the hen laid a golden egg, the man caught hold of it, took a sharp knife, chopped off its neck and cut its body open. There was nothing but blood all around & no trace of any egg at all. He was highly grieved because now he would not get even one single egg.

His life was going on smoothly with one egg a day but now, he himself made his life miserable. The outcome of his greed was that he started becoming poorer & poorer day by day and ultimately became a pauper. How jinxed and how much foolish he was.

Why do we kill the Golden Goose?

Logically, it don’t make sense to kill something that is good wealth source to us. However, emotionally we want it FASTER and in our journey of doing so, we kill the golden goose.

This primary emotion that we associated commonly is called Greed. However, I believe there could be deeper reasons. I believe that is the reason why many people fall into simple scams, empty promises or bad health (See more: Regrets).

For some, they feel their life is about acquisition and no longer as a means of satisfying their material need. They want to have more than their peers to feel a sense of superiority. For some, they want to have more because they do not have enough when they were young and they fear it will happen to them again. For some, they feel that by buying things they can fills an emotional void in their hearts such as a lack of affection at home. The list could go on and on but it is rooted to the same cause: an emotional void. By understanding, what cause our emotional void can then we protect ourselves from ourselves (read that again :p).

Protecting our Golden Goose

To prevent your life from being a roller-coaster, there are some hedges that we MUST put in place so that life will not change so drastically. In a certain sense, we are the golden goose and the ultimate treasure/asset that we have to protect. We hope that by sharing the two life hedges, you can live a life of abundance and laughter.

-

Discover the emotional void

I can say with confidence that many people live their lives without truly understanding about themselves. When we are young, some of us are force to go through education and we are constantly chasing for academical success. It seems like the success in life was to have good academical results. Then we come into the workforce and we are constantly chasing for material success. It seems that the success in life now is linked to our net worth. We constantly seek what the society wants from us and because of that, we might develop some sort of emotional void.

Spending some time with ourselves and asking ourselves deeper question is the start for us to discover the emotional void that we might have. For some, it is certainty. For others, it might be love and connection. I have listed 6 potential voids which people are looking for in their life.

The 6 voids are. “Lack of certainty”, “Lack of variety”, “Lack of love and connection”, “Lack of significance”, “Lack of growth” and the “Lack of contribution”. If this seems familiar, Tony Robbins, an American Author coined the above the 6 human needs. (Read more: 6 Human Needs) . Can you relate to them?

-

Maintain the Golden Goose

To have good quality eggs, I can only assume the body of the golden goose have to be strong. Just like ourselves, we need to work and maintain our body by exercising and also eating well. Take reference to the first Singapore’s Prime Minister, even well into his 80s, Mr Lee stuck to a strict exercise routine – 12 minutes walking on the treadmill every morning, 15 minutes after lunch, and another 15 minutes after dinner.

“Without that, I would not be in my present condition physically,” he had said.

Source: Straits Times: Staying fit anywhere, in any way

-

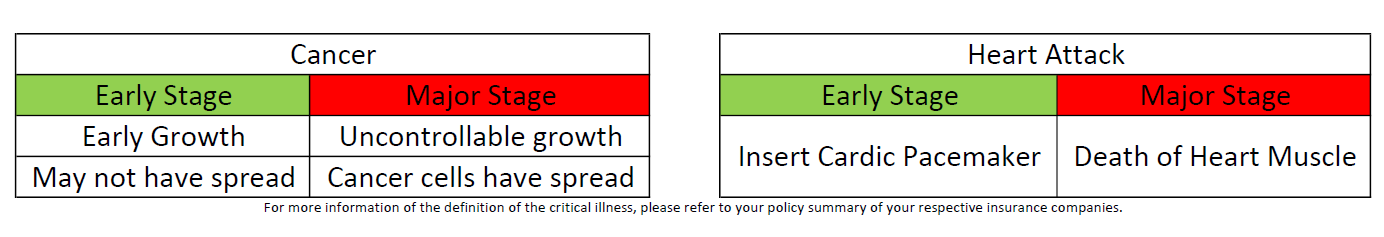

Income Hedge/Insurance

Even if we do the above, an illness might still strike us. In an event of major critical illness, we might need to use our life savings to spend on our treatments or new lifestyle. Some treatments could be life-long and we might be forced to sell away our homes to fund those new treatments.

At the same time, we might not be able to work at the same capability after an illness. This would mean that our income might not be as high as before and this will result in a lower standard of living in future.

Is your income hedged after you stopped working?

Wishing you the best in this period of time. We hope that everyone can remain calm and healthy during this season. It is a season of crisis but it is also a season of opportunity. Invest with what you have and don’t borrow money to invest in this period of time. If you are new to investing and need help, do talk to me using the contact form or any methods listed below.

God Bless.

If you read until here, thank you again for your patience and your support over in 2019. I hope that in 2020, Wealthdojo can continue to value add you. Let us know what you think in the comments below. This is a working article. The above doesn’t represent my stock recommendation in anyway. Please read our disclaimer for more information.

I hope to nurture genuine relationships with all of my readers. Please feel free to contact me on my Instagram (@chengkokoh) or Facebook Page or my Telegram Channel! Or subscribe to our newsletter now!